The price of the USD/JPY is now testing the 110.00 psychological resistance, the highest for the currency pair in a year. The recent upward trajectory of the dollar against the rest of the other major currencies was an impetus for the bulls in the current movement. The US dollar's gains came in support of important factors as rapid vaccines and hopes of stimulating stimulus boosted optimism about a faster economic recovery. Also, US President Joe Biden will outline his infrastructure spending plan on Wednesday in Pittsburgh.

The economic package, worth about $3 trillion, covers infrastructure, education, healthcare and environmental programs. The administration plans to split the package in two to take advantage of support from Republicans in Congress. Investors will also be watching the US jobless claims data and payroll report due later this week.

US President Joe Biden's plan aims to make generational investments in infrastructure, revive domestic manufacturing, combat climate change, and preserve the United States' ability to compete with China, officials said. That could include $3 trillion in tax increases. The final price is in flux but was expected to be between $3 trillion and $4 trillion.

While the White House stresses the urgency, it also insists that this will not be considered an emergency response like the $1.9 trillion virus relief bill Biden signed into law due to Republican objections earlier this month. So White House officials have said that the administration wants to see progress in the new legislation by Memorial Day and for it to be passed over the summer.

"The president has a plan to fix our infrastructure and a plan to pay for it," White House Press Secretary Jen Psaki said. "But we certainly expect to have a discussion with members of Congress, as we move forward, about areas in which they agree and disagree, and where they would like to see more focus or not.”

The administration is setting the pace and political tone for this next big priority on Biden's agenda. Although the COVID-19 bill is widely popular among voters of both parties, the president has been criticized for adopting it alone with Democratic votes only. White House officials believe that this time there will be a much greater chance of gaining some support from the Republican Party and planning a major outreach on Capitol Hill.

More than 93.6 million people, or 28.2% of the population of the United States of America, have received at least one dose of the coronavirus vaccine, according to the Centers for Disease Control and Prevention. About 51.5 million people, or 15.5% of the population, have completed their vaccination. As for cases, the current rate of seven days of daily new cases rose in the United States during the past two weeks, from 53,670 on March 14th to 63,239 on Sunday, according to Johns Hopkins University. With regard to deaths, the current average of seven days of new daily deaths in the United States during the past two weeks decreased from 1363 on March 14 to 969 on Sunday, according to Johns Hopkins University.

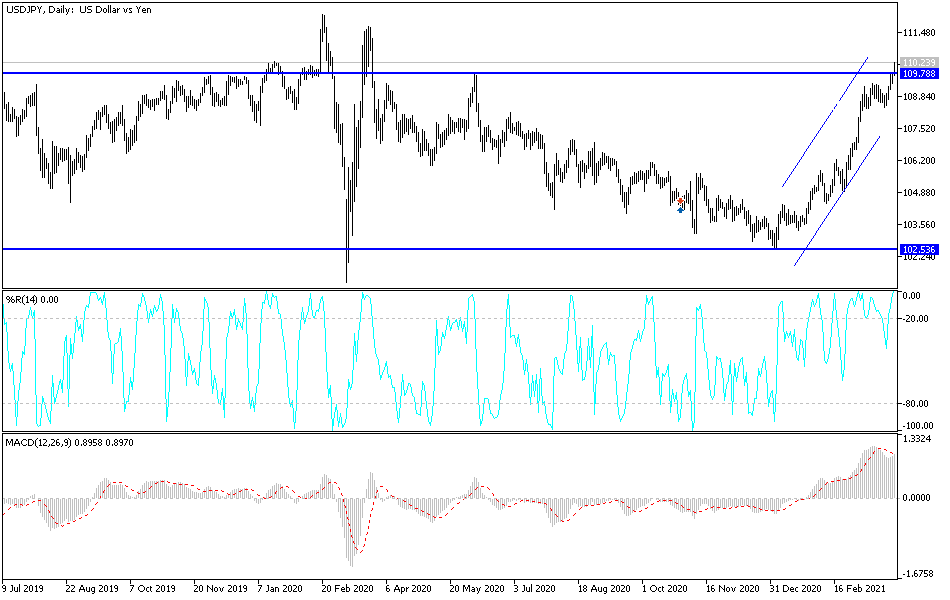

Technical analysis of the pair:

I mentioned that the bulls' control would be strengthened if they moved the USD/JPY towards the psychological resistance of 110.00, which is what happened today. Although it is important to expect more gains, it is necessary to anticipate technical indicators on the daily chart reaching strong overbought levels. After that, profit-taking is expected at any time, especially if the dollar's momentum stops. So far, the closest resistance levels for the currency pair are 110.45 and 111.20.

On the downside, there will be no reversal of the current performance without moving towards the support level of 108.00. Today, the currency pair will be affected by risk appetite, as well as the announcement of US consumer confidence data.