Throughout last week’s trading, the USD/JPY maintained its gains near and above the 109.00 resistance, closing the week's trading steadily near it. In light of the strength of the US dollar, investors abandoned the Japanese currency as a safe haven. Recently, the unexpected rise in the yield on the 10-year US bonds has affected the sentiment of markets and investors. Accordingly, the US dollar was being bought and the stock markets fell, as the major ten-year US Treasury bonds achieved 1.588%, an increase of 2.94% over the level at which they opened at the end of the week.

Rising US bond yields were a major source of dollar strength in 2021 as foreign investors sent their capital to the United States to take advantage of the yield they provide, driving the currency's value up. In the current environment, if yields continue to rise, the dollar will likely remain supported and equity markets are under pressure. “We are all bond traders these days, and given how the fortunes of other asset classes are related, at the moment, there is an intrinsic connection to how government bonds - mainly Treasuries - are traded in whatever form,” said Michael Brown, Senior Market Analyst at CaxtonFX.

Also, some financial commentators question whether the sudden spike in yields before the weekend was just a passing move, noting that the 10-year bonds fell briefly to below 1.50% last week as investors expressed their satisfaction with the unnoticed mid-week release of inflation data. In addition, some well-underwritten bond auctions outside the US helped calm the rise in bond yields. American investors have been selling bonds heavily recently as they expect higher levels of inflation in the future due to the reopening of the US economy and the global economy, a development that will only be stimulated by the massive stimulus program that will take effect soon in the United States of America.

Therefore, when investors get rid of bonds, they are demanding to pay a higher return on the bonds they buy in order to compensate for future inflation. Rising returns in turn raise the cost of financing in a wider economy and act as a headwind to growth, hence lower equity markets.

Therefore, all eyes will now turn to the Fed’s decision this week and whether US monetary policymakers will act to try to calm the rise in yields. The Fed could make adjustments to the quantitative easing program that it deems to be buying bonds to keep yields low, but this would be a tough sell decision if inflation is actually expected to pick up significantly in the coming months. While it is unlikely that any change in policy will be announced in March, investors fear that inflation will become a problem in the coming months to the point that the Federal Reserve will raise interest rates sooner than expected at the start of the year.

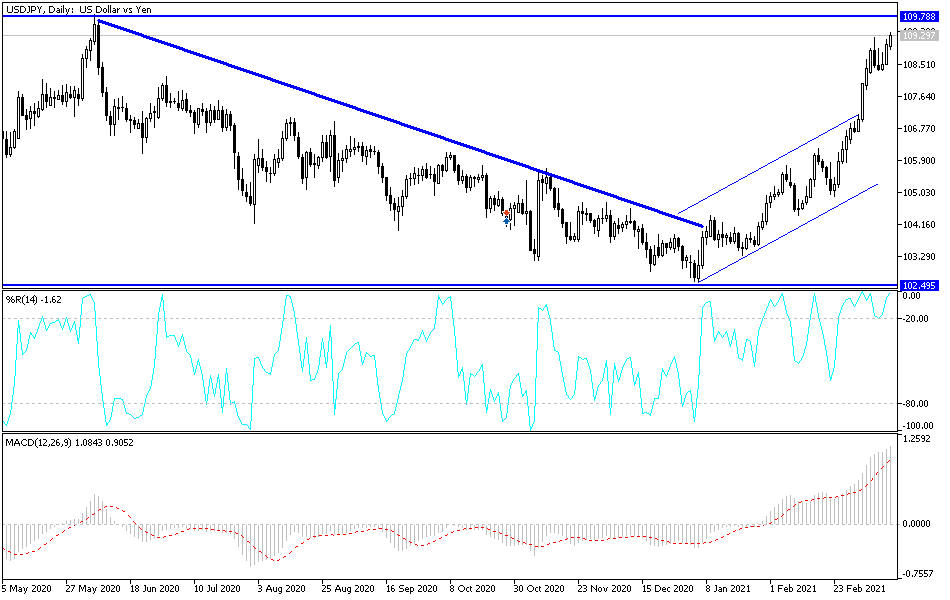

Technical analysis of the pair:

On the daily chart, the price of the USD/JPY is still sticking to its recent gains, which reached a nine-month high. At the same time, technical indicators are pushing into strong overbought areas, and unless the pair gets more momentum, there will likely be profit-taking.

On the downside, according to the performance over the same period of time, there will be no first reversal of the trend without breaching the support level of 106.60. Otherwise, the general direction of the currency pair will remain bullish.