By the end of last week's trading, the Japanese yen returned to achieve strong gains against the rest of the other major currencies. The USD/JPY pair retreated to the 108.60 support level before closing the week's trading by stabilizing around the 108.88 level, which stopped the bulls' attempts to bounce back higher to the 109.36 resistance level. So far, the 110.00 psychological resistance has become a relatively distant dream for the bulls after the last attempts.

The Japanese yen rose even with higher-yielding commodity currencies such as the Canadian dollar after the Bank of Japan's monetary policy decision for March. The Japanese central bank’s decision in March was described as a "clarification" of the current policy, and it raised more questions than it answered in some parts. The main decision was to leave the benchmark interest rate at -0.1% and the yield curve control target for 10-year notes unchanged at 0.10%, as was expected by the markets. The Bank of Japan also maintained upper limits on the amount of stock market assets it would purchase as part of its monetary easing program, but canceled previous targets for actual accumulated amounts. These were the expected, clear and non-controversial results from the meeting that ended last Thursday.

But these “cautious” policy decisions belie the implications of the “eagerly awaited assessment of more effective and sustainable monetary easing,” which was announced in December, and the Bank of Japan also said after the last major revision of its policy program in July 2018 that a 10-year return - which remains its official target of 0.10% - would allow it to "move up and down in about twice the range, which was previously between positive and minus 0.1% of the target level".

However, the Bank of Japan and Governor Haruhiko Kuroda said that it is “appropriate to clarify that the range of fluctuations in the 10-year Japanese government bond yield will be between about 0.25% plus or minus,” while actually extending the range and increasing the 10-year maximum yield. A convincing rise in yield came, which also came along with a convincing rate hike.

Commenting on the bank’s policy, Derek Halpeni, Head of Global Markets Research at MUFG said, “With the aim of being able to lower interest rates, the Bank of Japan has created an interest plan to encourage lending which will include changes in the classification of current account balances to better protect banks and enhance lending. The eagerly awaited results of the Bank of Japan policy review led to the bank's announcement that it would now pay commercial lenders an interest rate of up to 0.2% on some loans to businesses and households, although it was said as part of a major policy decision." The reference interest rate will remain at -0.1%.

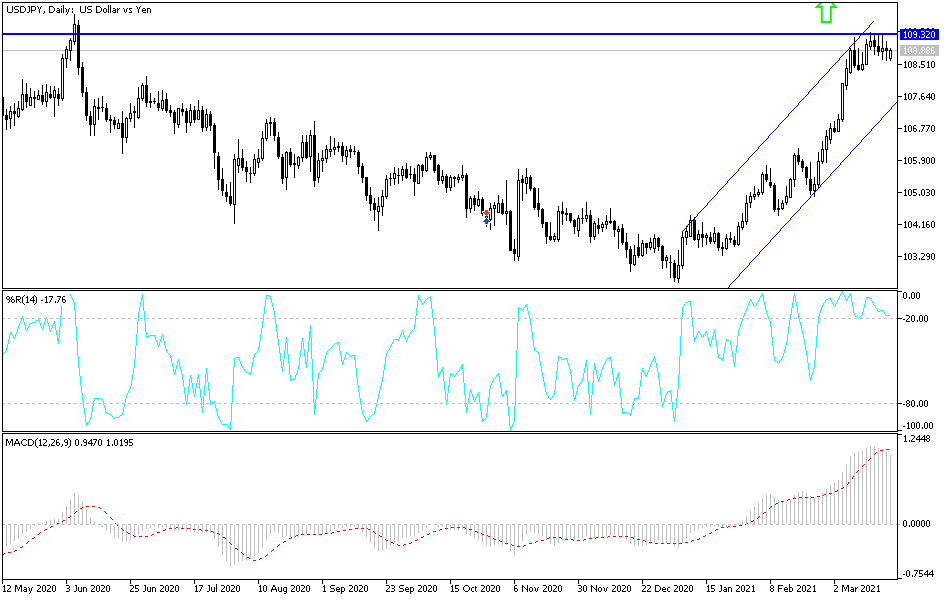

Technical analysis of the pair:

The recent downward correction of the USD/JPY will strengthen in the event that the bears move the price to the support level of 108.00, which may increase profit-taking towards stronger support levels. On the upside, I still see that the psychological resistance at 110.00 will remain the most important target for the bulls to control the performance. Performance so far is neutral, pending stronger incentives in either direction. This may happen with the remarks of US Federal Reserve Chairman Jerome Powell today. On the 4-hour chart, there is cautious stability pending any new developments and on the daily chart, the currency pair is still moving within its ascending channel.