The USD/JPY pair has been moving in an upward correction range, ultimately testing the 106.89 resistance, its highest in six months, before stabilizing around 106.76 as of this writing. Expectations of higher growth and inflation have caused the yield on US government bonds to rise rapidly in recent weeks, leading to tightening financial conditions not only in the US but around the world. Rising bond yields raise the cost of corporate financing and help explain why investors are taking a more tense stance on stocks and buying dollars again, thus raising questions about economists’ expectations that 2021 will be the year of the dollar’s decline.

The downturn in equity markets that we have seen in recent weeks is still relatively mild compared to previous episodes of market weakness when bond yields were rising.

What worries investors is that the gradual reboot of the 2013 taper tantrum may be about to begin. This was a sharp sell-off in bonds and financial assets in response to the Federal Reserve's decision that it would start withdrawing stimulus support.

Forex analysts say more dollar strength and weak emerging market currencies, in addition to the euro and the British pound, could follow. Accordingly, analysts at Barclays told clients that they have raised their 10-year US yield forecast, from 1.40% to 1.70% by the end of the year. Juan Prada, an analyst at Barclays, says, “We believe the current rate hike is driven by growth, as it was in 2016 rather than 2013. In light of this, further price selling is driven by better growth prospects and an additional financial package that could support the US and G10 commodity currencies, while affecting the safe havens such as the Japanese yen and the Swiss franc in the near term.”

Investors are increasingly confident in the global "V" recovery, to the point that the emerging concern is not growth, but inflation. The growing confidence in the global economic recovery, especially in the US, is leading to speculation about when the Fed might take its foot away and buy fewer Treasury and agency bonds. ING argues that the Fed will have learned from the 2013 policy mistake that ultimately led to destabilizing sell-offs in some asset classes.

The US manufacturing sector experienced growth in February at the fastest pace in three years with a surge in new orders. The ISM reported that its measure of manufacturing activity rose to a reading of 60.8% last month, 2.1 percentage points above the January level of 58.7%. It was the strongest performance since February 2018. Any reading of the index above the 50 level indicates growth in the manufacturing sector. Last month's reading of 60.8% coincided with a similar reading in February 2018, and the level in those months was the highest since the 61.4% reading in May 2004.

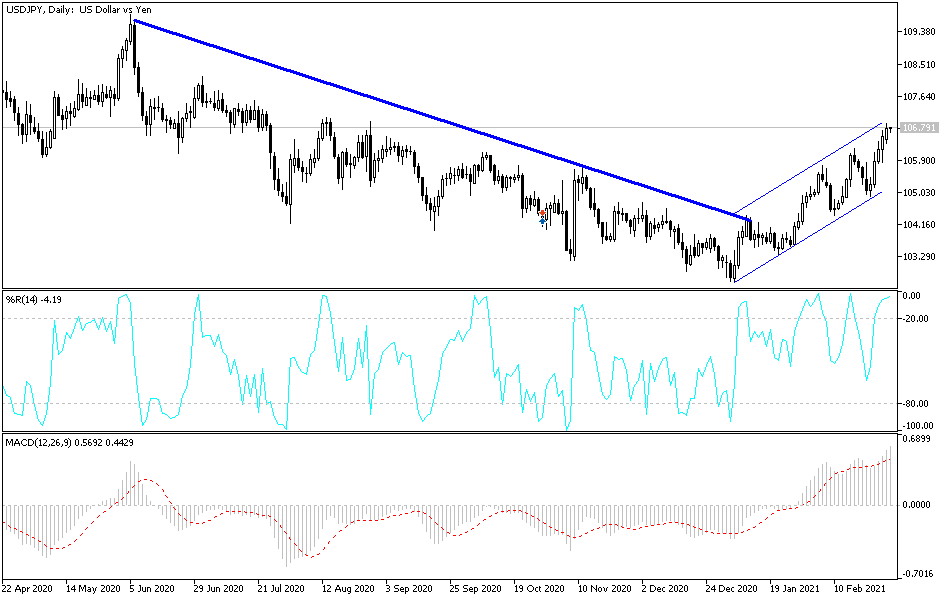

Technical analysis of the pair:

The USD/JPY pair's stability above the 106.00 resistance continues to support bullish moves to stronger ascending levels. Taking into consideration the performance on the daily chart, a breach of the resistance levels of 107.35 and 108.20 moves the technical indicators to strong overbought levels, which at the same time supports a move towards the most important psychological resistance of 110.00. On the downside, the bears may return to dominate the performance if the currency pair moves to the 105.90 and 104.80 levels.

I would still prefer buying the pair from every dip, especially below the aforementioned support levels. The currency pair does not expect any important US economic data. From Japan, the unemployment rate and capital spending rate will be announced. This is in addition to the extent of investor risk appetite.