The announcement of slow Japanese economic growth on Tuesday morning was an additional impetus for the USD/JPY to push to the 109.23 resistance level. This is the pair's highest level in nine months, and where it has stabilized as of this writing. Japan's Cabinet Office announced on Tuesday that Japan's gross domestic product (GDP) rose 11.7% year-on-year in the fourth quarter of 2020. That fell short of expectations for a 12.8% increase after a 22.9% increase in the previous three months. On a quarterly basis, Japan's GDP growth rose by 2.8% - again missing the forecast of 3.0% and down from 5.3% in the previous three months.

Capital expenditures rose 4.3% on a quarterly basis, beating expectations of a 4.1% gain after contracting 2.4% in the third quarter. External demand rose 1.1% on a quarterly basis in the fourth quarter, slowing from 2.6% in the third quarter - while the Price Index rose 0.3% year-on-year after rising 1.2% in the previous three months.

Private consumption increased 2.2% on a quarterly basis, slowing from 5.1% in the third quarter.

On the other hand, the Ministry of Internal Affairs and Communications said that the average household spending in Japan fell by 6.1% year-on-year in January, reaching 267,760 yen. That fell short of expectations of a 2.1% year-on-year decline after a 0.6% contraction in December.

The average monthly income of a Japanese household is 469,254 yen, down 2.5% year-on-year. Individually, spending on food, housing, clothing, medical care, transportation and entertainment decreased. It was higher for fuel, furniture, and education. On a monthly basis, household spending decreased by 7.3%.

Treasury Secretary Janet Yellen said that fears that the $1.9 trillion subsidy bill from the current US administration may lead to a rapid rise in inflation are misplaced. In an interview with MSNBC, Yellen said that the measure, which will provide $1,400 checks to millions of Americans along with other aid, will provide needed relief and help the economy return to full employment by next year.

Asked about some economists’ concerns that the measure could stimulate the US economy too quickly and lead to higher inflation, Yellen said: “I don’t think this is really going to happen. We had an unemployment rate of 3.5% before the pandemic and there was no sign of further inflation.” The US unemployment rate in February of last year, before the loss of 24 million jobs due to the epidemic, was stable at its lowest level in half a century at 3.5% with inflation lower than the Fed's target of 2%.

Yellen said inflation was "very low" during a period of extremely low unemployment rates.

"If inflation becomes a problem," she said, "there are tools to tackle that" and policymakers will monitor the situation closely and be ready to act. The House of Representatives is expected to give final approval to the relief bill this week, and the administration has said that the president will sign the measure once it gets to his office. The expanded unemployment benefits for Americans are expected to expire on March 14th if new legislation is not passed.

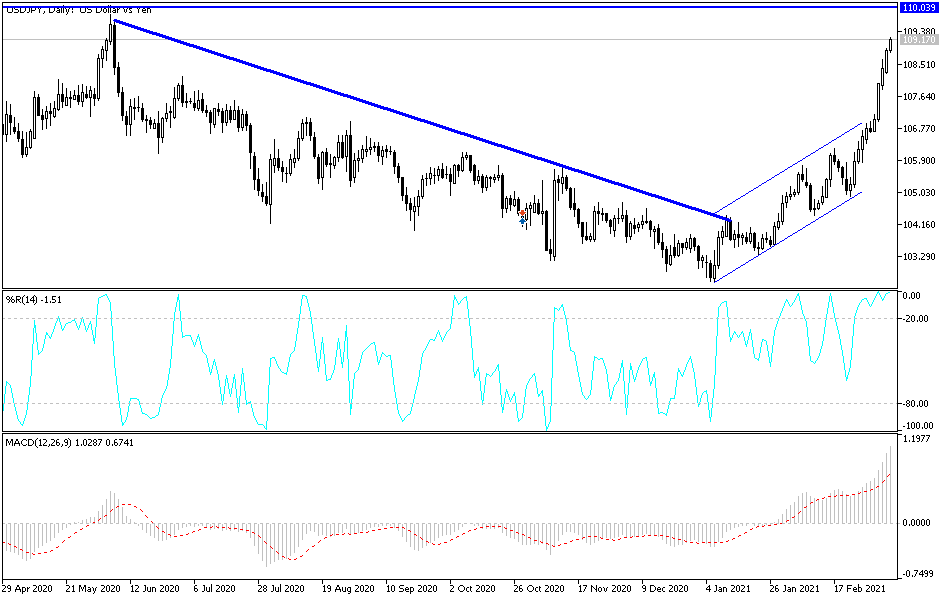

Technical analysis of the pair:

The bulls seem determined to push the USD/JPY pair to the psychological resistance level of 110.00, which is the closest to testing the upper line of the recently formed ascending channel that contributed to strong gains. According to the performance on the daily chart, there will be no return to a bearish performance without breaching the support level of 106.45. With the current optimism, it must be taken into account that most technical indicators move to strong overbought levels. Therefore, a correction in the midst of profit-taking may happen at any time.

Other than the announcement of the Japanese economic data package, the currency pair is not anticipating any important US economic data for the second day in a row.