A continuous bullish path for the USD/JPY pair awaits more momentum to test stronger highs. The currency pair is stabilizing around the resistance level of 109.25 as of this writing, ahead of important US data, and the pair may remain in its current range until the US Federal Reserve announces its monetary policy decisions on Wednesday. At the Fed's policy meeting and press conference that follows, Chairman Jerome Powell will face a new challenge: convincing financial markets that even as the economic picture brightens, the Fed will be able to continue providing support without contributing to higher inflation.

Powell's message is likely that the US economy still needs significant support from the Federal Reserve in the form of short-term interest rates close to zero and the purchase of bonds aimed at lowering long-term borrowing rates.

In anticipation of faster growth and inflation, investors have priced at least three increases in federal interest rates by 2023 - a much earlier increase than the Fed itself had anticipated. In December, policymakers at the Federal Reserve collectively predicted that they would not begin raising interest rates until at least 2024. Some economists expect the Fed to expect that the next rate hike could happen by the end of 2023, earlier than they expected in December. This move will reflect an improved economic outlook.

Rising US bond yields were a major source of dollar strength in 2021 as foreign investors sent their capital to the US to take advantage of the yields they provide, causing the currency to appreciate. In the current environment, if yields continue to rise, the dollar is likely to remain supported and equity markets under pressure. American investors have been selling bonds heavily recently as they expect higher levels of inflation in the future due to the reopening of the US and global economy, a development that will only be stimulated by the massive stimulus program that will take effect soon in the US.

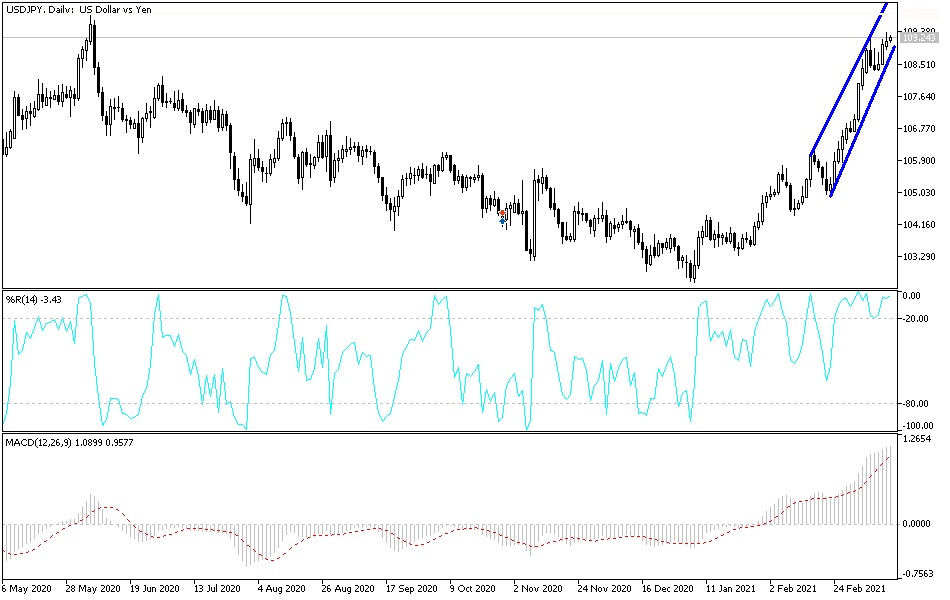

Technical analysis of the pair:

On the daily chart, the USD/JPY is still moving within its bullish channel, and the psychological resistance at 110.00 is still the most important target for bulls. But that level is capable of pushing technical indicators to overbought levels and activating profit-taking. I expect the currency pair's performance to remain in a limited range until the Federal Reserve announces its monetary policy decisions tomorrow. On the downside, according to the performance over the same period of time, any move below the support level of 108.22 is a threat to the current bullish outlook and thus a signal for the bears to move to stronger descending levels.

In addition to the extent of investor risk appetite, the currency pair will be affected by the announcement of the results of US economic data, including retail sales and industrial production.