In its best week since November 2020, the USD/JPY moved towards the 108.65 resistance level before closing last week’s trading around 108.37, and close to testing the psychological resistance of 110.00. That level is particularly important for the bulls after last week's bullish retracement. The US dollar continued its gains against the rest of the other major currencies, after the US Labor Department report showed that job growth in the country had accelerated more than expected in February, driven by the reopening of companies in the wake of the decrease in new infections with the launch of vaccines.

Accordingly, official data showed a much stronger-than-expected growth for US jobs in February amid a significant recovery in employment in the entertainment and hospitality industry. Non-farm payrolls jumped by 379,000 jobs in February, after increasing by 166,000 jobs, which were revised upwards in January. Economists had expected an increase in US employment of 182,000 jobs compared to the 49,000 increase that was originally reported for the previous month.

The US unemployment rate unexpectedly decreased to 6.2% in February from 6.3% in January. Economists had expected the country's unemployment rate to remain unchanged. Commenting on the numbers, Kathryn Judge, an economist at CIBC Capital Markets, said: "The US labor market returned to recovery in February as states moved to reopen economic sectors and coronavirus cases continued to decline." The US has continued to ease restrictions on social distancing, while the pace of vaccination accelerates and there is another dose of financial stimulus on the way, indicating that the recovery will gain momentum from here.

On the other hand, data from the Commerce Department showed that the US trade deficit widened in January. The department announced that the trade deficit rose to $68.2 billion in January from $67.0 billion in December. US exports grew 1% to $191.9 billion in January while imports rose 1.2% to $260.2 billion, resulting in a balance that was running a deficit of $68.2 billion. Analysts view the rise in the deficit as a sign of economic recovery, but it indicates an increase in the supply of dollars in the market.

Fed Chairman Jerome Powell reiterated his commitment to maintaining an ultra-easy monetary policy. The Fed Chairman said that the recent massive sell-off in Treasury notes was not "disorganized" or likely pushing long-term interest rates much higher. Powell added that there would be "some upward pressure on prices" due to the improvement in economic conditions. But at the same time, he acknowledged that the rise will be temporary and will not be sufficient for the US central bank to change its very loose policies aimed at supporting the economy. Overall, Powell's comments failed to assuage concerns about rising borrowing costs.

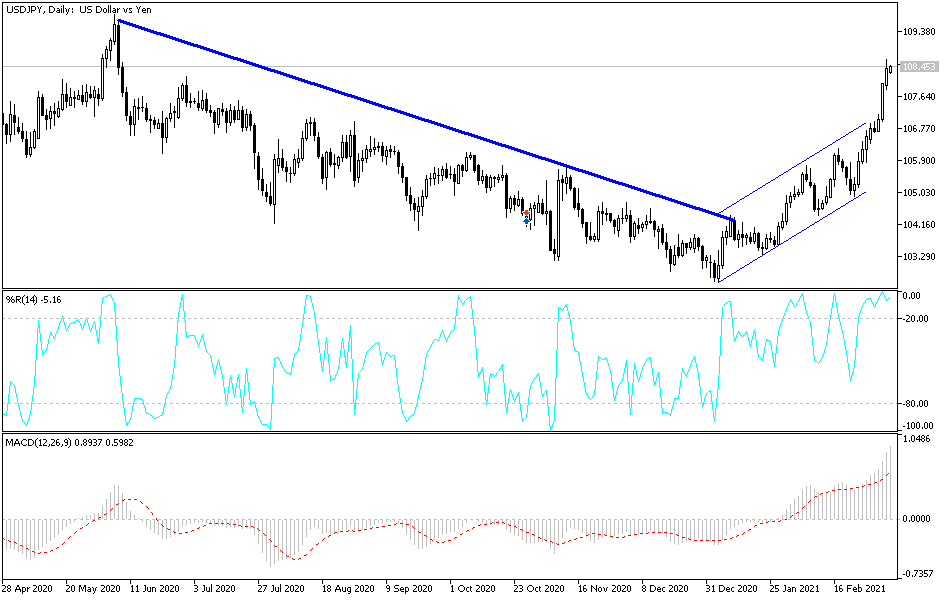

Technical analysis of the pair:

The general trend of the USD/JPY is getting bullishly stronger, and the bulls are currently targeting the 110.00 psychological resistance level. However, it must be taken into account that technical indicators have reached strong overbought levels, which may trigger profit-taking at any point, especially if the dollar has lost its recent momentum from the bond market and the results off US economic data. The pair could first begin to abandon its ascending channel by moving to the support level of 106.35 and from there to 105.15.

The currency pair does not anticipate any important US economic data today, and investor risk sentiment will have a significant impact on the direction of the currency pair today.