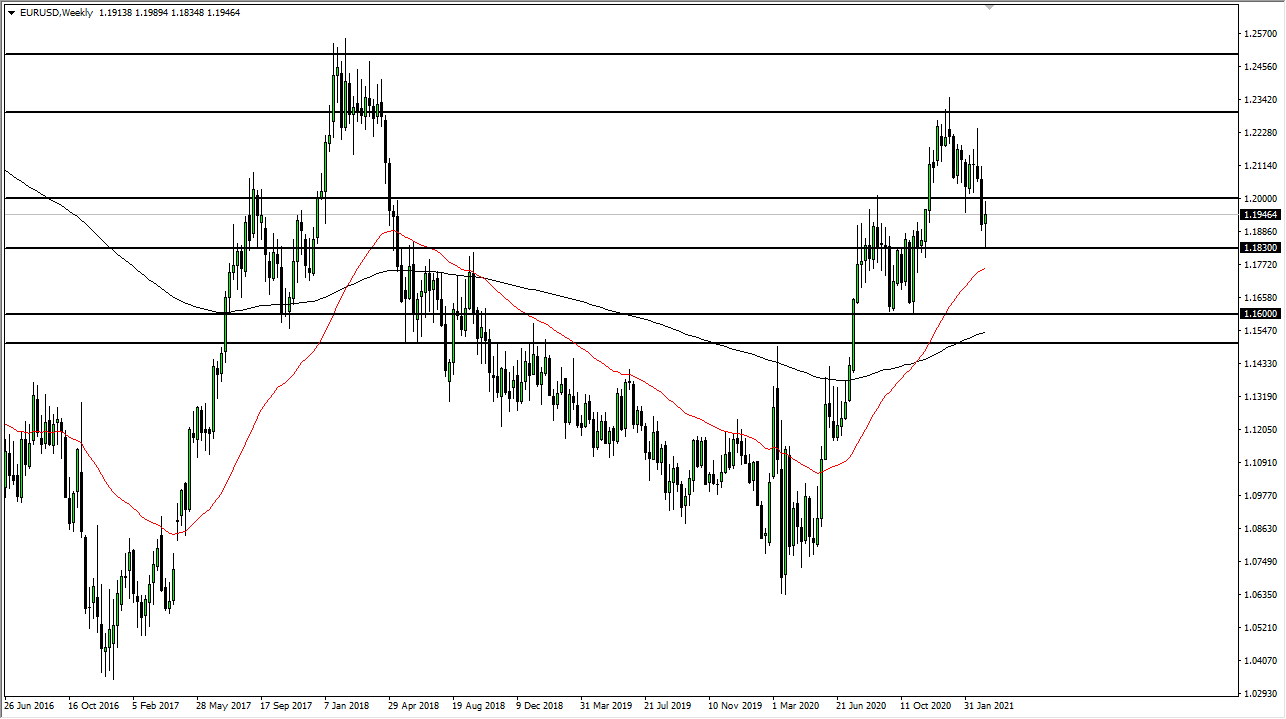

EUR/USD

The euro has gone back and forth during the course of the week, reaching down towards the 1.18 level, but has also tested the 1.20 level for resistance. With that being the case, the market looks very likely to continue to see a lot of choppy behavior. At this point, I believe that the market remains very noisy, but if we were to take out the 1.20 level, then we could go looking at the 1.22 handle. On the other hand, if we break down below the 1.18 level, that opens up a move down to the 1.16 handle. Until then, it will probably be a lot of consolidation and noisy chop.

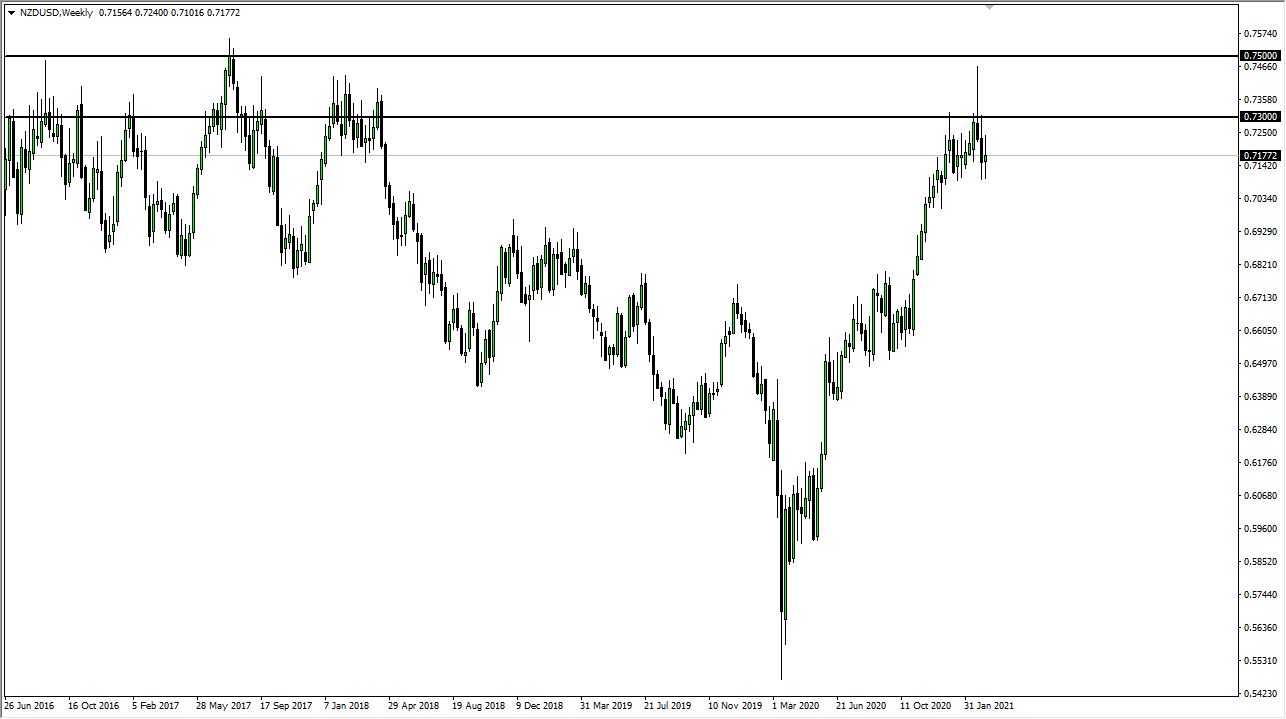

NZD/USD

The New Zealand dollar fluctuated during the course of the week as we continue to struggle at very elevated levels. The question at this point is whether or not we are still trying to price in some type of stimulus or spending, or if we are trying to focus on the fact that there could be yield control in the United States. The New Zealand dollar is highly sensitive to the commodity markets, but it has been parabolic to say the least. The area between the 0.73 and the 0.75 levels continues to be massive resistance. Because of this, I do think that a pullback is more likely than not, but we need to break down below the 0.70 level to see this market really pullback.

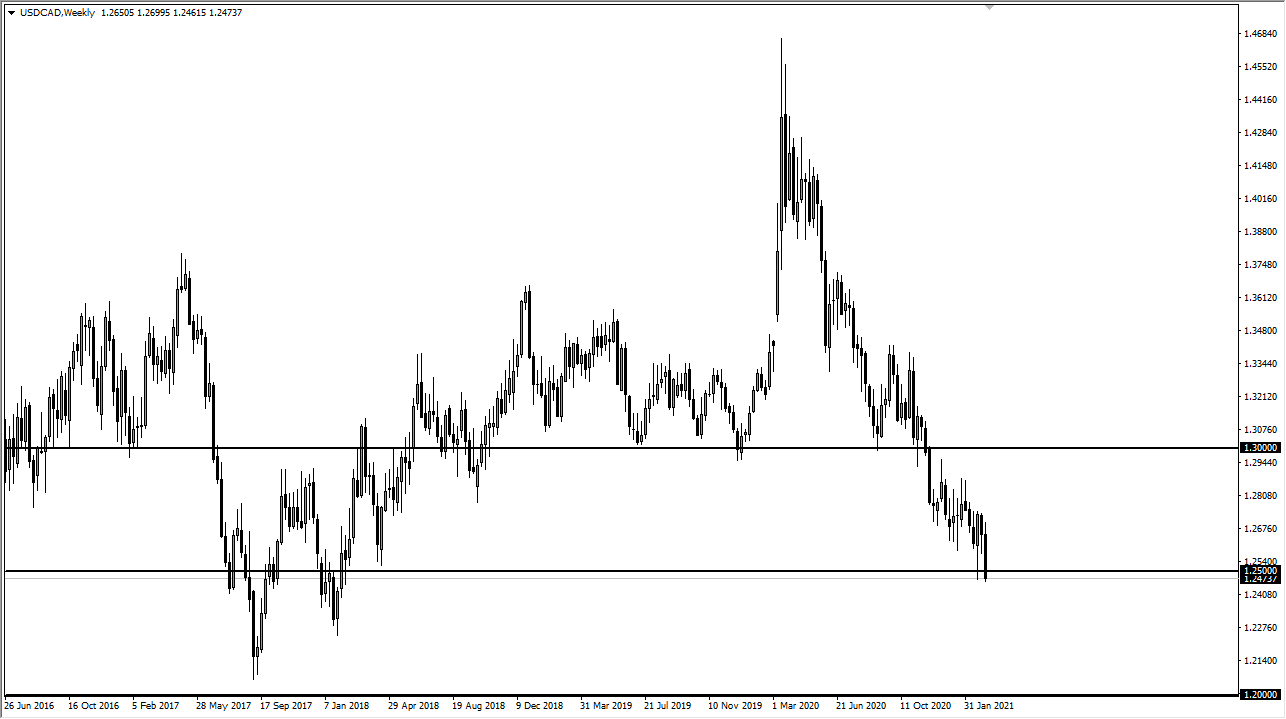

USD/CAD

The US dollar cratered against the Canadian dollar during the course of the week, not only due to the massive amount of bullish pressure that we have seen in the crude oil markets, but also because of the better-than-anticipated employment numbers coming out of Ottawa on Friday. Because of this, if we can break down below the candlestick for the week, I think that this next week will continue to see the US dollar fall against the Loonie. On the other hand, if we turn around a break above the 1.25 handle, we probably have to revisit the 1.26 level given enough time.

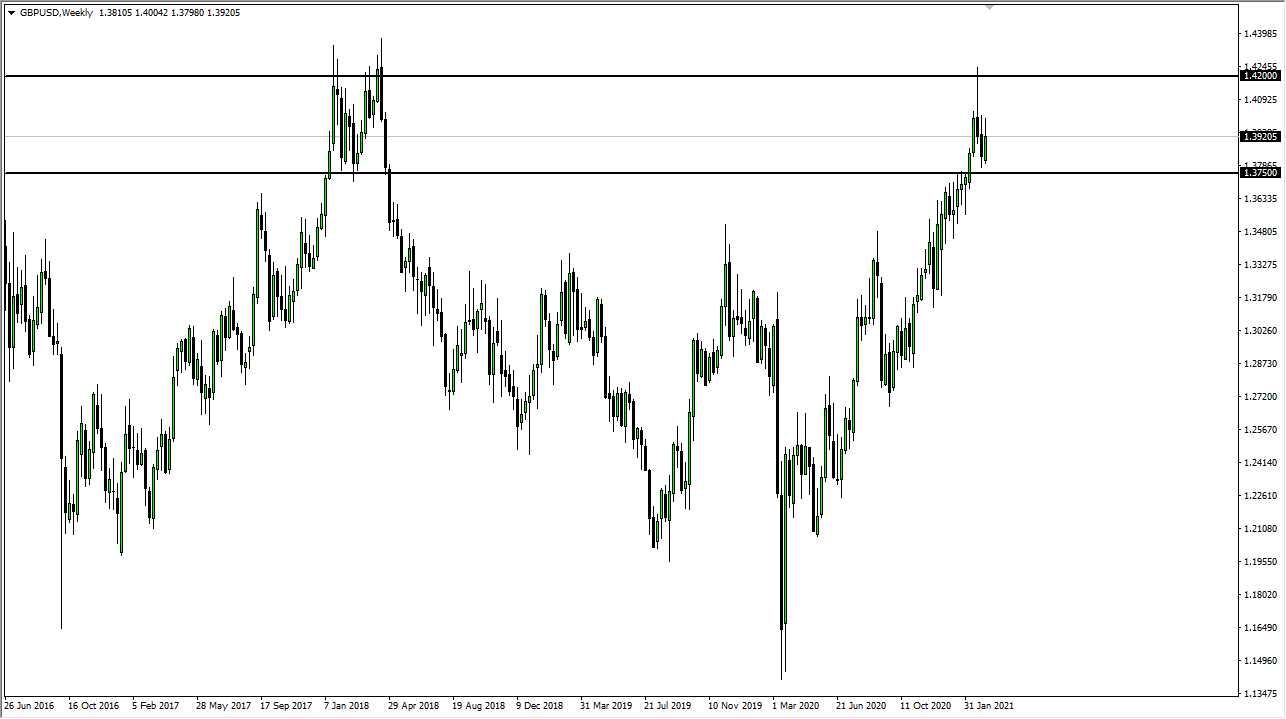

GBP/USD

The British pound has rallied a bit during the course of the week, but it has been very noisy. It now looks as if the 1.3750 level underneath is massive in its importance and potential support, so if we were to break down below there it could send this market tumbling. However, I do not expect to see that happening anytime soon, and I recognize that the 1.40 level is a little bit of resistance, but if we were to break above there, then I think the market could go looking to the 1.42 handle.