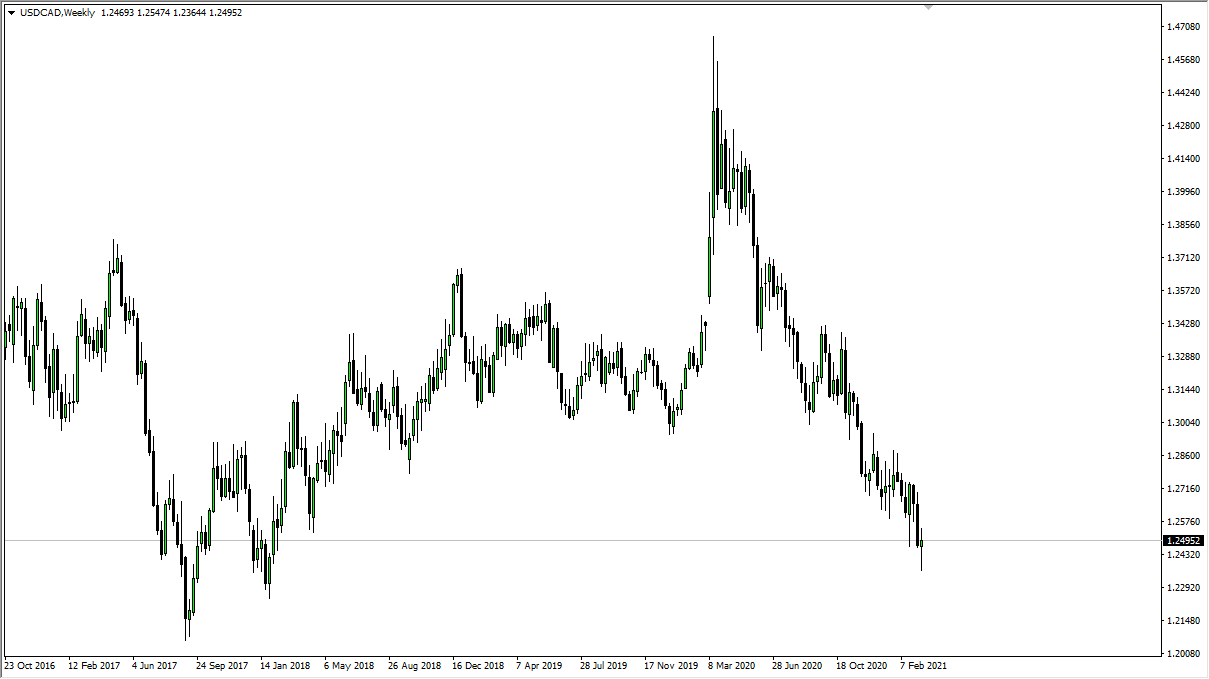

GBP/JPY

The British pound has had a slightly choppy and negative week against the Japanese yen, but as you can see, we are most certainly in a very bullish market. At this point, I think it is only a matter of time before we get a pullback, so if you are looking at this from a longer-term prism, you are waiting for an opportunity to buy the British pound closer to the ¥150 level, maybe even the ¥147.50 level. On the other hand, if we were to break above the ¥152.50 level, then the market goes looking towards the ¥155 level.

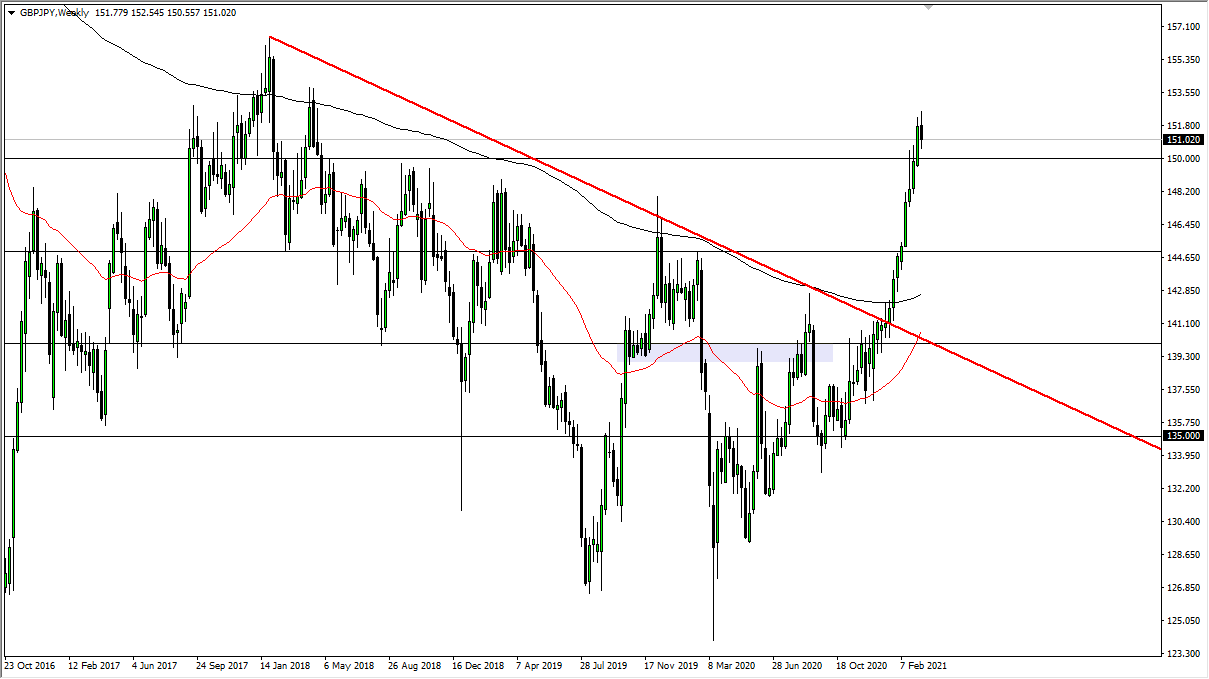

EUR/USD

The euro has chopped around in the same range during the week as we continue to see the 1.20 level as resistance and the 1.18 region as support. I believe that this is a market that is going to continue to be very sloppy and difficult, so I would not be looking for easy clues at this point. Short-term back-and-forth trading is probably about as good as it gets, but we are certainly starting to “slump” to the downside a bit. If we were to break down below the lows of the previous week, then I think this market goes looking towards the 1.16 handle.

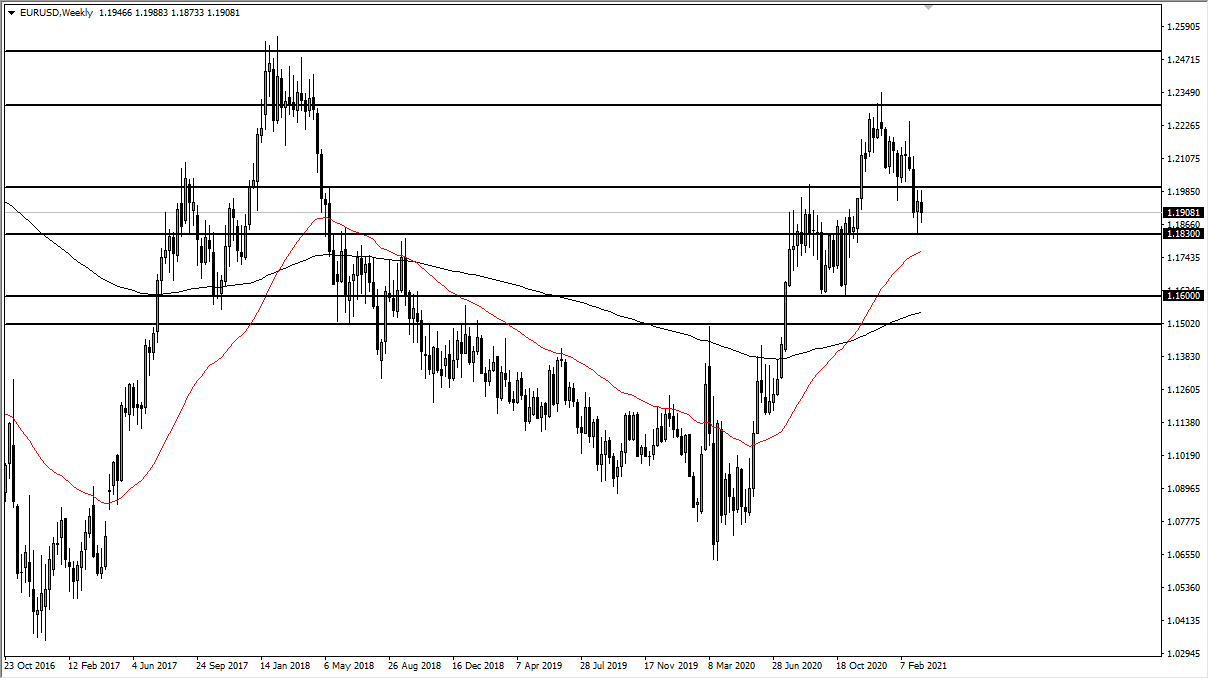

NZD/USD

The New Zealand dollar has had a fairly tough week, as we are starting to see cracks in the ice when it comes to the uptrend. If we break down below the 0.71 handle, then it is likely that the market could drop quite a bit and go looking towards the 0.68 handle underneath where the next support level is found on the longer-term charts. Otherwise, I would anticipate trading in the same range we had been in over the last couple of weeks.

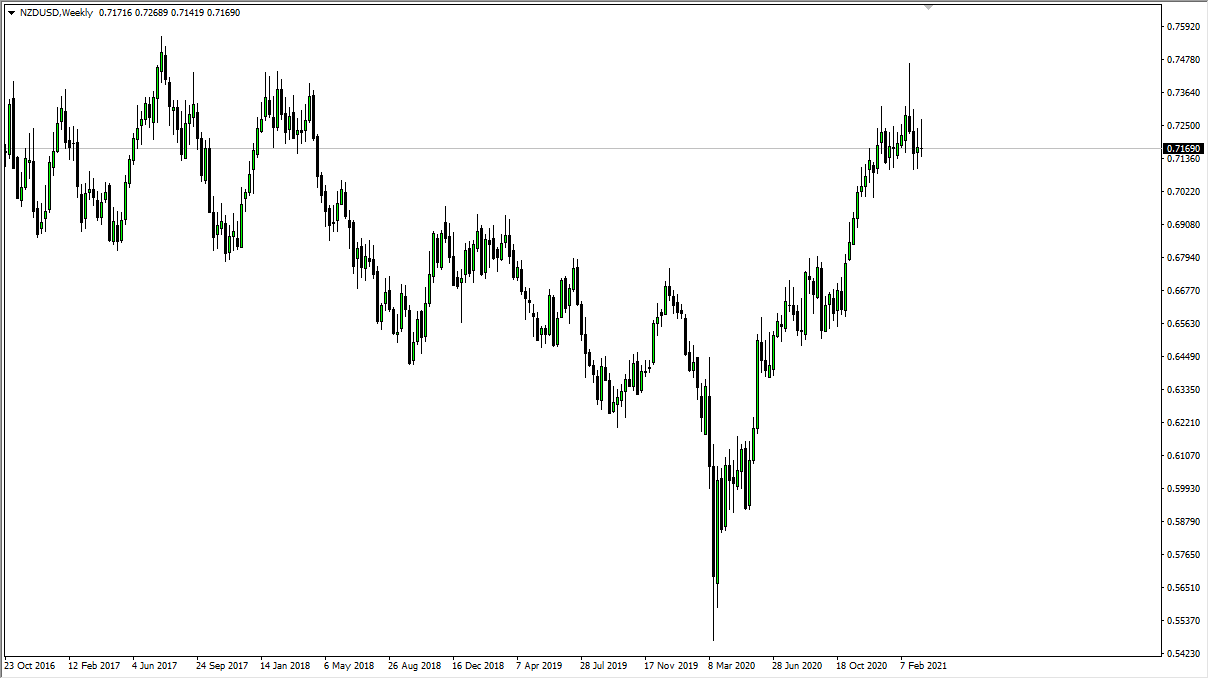

USD/CAD

The US dollar has gone back and forth against the Canadian dollar during the trading week, as oil got hammered for almost 9% during trading on Thursday. Because of this, one has to wonder whether or not we are getting towards the end of the rally for crude. Because if we are, it is going to work against the value of the Canadian dollar as well. If we break above the highs of this previous week, I think that we will probably move another handle or two to the upside. Otherwise, I would look for very choppy and sideways action this week.