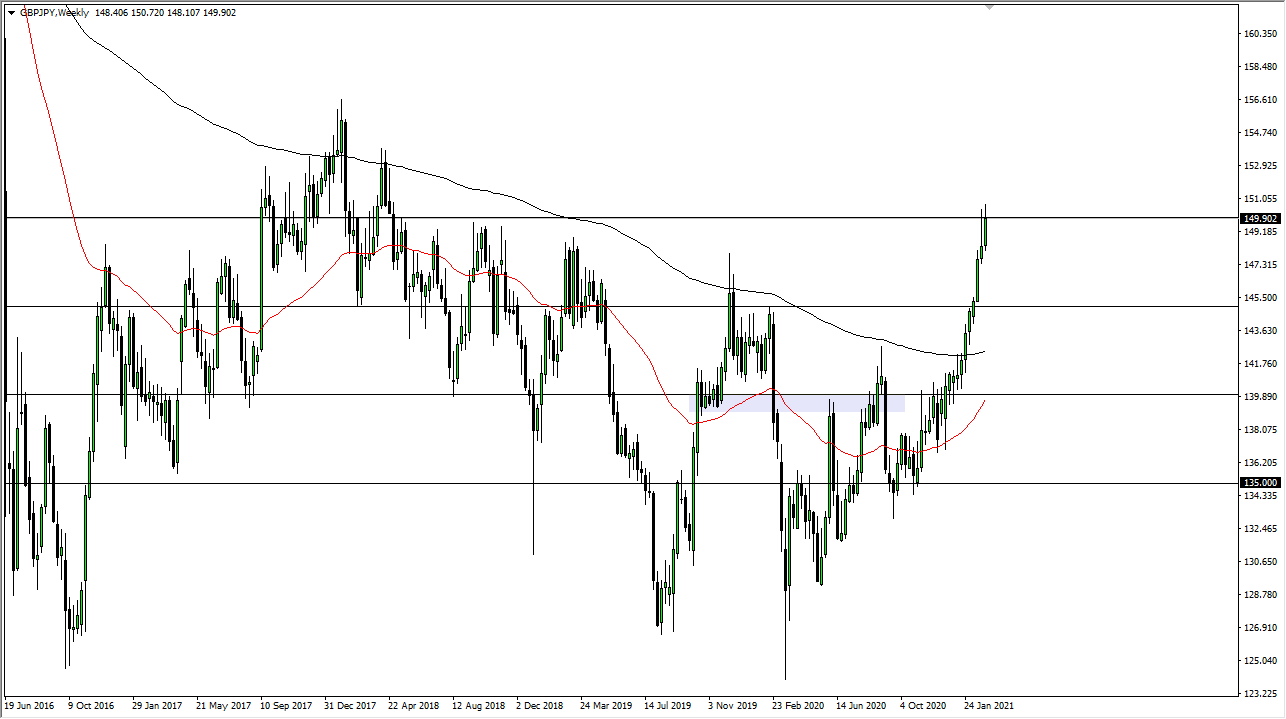

GBP/JPY

The British pound rallied rather significantly during the course of the trading week to break above the ¥150 level again. Right now, it looks like we are doing everything we can to break above it, and I think eventually we will. I look at short-term pullbacks as potential buying opportunities, especially near the ¥147.50 level. More than anything else, I think that you will see the market try to build up the necessary momentum to break out, and that may take a bit of time. On the breakout, expect this market to go looking towards the ¥140.50 level.

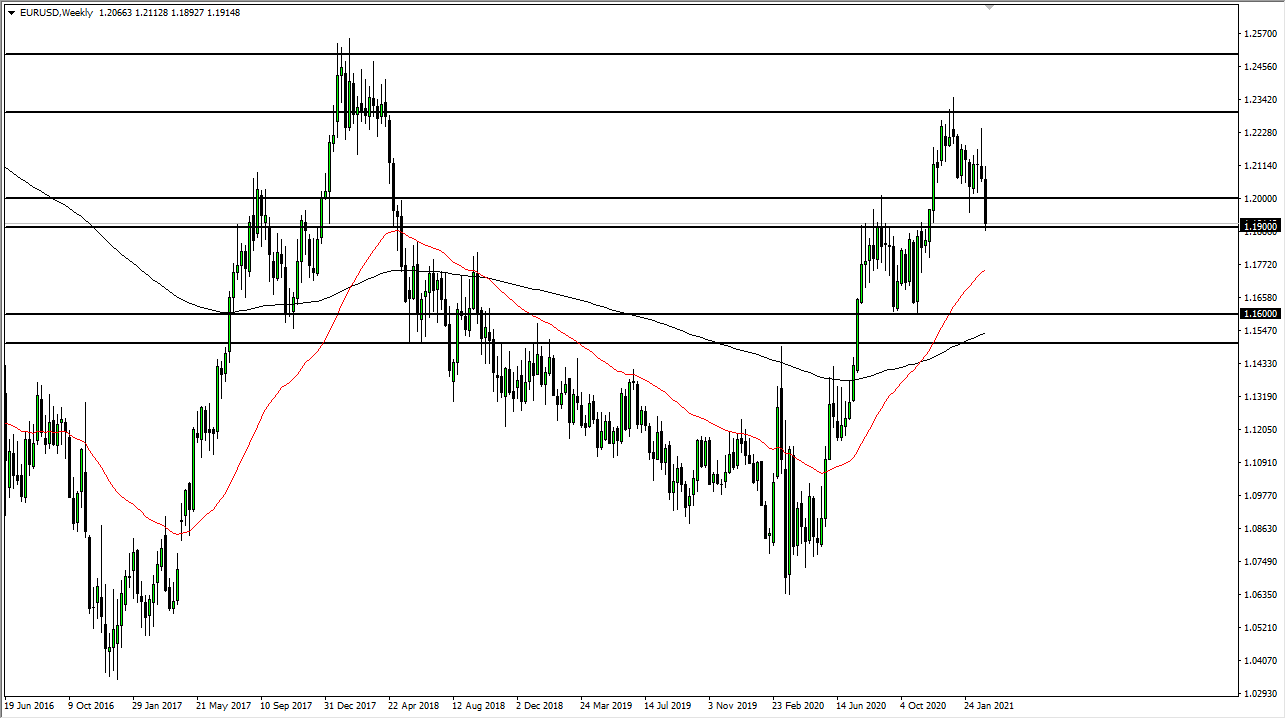

EUR/USD

The euro initially tried to rally during the week but then broke down significantly to crash into the 1.19 level. This was in reaction to higher bond yields coming out the United States, and the jobs number coming out much better than anticipated on Friday had an effect as well. Nonetheless, the market looks as if it is trying to hang on to the 1.19 level, which is the bottom of the major support level that extends to the 1.20 level. To the upside, I do not think that the market can get above the 1.23 level anytime soon. This is a market that continues to see upward momentum, but if we were to break down below the lows of the week, we could find ourselves dropping as low as 1.16. I think we have big decisions to make somewhere around the current level.

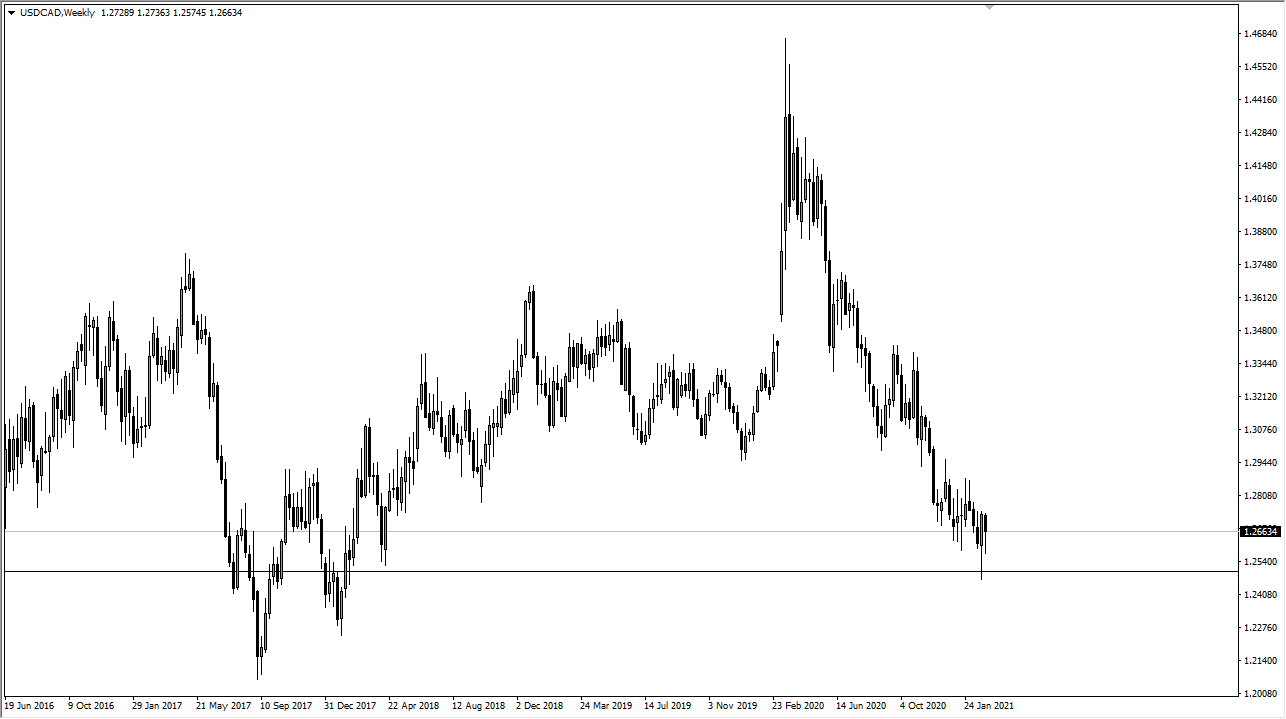

USD/CAD

The US dollar has bounced significantly from the 1.25 level during the previous couple of weeks, and now we have seen the market try to fall again only to turn around and form another hammer. I do think that it is only a matter of time before we turn things around, and if we can break above the 1.2750 level, the market is likely to continue going higher, perhaps reaching towards the 1.29 level, possibly even the 1.30 level. I think at best we are probably looking at the market as a sideways market and therefore the 1.25 level underneath would be massive support. If we were to break down below there, the bottom will fall out of this market.

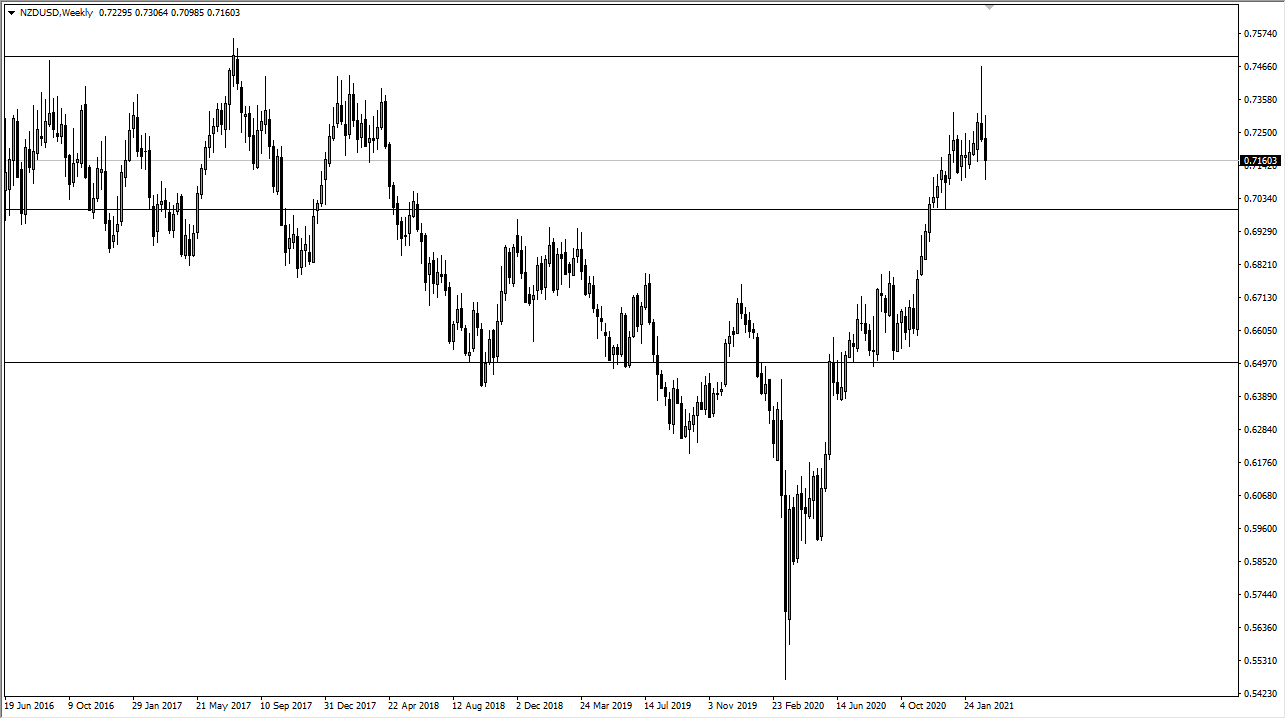

NZD/USD

The New Zealand dollar initially tried to rally during the course of the week but then broke down to show signs of weakness. I think this is a market that could drift down towards the 0.70 level, but a lot of this is going to come down to what we see in the yield complex in America. Keep an eye on that 10-year note; if the yields rise, that will put more pressure on this market.