EUR/USD

The Euro initially gapped lower to kick off the week but then turned around to fill that gap. After that, the market then felt significantly to break below the 1.18 handle, and now looks very vulnerable to say the least. All things being equal, we have broken through enough support that I suspect we will continue to see sellers on short-term rallies, perhaps trying to drive the Euro down to the 1.16 level underneath. The market taken out to the 1.19 level to the upside sets up a potential challenge of the 1.20 handle.

AUD/USD

The Australian dollar has also gapped lower to kick off the week, turned around to fill that gap, and then started falling again. We have almost Broke down below the shooting star from the February candlestick, so if we break down below the lows of this week, then I think the market is likely to go lower. At that juncture, the next move is probably to reach down towards the 0.72 handle. On the other hand, if we do not break down, I suspect that the Aussie dollar will be more neutral than anything else, so it is in either sell signal set up, or a neutral market for me.

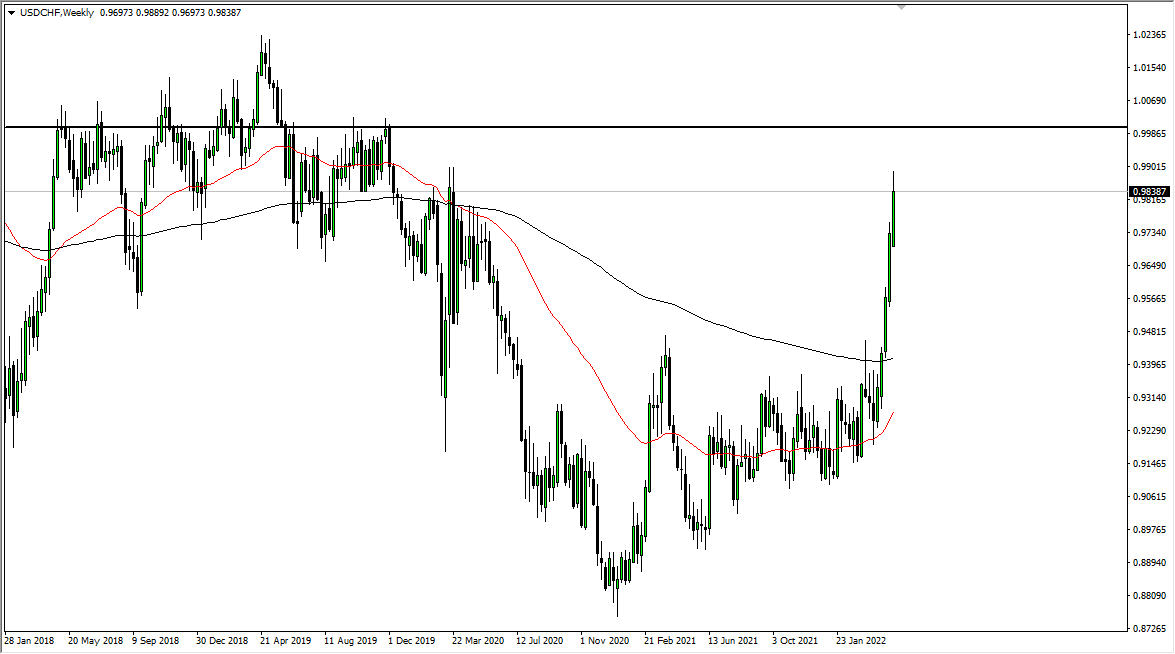

USD/CHF

The US dollar initially fell against the Swiss franc but then shot higher to break above the 0.94 level at one point. We have pulled back ever so slightly from there, but this is a good sign considering that the previous two candlesticks were a shooting star followed by a hammer, followed by the candlestick that we have just now formed. In other words, we have broken through a certain amount of resistance, and it is likely that we are going to continue to see more upward pressure as the yield rate differential between the two countries is widening, and therefore it makes the US dollar much more attractive in general.

CAD/JPY

The Canadian dollar initially fell against the Japanese yen during the week but found enough support near the ¥86 level to turn things around and show signs of strength again. Ultimately, the ¥88 level has recently formed a massive resistance as we had a shooting star from the previous week. If we can break above there, then it is very likely that the pair goes much higher. However, the fact that this market has turned around to form a bit of a hammer for the week tells me that we are more likely than not to see a lot of back and forth between the ¥86 level and the ¥88 level.