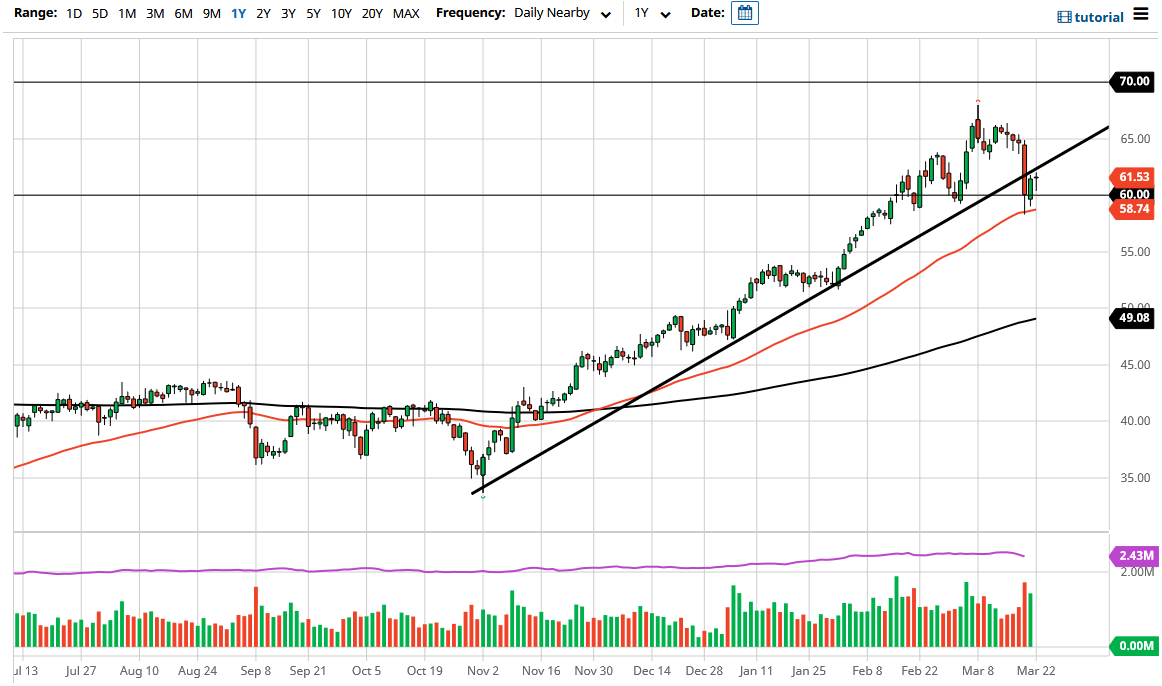

The West Texas Intermediate Crude Oil market has initially fallen during the trading session on Monday as traders came back to work, but it looks like the $60 level is going to continue to cause a bit of support as we have bounced quite nicely from there. However, we still have the major uptrend line from previous trading just above offering resistance. The ultimate result of the trading session that we just had formed a hammer, and it suggests that we could see a push higher. However, we need to get above that trendline to see more continuation and reach towards the $65 level.

To the downside, if we were to break down below the 50 day EMA the market could continue to go much lower, perhaps reaching down towards the $53 level. I think we recently had seen a shot across the bow as it were for the buyers, and now the question is whether or not we see some type of continuation? It is hard to imagine that we would lose 9% in one day and not see some type of follow-through, but the candlestick on Monday does suggest that it is possible.

I do recognize that the market is likely to be very noisy in the short term, as we are focusing on a whole plethora of things, not the least of which would be stimulus and the OPEC production cuts. However, it is also worth noting that at these high prices it is only a matter of time before US shale becomes viable as well, and that of course could come into play in order to cause issues. While I do not suggest that there is no way we will go higher, but the $70 level above I think will act as a major “ceiling in the market” as it is a large, round, psychologically significant figure, and an area that we have seen a lot of selling at previously.

All things been equal, I think this is a market that is going to be very noisy to say the least. I would wait until we get a daily close above the uptrend line or a daily close below the 50 day EMA to follow right along with whatever direction we break.