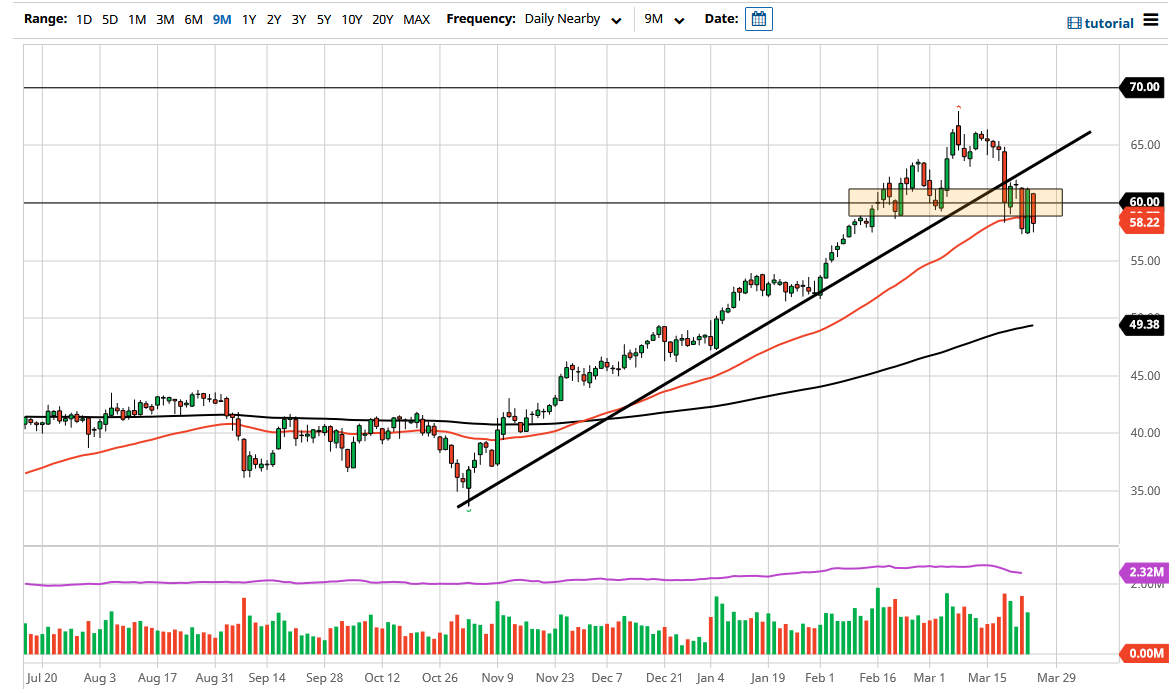

The West Texas Intermediate Crude Oil market has fallen again during the trading session on Thursday to reach down below the 50 day EMA. All things been equal, it is likely that we will continue to see significant noise, as the crude oil markets have to deal with the fact that there are lockdowns in the European Union that continues to be a serious issue when it comes to the idea of demand.

Looking at the candlestick for the day, it is obvious that there is still a lot of downward pressure, especially as we have all but wiped out the gains from the trading session on Wednesday. After all, the Wednesday candlestick was formed based upon the idea that a blockage in the Suez Canal was going to send the market straight up in the air. That being said, reality came back into play on Thursday, and now it looks as if we are trying to break down a bit. If we get down below the lows of the last couple of sessions, then I think we unwind the market to reach down towards the $55 level, possibly even the $53 level after that.

If we were to turn around and break above the Monday candlestick, then it would be a huge turn around and victory for the buyers. That being said, it does not look like we have enough momentum to make that happen, and with the inventory numbers not necessarily looking bullish as of late, it makes sense that we would see this market continue lower.

What I am not suggesting is that we are suddenly going to get a massive bearish market, but we had gotten ahead of ourselves. It will be interesting to see whether or not the selloff picks up steam, or if we simply drift lower going forward. I do think that there are quite a few support levels underneath so the selloff will probably be somewhat limited, but as demand clearly is not keeping up with the pricing that we have seen the market take off to. If we break down below the 200 day EMA, then the market could truly start to fall apart but at this point in time we have choppy and downward behavior ahead of us, and I still believe that we probably have more downward pressure than up.