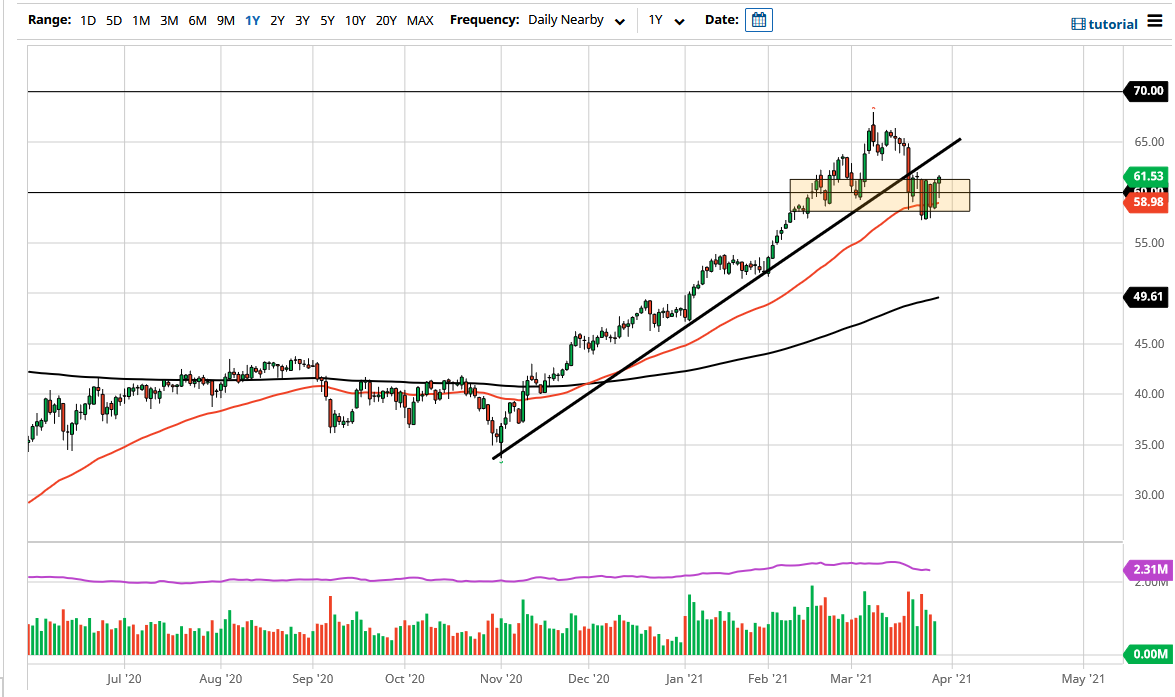

The West Texas Intermediate Crude Oil market initially fell during the trading session on Monday, but then turned around as rumors creep into the market that the Russians are looking to continue production cuts, thereby adding more upward pressure on the market in general. With that being the case, it is likely that we are going to try to get towards the uptrend line that we have seen broken recently. On the other hand, we could turn around and go back and forth in general in this overall vicinity of the $60 level. The one thing that I would say is that the choppiness will continue to be a major issue.

The idea of oil going higher is based upon the possibility of reopening the markets around the world, and more importantly, the economies. The $65 level above will be resistance, just as the $57.50 level would be support. If we break down below there, then it is likely that we are ready to go towards the $55 level, and then down to the 200 day EMA which is sitting just below the $50 level.

What is interesting is that the US dollar was strengthening in general during the trading session, even though oil rallied, or perhaps you could talk about it in a vice versa manner. This tells me that this is about crude oil specifically and not the dollar. Even though the Suez Canal has been opened up, that did very little to bring down fears of higher oil prices, so that tells me we are more than likely going to see a little bit of follow-through eventually. Whether or not we can break out to a fresh, new high is a completely different story, because from a technical analysis standpoint we are seing a little bit of sideways action. Nonetheless, that could be a good sign, because you do need to work the froth off of a major shot higher like we have had, which has been nothing short of parabolic at times.

I believe that you will continue to see a lot of chop, and therefore your position sizing will be crucial as you could get yourself into serious trouble in a scenario where markets could be very violent in the way they behave. With this, I think more of a sideways trading system with perhaps a slightly upward bias is the best way to go going forward.