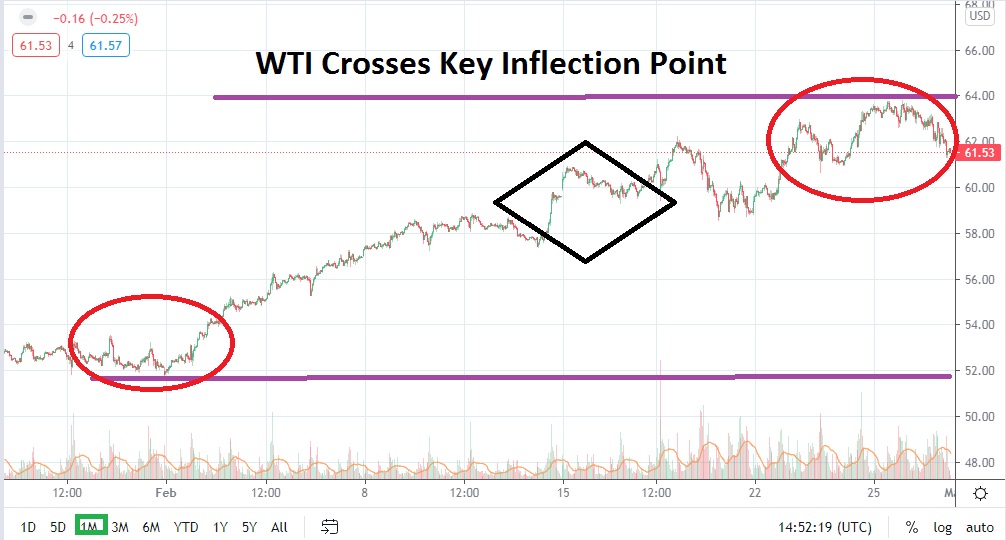

WTI Crude Oil enjoyed a strong month of upward value mobility in February as speculative and fundamental demand combined to create a terrific bullish trend. A powerful winter with good ‘old fashioned’ cold temperatures has helped create a definite undercurrent for demand to warm up households and buildings across North America and Europe. WTI burst through important resistance in the middle of February when it catapulted through 58.00 and 59.00 USD per barrel with relative ease.

WTI Crude Oil is now traversing above the 60.00 price level. In fact, as of this writing, the commodity is holding rather firmly above 61.00 and speculators are being forced to consider long-term charts. Technically, WTI is beginning to create value near last year’s highs which were seen in early February of 2020, when the price flourished within sight of 64.00. However, after that level was hit, the dark days of coronavirus implications saw the commodity slump famously to a negative value in the future markets in late April.

WTI is not about to go negative short term, and it continues to look like fundamental demand and a belief in economic recovery will help the commodity. If last year’s value can be toppled, new highs can emerge which will bring WTI Crude Oil into the vicinity of prices not engaged since 2018. Technically, WTI will have to prove it can sustain its current ratios as the promise of spring begins to emerge in the northern hemisphere. However, the broad commodity market appears to also be growing quietly optimistic that bullish speculative buyers are on the prowl.

If WTI continues to see demand remain steady there is a reason to suspect that resistance levels will prove vulnerable. Short-term traders will need to take into consideration that the global markets, particularly in equities, seem to be showing some cautious behavior the past week and this could dampen the mood of speculative commodity players. If WTI Crude Oil does begin to struggle within its current price mode, the 60.00 USD level should be monitored. If this value crumbles, it could ignite fast market conditions which may test additional short-term support junctures which were created in February.

Intriguingly, if current support proves to be capably strong over the next couple of weeks, it could be setting the table for additional moves upward. WTI Crude Oil is achieving a healthy price for the commodity at its current levels, one which makes production profitable. While this could reestablish the desire for more oil to be supplied via drilling, it is also based on the notion that as coronavirus concerns begin to vanish, global populations will return to normal livelihoods and the commodity will be needed for transportation and industrial use.

The trend of WTI Crude Oil has been strong and now may not be the time to fight against the existing trend. If a speculator doubts the resurgence of the commodity and chooses to wager on a sudden dose of bearish momentum developing, they will be going against the crowd as long as global sentiment continues to be steady to optimistic. Buying WTI Crude Oil on slight drawdowns looks like the appropriate trade for speculators who are able to efficiently use their risk-taking tactics and guard against occasional downward moves.

WTI Crude Oil Outlook for March:

Speculative price range for WTI Crude Oil is 57.00 to 67.50 USD.

Psychological support may be suspect near 61.00 and it if this level falters a test of 58.50 could develop. Should that stronghold vanish, a march towards 57.00 might ignite.

Interesting resistance may emerge near the 64.50 mark and, if it is proven vulnerable, a challenge could develop towards 65.80. Bullish speculators with long-term targets may believe 67.50 could be reached.