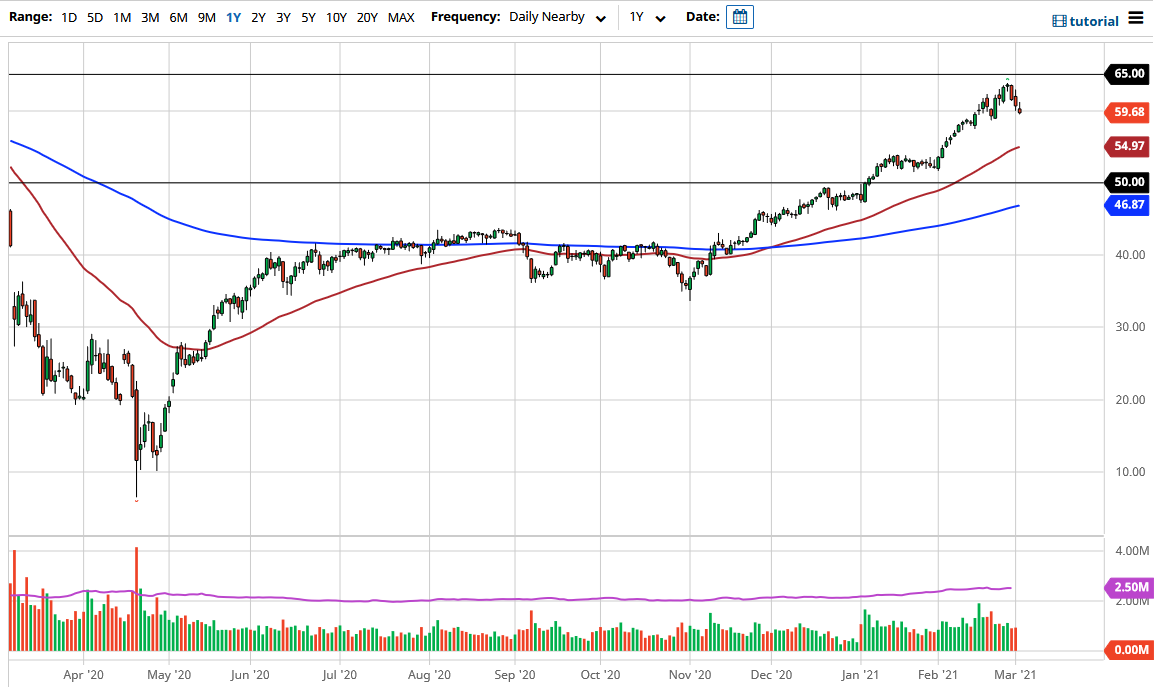

The West Texas Intermediate Crude Oil market initially tried to rally during the trading session on Tuesday but gave back the gains as we fell below the $60 level a couple of times during the session. This is a very negative sign and could send this market lower, perhaps reaching down towards the 50-day EMA. The 50-day EMA is currently at the $55 level, so that could be a potential target.

Rallies at this point look like they are going to continue to struggle, so oil is in a bit of a precarious situation. After all, there is the “reopening trade”, but at the same time one has to wonder whether or not OPEC will increase production in order to keep prices somewhat stable. After all, we have shot straight up in the air for some time. and it is worth noting that the last couple of weeks had started to form a bit of a megaphone pattern, which is a sign that we could pull back.

To the upside, the $65 level is significant resistance, as it was an area where we have seen a lot of selling in the past. In fact, we had cratered from that region before the pandemic hit, so I think it would make sense that we would struggle with that area. We have chewed through the pre-pandemic breakdown, so now the question is if we are really going to be that much more economically strong than before. If we order, that would be a short-term pop more than anything else, so one would have to think that the uptrend is somewhat limited. That's why I do favor shorting signs of exhaustion, or a breakdown below the lows of last week. At this point, the one thing that you can count on is that we are going to see a lot of noisy trading, so I think you have to be very cautious about your position size, but I am starting to focus more on the downside than anything else. I do not necessarily think that we are going to kick off a major selling situation, just that we had gotten far too ahead of ourselves over the last several weeks.