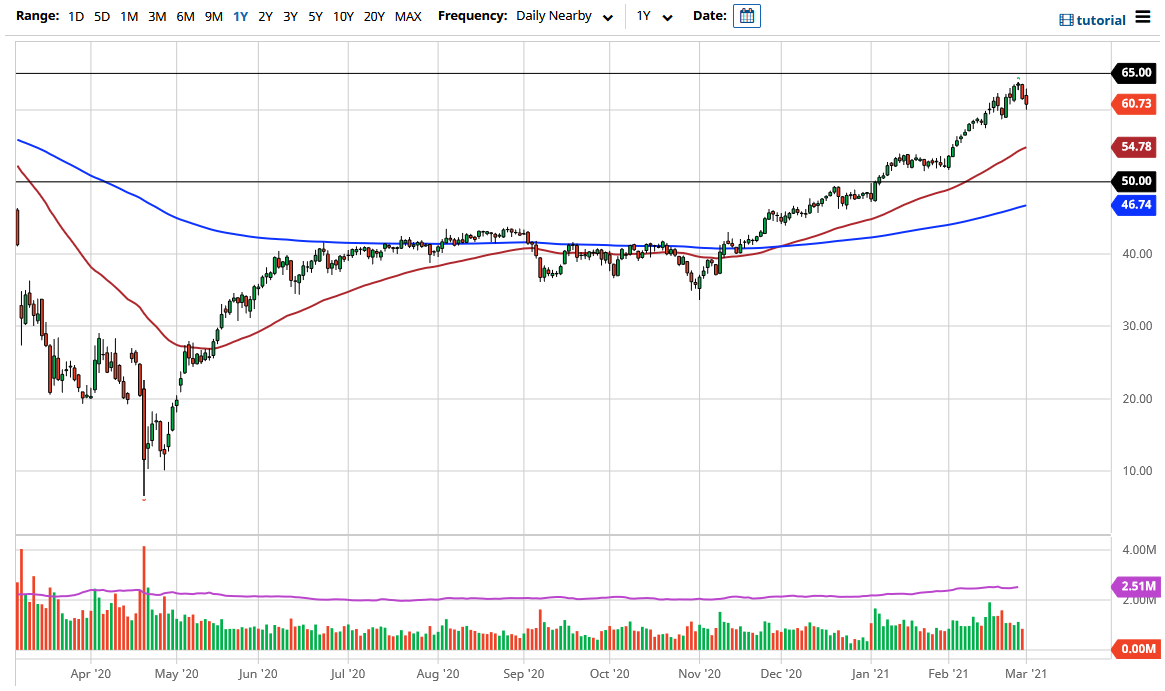

The West Texas Intermediate Crude Oil market initially tried to rally during the trading session on Monday, but then fell to crash into the $60 level. The $60 level is a large, round, psychologically significant figure, so it does make sense that there could be a little bit of buying pressure as we bounced towards the end of the day. The market is clearly showing signs of choppy behavior and perhaps running out of momentum. After all, we had previously been very impulsive, so the fact that we were chopping around in this general area tells me that perhaps we are starting to run out of that bullish pressure that had been so relentless in this market.

To the upside, the $65 level is massive resistance, and therefore it is worth looking at the longer-term charts where we had seen a lot of supply. In fact, we sold off from the $65 level before the pandemic, so I believe that it is going to be difficult to break out above this level to really take off to the upside. In general, I think that even if we were to take off to the upside, it would take multiple attempts to break out. After all, that is an area that will have a huge amount of selling pressure attached to it, so clearly a breakout above there would be a huge deal.

If we do turn around and break down below the $58 level, then we would more than likely go looking towards the 50-day EMA which is sitting just below the $55 level. I think the best that we will see is a significant amount of choppiness and volatility, perhaps offering short-term opportunities in both directions. However, this rally is getting a bit overdone and it is likely that we need a pullback at the very least. If we did break above the $65 level, then it is likely that the market could go looking towards the $70 level. The one thing that you can see is that the range that we are trading in when it comes to the uptrend line is starting to widen out, and that shows more indecision overall. Because of this, I think that you will more than likely see a significant sell-off sooner or later.