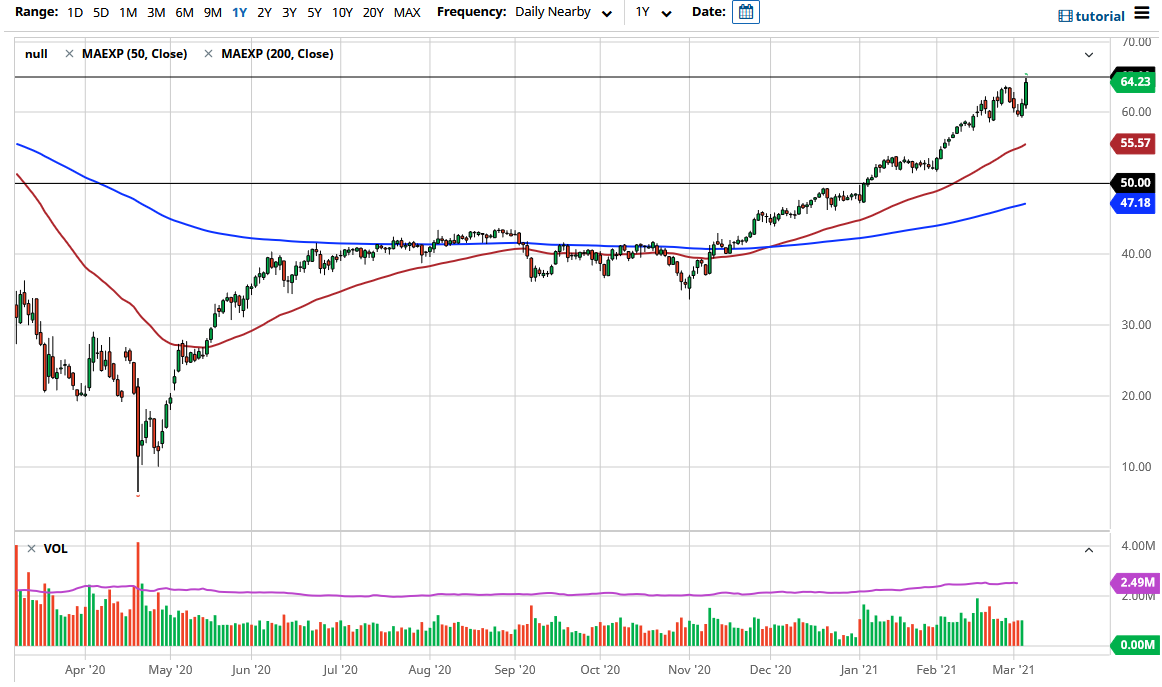

The West Texas Intermediate Crude Oil market has rallied rather significantly during the trading session on Thursday to touch the $65 level. The $65 level was an area that I have talked about as being crucial due to the longer-term charts, and the $65 level has seen massive resistance in the past, and it is not a huge surprise to see that we had seen that happen during a day where we shot straight up in the air.

All things being equal, the market is likely to see the $65 level to continue offering quite a bit of trouble for buyers, but if we were to break out above there, perhaps on a weekly close, then you can take a look at moving towards the $70 level. A lot of the pressure to the upside was due to the fact that some of OPEC+ members are arguing for an extension of production cuts into the month of April, if not May, and we have in fact seen the agreement to keep production cuts where we are until the end of April at the very least. With this, it tightens up supply but there are some other things to pay attention to here.

One of the biggest things that could cause some issues as the fact that higher oil prices will almost certainly bring in more US shale, which will eventually increase the supply. With this, I do believe that the market is likely to see somewhat of a headwind above, even though it looks like traders will do everything they can to break it out. Nonetheless, the market is likely to see a lot of noisy behavior, so with that being the case I think that what we are seeing here is an attempt to break an even bigger move, because if we do slice above the $65 level it would be yet another monumental push. However, if we were to turn around a break down below the $59 level, we could see a massive correction. I do think that a day of reckoning is coming but clearly, we are not ready to see it quite yet. Even if we do get a pullback, I would have to believe that there should be buyers underneath near the 50 day EMA. All things being equal, I think we are going to see a lot of noise and rumormongering.