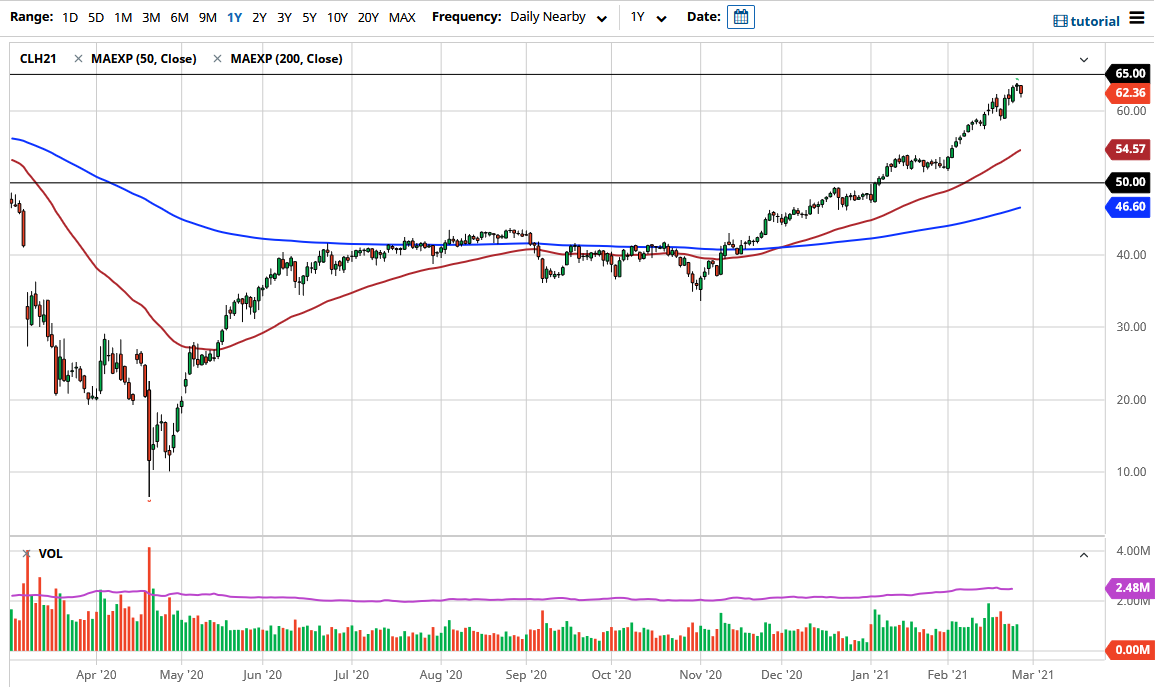

The West Texas Intermediate Crude Oil market pulled back a bit during the day on Friday to end the week in a flurry of profit-taking. This makes sense, because the markets have gone straight up in the air for what seems like a millennia. Nonetheless, we are approaching a major resistance barrier in the form of the $65 level, so that is also something worth paying attention to, as it will trigger a certain amount of selling pressure. The $65 level has been an area that the market has pulled back from multiple times on longer-term time frames, which can explain why we're seeing trouble in that general region.

The market still does look bullish in general, and I think that a pullback from here makes sense for no other reason than to build up the necessary momentum to challenge that $65 level. If we were to break above the $65 level, then I believe that the crude oil market could go much, much higher. In fact, I believe at that point you would be looking at at least another five dollars a barrel before serious selling pressure came back into the market.

Underneath, I believe the $60 level should be somewhat supportive, and the $57.50 level should be supportive after that as well. In general, I believe that crude oil has gone too far in too short of amount of time, and I think that a correction is not only coming, but it is desperately needed as well. Whether or not we can break above the $65 level is a completely different question, but I do think that the “easy money” has already been made in this market.

If we were to break down below the $55 level, then I think you would probably lose a lot of the momentum players and probably see an increase in selling, perhaps enough to drive down to the $50 level underneath. The reason I say this is that by the time we would get to the $55 level, we would be challenging the psychologically and technically important 50-day EMA. With everything that we have seen over the last couple of weeks accelerating to the upside, I believe that any pullback will probably be welcome news.