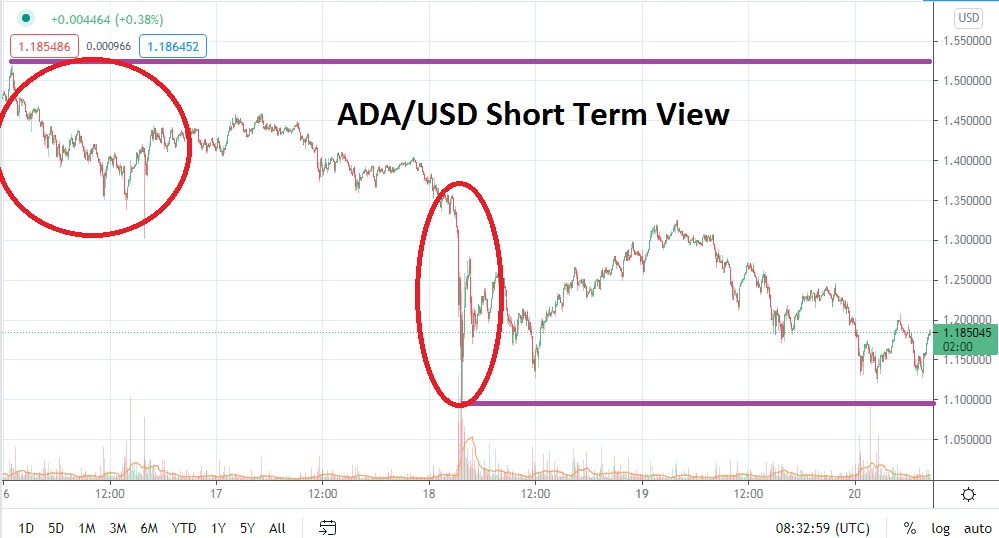

After reaching a high only one week ago above the one-and-a-half dollar mark, ADA/USD has seen its value incrementally lower. However, taking into consideration the volatility that the cryptocurrency market has produced the past week-and-a-half of trading, the results with Cardano are within line of its major counterparts. As of this writing, ADA/USD is battling short term support levels near the 1.180000 juncture and traders who remain optimistic regarding the future results of digital currencies may be enticed.

In early trading this morning, ADA/USD has generated plenty of action. A low of nearly 1.120000 was registered before a reversal higher developed. The current price of ADA/USD has it traversing a value level which was seen the last week of March and into the first week of April. On the 11th of April, ADA/USD was trading near the 1.200000 price, this before finding itself perched high above at nearly 1.550000 on the 14th with record values. Speculators drawn to volatility and the potential of finding rapid moves may find the current price range of ADA/USD technically alluring.

While a definite wave of selling has taken hold within the broad cryptocurrency market the past few days, ADA/USD has managed to stay within sight of its higher price range. ADA/USD is now traversing near important support; if the current junctures of 1.180000 to 1.160000 prove sustainable, it may signal another move higher could develop sooner rather than later.

If ADA/USD is able to show the ability of not only engaging resistance levels near the 1.200000 price, but also puncturing this juncture, Cardano may find itself off to the races again. Optimism was rampant within the broad cryptocurrency market only one week ago; it is actually healthy, however, to see reversals lower within financial assets. The question is if and where support levels will prove durable.

Traders who remain bullish regarding ADA/USD may believe the current support levels being tested provide an opportunity to be a buyer. Traders should certainly use limit orders and make sure they have their stop losses functioning. Tactically looking for upside momentum to develop in the short term appears challenging, but it may prove worthwhile if current values prove to be a solid ground.

Cardano Short-Term Outlook:

Current Resistance: 1.202500

Current Support: 1.177500

High Target: 1.268900

Low Target: 1.094800