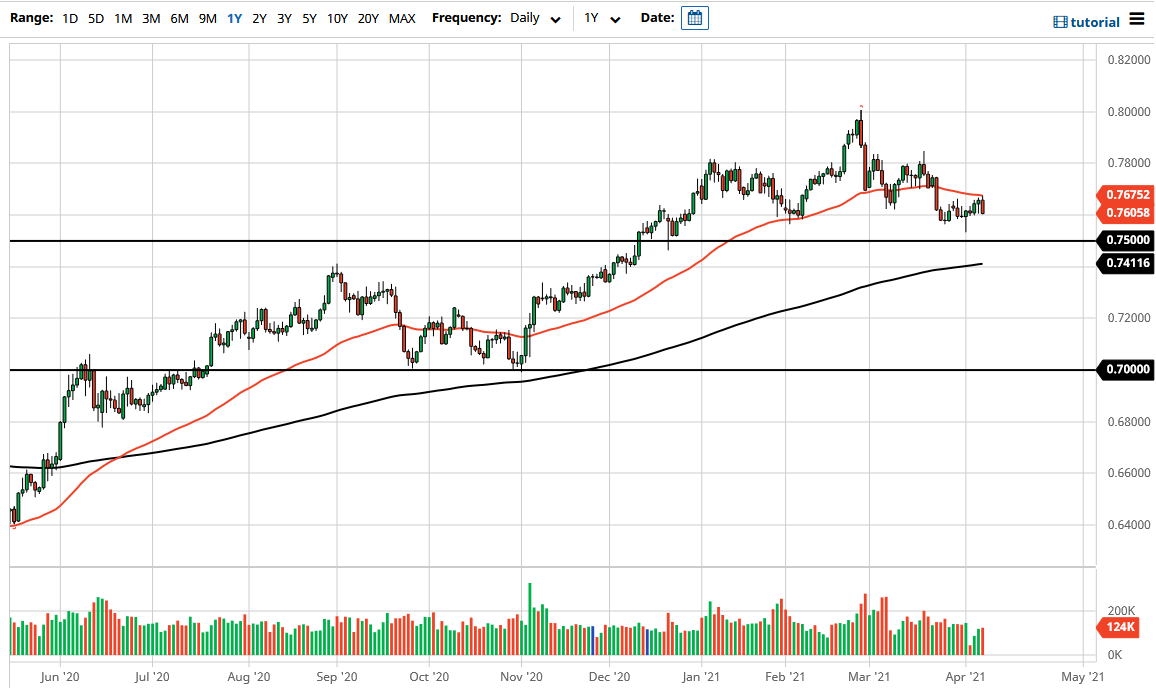

The Australian dollar initially tried to rally during the trading session on Wednesday but found the 50-day EMA to be a bit too resistive to continue going higher. Ultimately, the market then fell towards the 0.76 handle, an area that has been a bit of a magnet for price as of late.

Out of all of the markets that I am employed to follow, the Australian dollar strikes me as being one of the more interesting ones currently. This is because we can draw multiple trendlines that suggests we are in the midst of breaking down, not only from a trendline break, but also a head and shoulders pattern. However, the 0.75 level underneath seems to be massively supportive. Adding more bearish fuel to the fire is the fact that both the February and the March candlesticks were shooting stars, something that is rarely seen on the monthly chart. Needless to say, that is a very negative technical set up, so I think that rallies will continue to face a lot of trouble. The question at this point is whether or not we can break down below support.

Quite often, markets will front-run events. I do not know what would cause this market to break down, because it could be a whole slew of things. The US dollar can strengthen because of interest rates spiking, which we have seen as of late in various markets, not just the Forex markets. But we could also see something specific to Australia that comes in and causes issues. For example, recently the Australians and the Chinese have had a bit of a spat going, and that does not seem like it is letting up anytime soon. Perhaps that may escalate enough to cause issues for Australia?

To the upside, I see the 50-day EMA as obvious resistance, but then after that we would have to go looking at the 0.78 level. That area has caused a lot of resistance recently, and therefore I think what we are looking at is a scenario where if we could break above there, then we will probably have a bit of an “air pocket” reaching towards the 0.80 level. It is at that level that monthly charts really start to show signs of massive resistance.