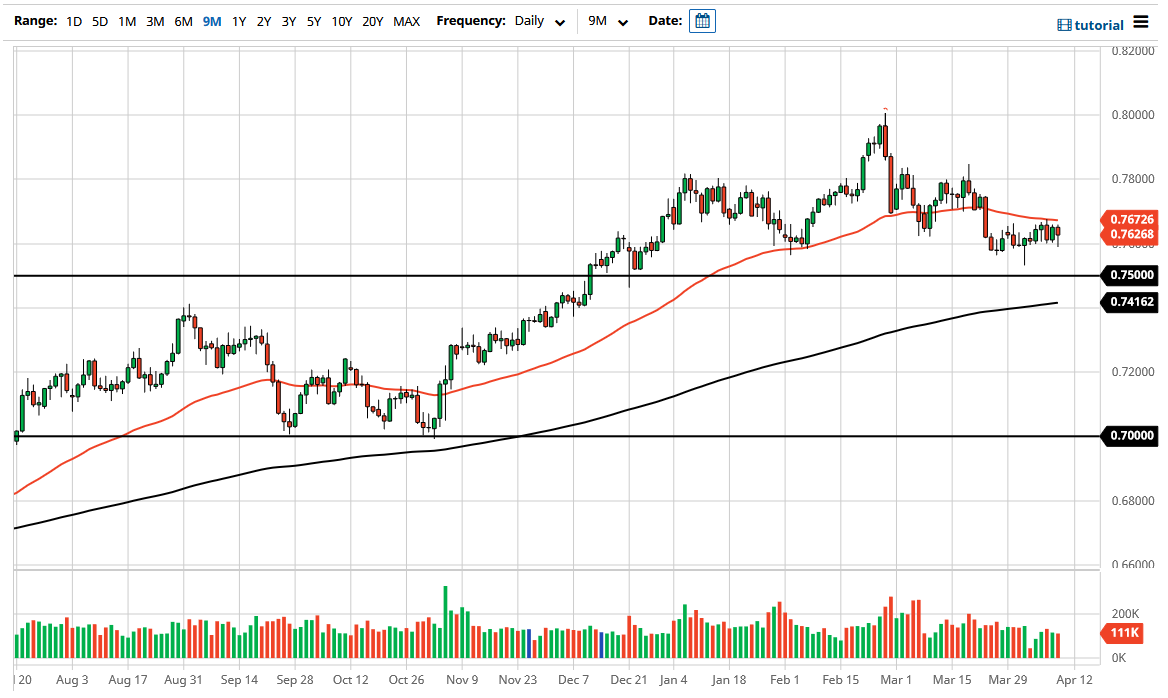

The Australian dollar initially fell during the trading session on Friday but then turned around to show signs of life again. That being said, the market looks as if it is trying to figure out where to go from a longer-term standpoint, and I think that we should get a rather large move sooner or later. The candlestick for the trading session on Friday was rather lackluster, just as the last couple of weeks have been. It does suggest that the 0.76 level is going to continue to offer support, so if we were to break down below there, I think that the market is likely to go much lower.

The monthly candlestick has been in focus as of late, with the February and March candlesticks are both forming shooting stars. This suggests that we could see a bit of a withdrawal from these high levels, and I do think that would make sense. That would be especially true if the US dollar suddenly sees strength across the board. The Australian dollar is not behaving like a currency that is ready to take off quite yet, although if you had to classify the Friday candlestick as anything, it would probably be a hammer.

At this point in time, you should keep an eye on the 50-day EMA, because it is an area that has offered a significant amount of resistance over the last couple of weeks, as well as support previously. Because of this, I think this is a market that will continue to see a lot of noise and choppiness, but eventually we will get some type of impulsive candlestick. Once we do, then it is likely that we will simply follow right along to reach the 0.78 level to the upside, or the 0.71 level underneath. The 0.71 level underneath is the target based upon the “measured move” of the potential head and shoulders pattern, so I think what we are looking at here is a bit of a self-fulfilling prophecy. Pay close attention to those yields coming out of America, because if they continue to spike it will favor the greenback, especially if it is going to be done rather quickly. On the other hand, if we get a little bit of stabilization in the market, that might allow the Australian dollar to rally.