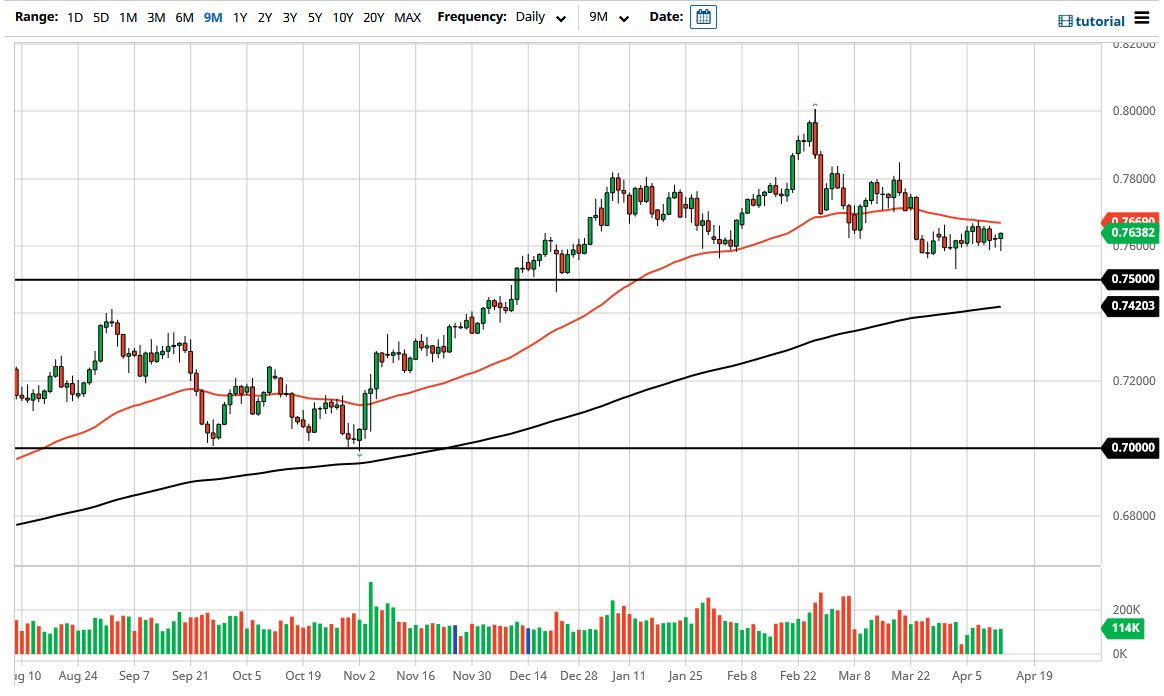

The Australian dollar initially fell during the trading session on Tuesday but found enough support just below the 0.76 level to turn things around and show signs of life again. We have been going back and forth in a relatively tight range for some time, as we are trying to figure out where to go next. Ultimately, I do think that there is significant resistance in the form of the 50-day EMA, so I am paying close attention to it.

The Australian dollar is going to need to see some type of catalyst to get going, and we have just been killing time in the support area over the last several weeks. In fact, a lot of traders have essentially “fallen asleep”, which happens occasionally in these markets. That being said, I do think that the move is coming soon, and as a result we will get some type of impulsive candlestick that we can follow.

It is worth noting that the market continues to look at the 0.76 level as important, just as it is worth noting that the February and March candlesticks were both shooting stars. That is a very negative sign in and of itself, so it is likely that we will see a certain amount of selling pressure above. In fact, it is pretty rare that you see a couple of shooting stars not kick off a bigger move to the downside. That does not necessarily mean that we have to break down, just that it looks likely to happen. At this point, though, the market breaking down below the 0.75 level would be necessary for this market to really break apart. At that point, the market would go looking towards the 0.71 handle.

If we were to break above the 50-day EMA, then it is likely that we would see resistance at the 0.7750 level. If we do reach towards that area, it is not until we break above the 0.78 level that I would be truly impressed. At that point, the market is likely to go looking towards the 0.80 level. That is an area that is massive resistance on monthly chart, so we need to pay close attention to the market if we break above there, because then it would become a longer-term “buy-and-hold” type of situation.