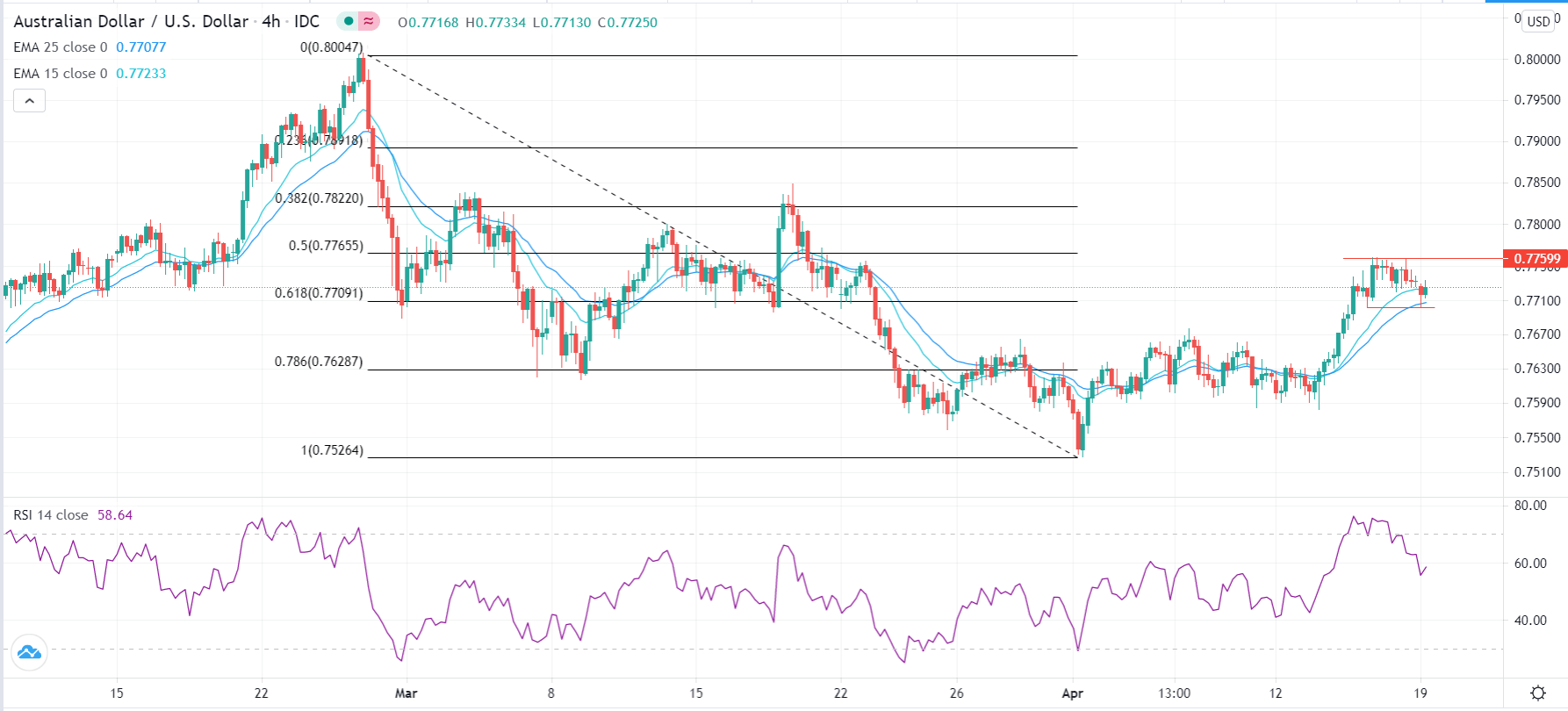

The Australian dollar pulled back a bit during the trading session on Friday as the 0.7750 level continues to offer resistance. I think that resistance extends all the way to the 0.78 level, so it is likely that we may get a bit of a pullback. With that being the case, it is very likely that we will continue to see noisy behavior out there, as we are getting a bit over-extended, and it does make sense that we would see parabolic moves get faded.

The Australian dollar is highly sensitive to risk appetite and the reopening trade, especially as the commodity markets are so highly levered to the Aussie. With this being the case, it is likely that we will see the .78 level as a major resistance barrier, and until we break above there, I think that this market still has to be looked at with a little bit of suspicion. After all, the February and March candlesticks were both shooting stars, which are negative signs. That being said, the market certainly sees a lot of selling pressure above, and a pullback from these lofty levels would not be a huge surprise. You also have to keep in mind that the US dollar has been under constant assault for a while.

The 50-day EMA underneath could be supportive, but I think the real support shows up near the 0.76 handle, which extends down to the 0.750 level. Breaking down below there could open up a significant move lower, possibly 400 pips or so. Even if we did pull back that far, it still is only a slight pullback for the longer-term market. On the other hand, if we were to break above the 0.78 level, it opens up a move towards the 0.80 level. The 0.80 level is a massive resistance barrier for the long term, and if we did break above there, then it could be more or less a “buy-and-hold” type of situation. Until then, one has to look at this as a market that is ready to be very choppy, and perhaps even pull back.