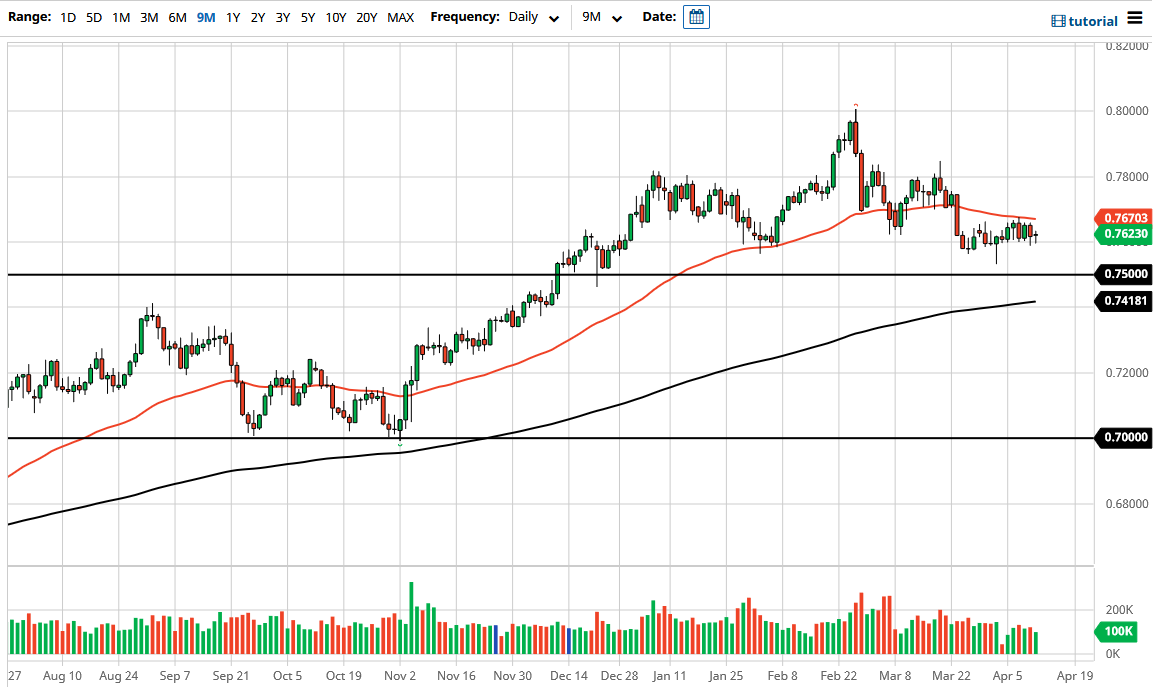

The Australian dollar continues to chop around back and forth during the trading session on Monday, as the markets are in general looking for some type of directionality. When you look at the chart, it is obvious that the 0.76 level continues to be crucial, as I have been talking about for some time.

All that being said, the 50 day EMA above continues to offer quite a bit of resistance, so if we were to break above there on a daily close it could send this market to much higher levels, perhaps reaching towards the 0.78 handle. That is an area that has been resistance as well, and I would anticipate that there should be sellers in that general vicinity also. Remember, we have formed a shooting star for both February and March, so it should not be a huge surprise to see selling pressure on rallies. At this point the Australian dollar looks as if it is due for some type a larger pullback.

That being said, you can also make an argument for the fact that we have seen quite a bit of resiliency in this general vicinity, so that is something worth paying attention to. If we break above that 50 day EMA, then I think we simply get a little bit of a short-term reprieve. If we were to break above the 0.78 handle however, that would be a very bullish sign and could send the market testing the 0.80 level again. That of course is a major area that I have been talking about for some time, as it is a monthly support and resistance level that has been crucial multiple times. If we were to break above there, the Australian dollar will take off.

That being said, I think a pullback towards the 0.71 level makes the most sense, based upon monthly candlesticks. Not only would that be a nice pullback, but it would still keep intact the overall bullish attitude that the market has seen for months. We had gotten far too ahead of ourselves, so it does make sense that we would need to pullback in order to build up enough momentum to go higher. A lot of this is going to come down to the interest rate situation and what is going on in the short term as rates have been spiking.