Bullish View

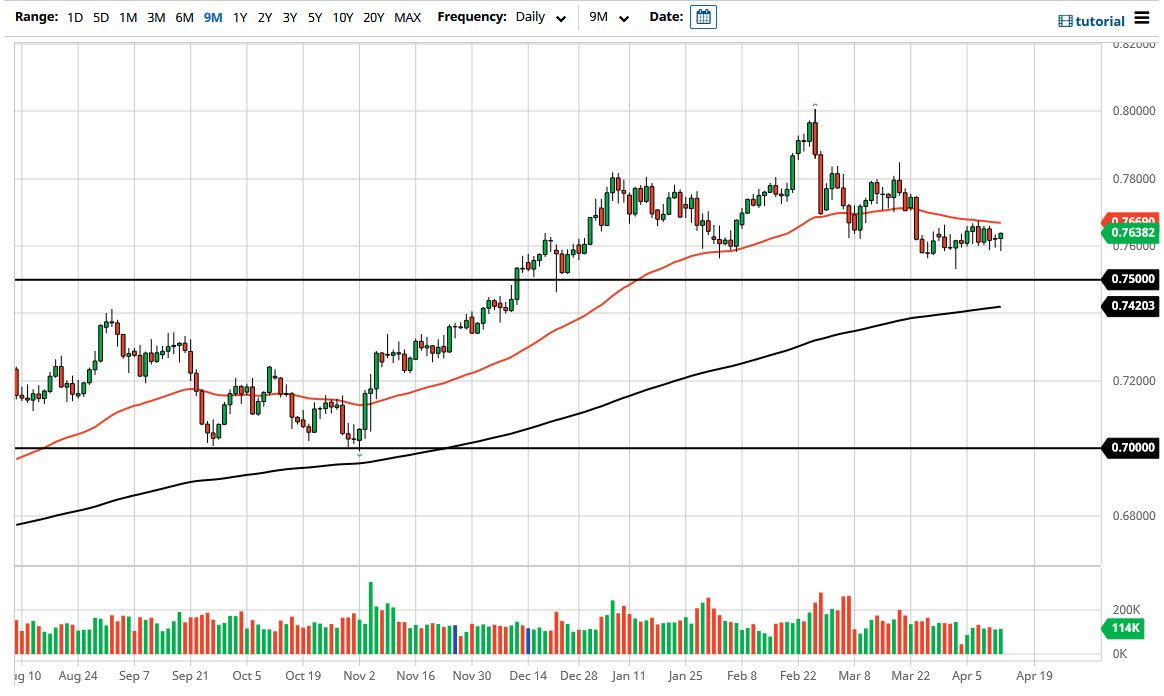

Set a buy stop at 0.7665 (upper side of the rectangle).

Add a take-profit at 0.7712 (61.8% retracement).

Set a stop-loss at 0.7600.

Bearish View

Set a sell-stop at 0.7630 and a take-profit at 0.7550.

Add a stop-loss at 0.7700.

The AUD/USD pair is up for the second straight day helped by the overall weaker greenback. The pair has risen to 0.7660, which is higher than yesterday’s low of 0.7585.

Weaker US Dollar

The AUD/USD is rising mostly because of the weaker greenback as traders react to the latest US Consumer Price Index (CPI) data. According to the Bureau of Labor Statistics (BLS), the headline CPI in the US rose by 2.6%, above the median estimate of 2.5%.

This increase was mostly because of the higher gas prices, the ongoing reopening, and the recent stimulus package. The data came two days before the US publishes the latest retail sales numbers.

The AUD/USD has also risen because of the relatively strong economic data from China and Australia. On Tuesday, data by NAB revealed that the business confidence fell from 18 in February to 15 in March this year. Tday, data by Westpac showed that the consumer sentiment increased from 2.6% to 6.2% as the country continued its reopening.

Yesterday, data by China revealed that the country’s exports rose by 30.6% in March after rising by 60.6% in the previous month. In the same month, imports increased by 38.1% after rising by 22.2% in February. This increase was better than the median estimate of 21.6%. These numbers are important for Australia because of the volume of goods the country sells to China.

Today, the AUD/USD price will react to a speech by Jerome Powell. In it, he will talk about the Fed’s policy going forward now that the headline inflation has moved above the target at 2.0%. Investors will also be waiting for the latest Australian jobs numbers and the US retail sales and jobless claims numbers scheduled for tomorrow.

AUD/USD Technical Forecast

The four-hour chart shows that the AUD/USD pair has formed a rectangle pattern whose support and resistance levels are at 0.7600 and 0.7665, respectively. The pair has also moved above the 25-day and 15-day exponential moving averages (EMA). It is also between the 78.6% and 61.8% Fibonacci retracement levels. Therefore, the pair will likely have a bullish breakout as bulls target the 61.8% retracement at 0.7712. A drop below 0.7627 will invalidate this trend.