Bullish View

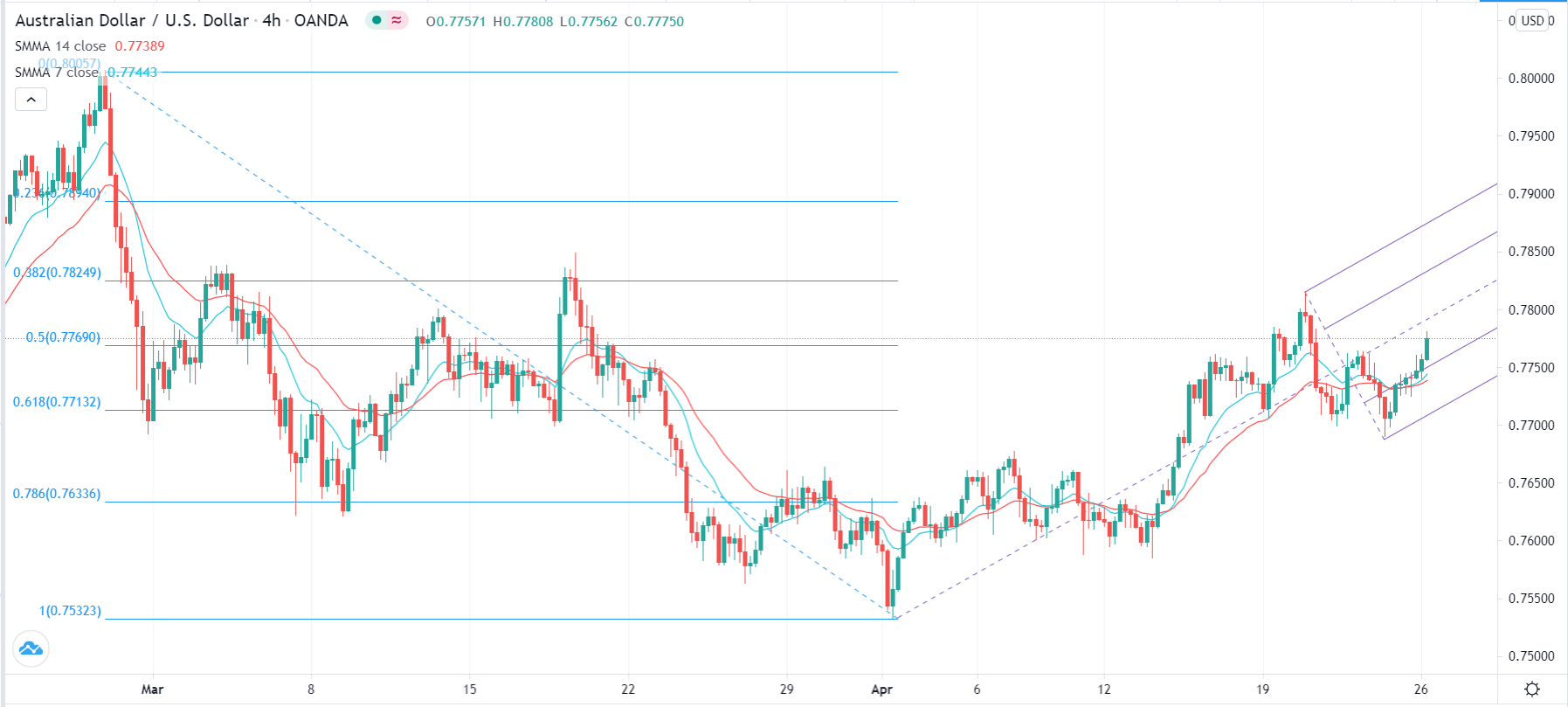

- Buy the AUD/USD and set a take-profit at 0.7825.

- Add a stop-loss at 0.7750.

- Timeline: 1 - 2 days.

Bearish View

- Set a sell-stop at 0.7750 and a take-profit at 0.7700.

- Add a stop-loss at 0.7800.

The AUD/USD inched upwards in the Asian session as commodity prices rose and the US dollar slipped. It rose to 0.7780, which was 1.20% above its lowest level in April this year.

Australian Dollar Rises

The AUD/USD pair is rising mostly because of the relatively weaker US dollar. The US Dollar Index, which measures the performance of the greenback against key currencies, declined by 0.20%. The dollar declined by 0.20% against the Canadian dollar, 0.60% against the Japanese yen, and by 0.25% against the euro.

This decline is mostly because of the falling bond yields as investors wait for the upcoming Fed interest rate decision. The 10-year Treasury yield is trading at 1.57%, which is lower than the year-to-date high of 1.76%. The 30-year yield, on the other hand, has fallen to 2.23%. The Fed will start its meeting tomorrow and deliver its decision on Wednesday. Analysts will be watching whether the bank will change its tune on rate hikes.

The AUD/USD is also rising because of the relatively higher commodity prices. The Bloomberg Commodity Index (BCOM) has risen by more than 0.20% as traders react to the recent strong flash global sentiment data. Last week, data by Markit revealed that US, European, and Asian Manufacturing and Service PMIs continued to rebound in April. This in turn led to higher commodity prices like copper, crude oil, and iron ore. The Australian dollar is often viewed as a good proxy for commodity prices.

Looking ahead, the AUDUSD price will react to the latest US durable goods orders that will come out today and Chinese industrial production numbers scheduled for tomorrow morning.

AUD/USD Forecast

The four-hour chart shows that the AUD/USD pair has been in a strong upward trend. It has moved above the 50% Fibonacci retracement level and the 25-day and 15-day smoothed moving averages (EMA). The pair is also approaching the median line of the Andrews Pitchfork tool. Most importantly, it has invalidated the head and shoulders pattern by moving above the right shoulder.

Therefore, the pair will likely keep rising as bulls target the next key resistance at 0.7826, which is along the first resistance of the pitchfork tool. For this to happen, bulls will need to move above the median pitchfork level at 0.7780. However, a drop below 0.7750 will invalidate this trend.