Bullish View

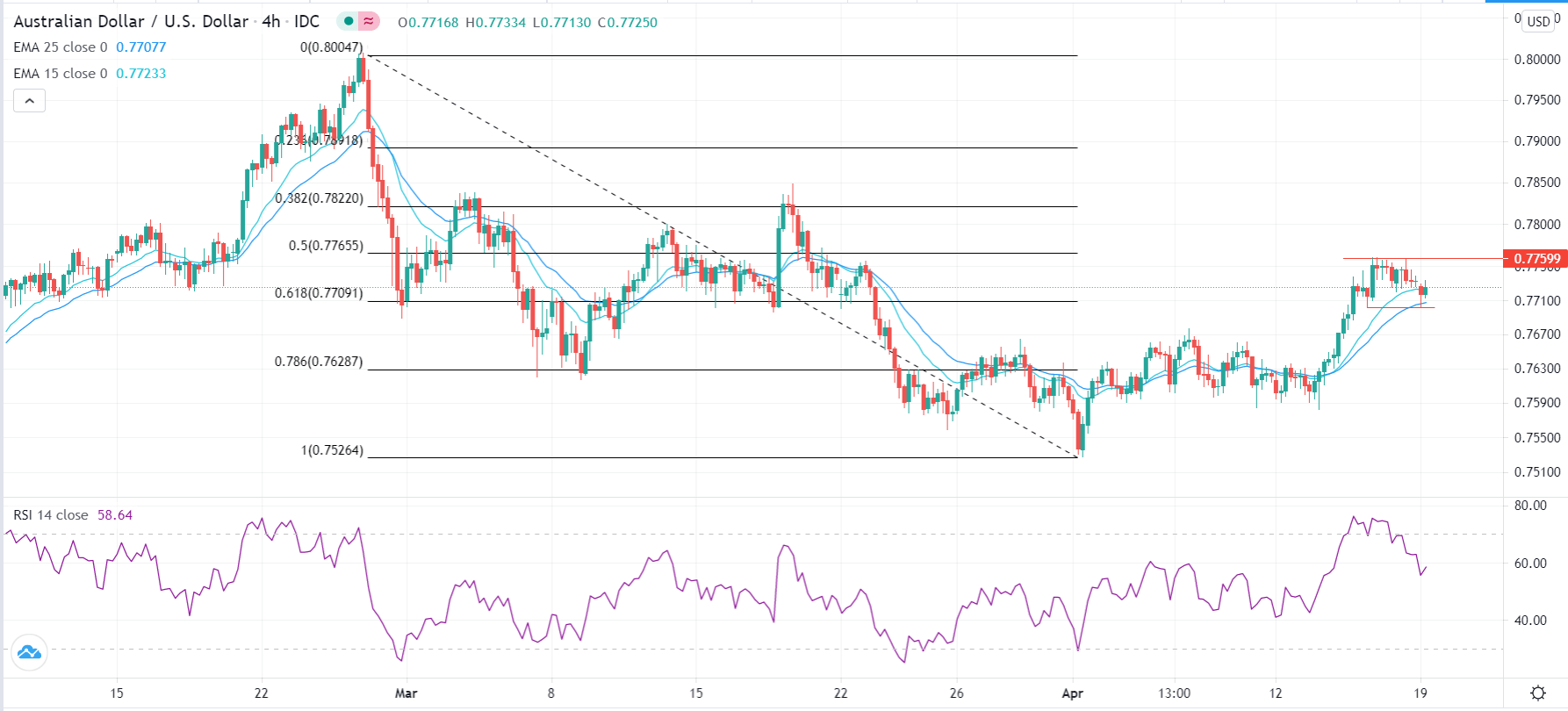

Set a buy stop at 0.7760 (last week’s high)

Add a take-profit at 0.7822 (38.2% retracement).

Set a stop-loss at 0.7710.

Timeline: 1-2 days.

Bearish View

Set a sell-stop at 0.7698 (today’s low.

Add a take-profit at 0.7628 and a stop-loss 0.7760.

The AUD/USD is little changed today as the US bond yields drop and as traders wait for the latest Reserve Bank of Australia (RBA) minutes. It is trading at 0.7726, which is slightly above the intraday low of 0.7700.

Australian Dollar Pressured

The Australian dollar had a relatively positive week last week as it rose from 0.7625 to 0.7760. This happened as the Forex market brushed-off the relatively strong data from the United States.

The numbers revealed that March was a positive month for the country as consumer prices and retail sales rebounded. The manufacturing sector also continued to recover while fewer Americans filed for initial jobless claims.

The overall weaker US dollar pushed commodity prices higher. The Bloomberg Commodity Index (BCOM) rose by more than 0.60%, as leading commodities like copper, iron ore and nickel rose. This performance was also supported by the strong China GDP numbers that came out on Thursday. In most cases, the Australian dollar performs well when commodity prices are rising because of the vast amount of commodities it exports.

This week, the AUD/USD will react to several key events. On Tuesday, the RBA will publish the minutes of the last meeting. In it, they will explain their thinking about the rate and their thinking about the current economic recovery. They will also talk more about the resurgent housing prices.

The pair will also react mildly to the PBOC interest rate decision set for tomorrow. Other important events from Australia are the preliminary retail sales and the flash Manufacturing and Service PMI numbers that will come out on Friday.

In the United States, the AUD/USD price will react to the latest new and existing home sales, and the initial jobless claims numbers.

AUD/USD Technical Outlook

The AUD/USD rose to a high of 0.7760 last week, where it found a substantial resistance. On the four-hour chart, the pair has moved slightly above the 61.8% Fibonacci retracement level while the Relative Strength Index (RSI) has moved from the overbought zone of 76 to the current 58.

It is also at the same level as the 25-day and 15-day moving averages. The pair has also formed a bullish flag pattern. Therefore, there is a possibility that it will rebound above last week’s high at 0.7760 and move to the 38.2% retracement at 0.7822.