Bearish View

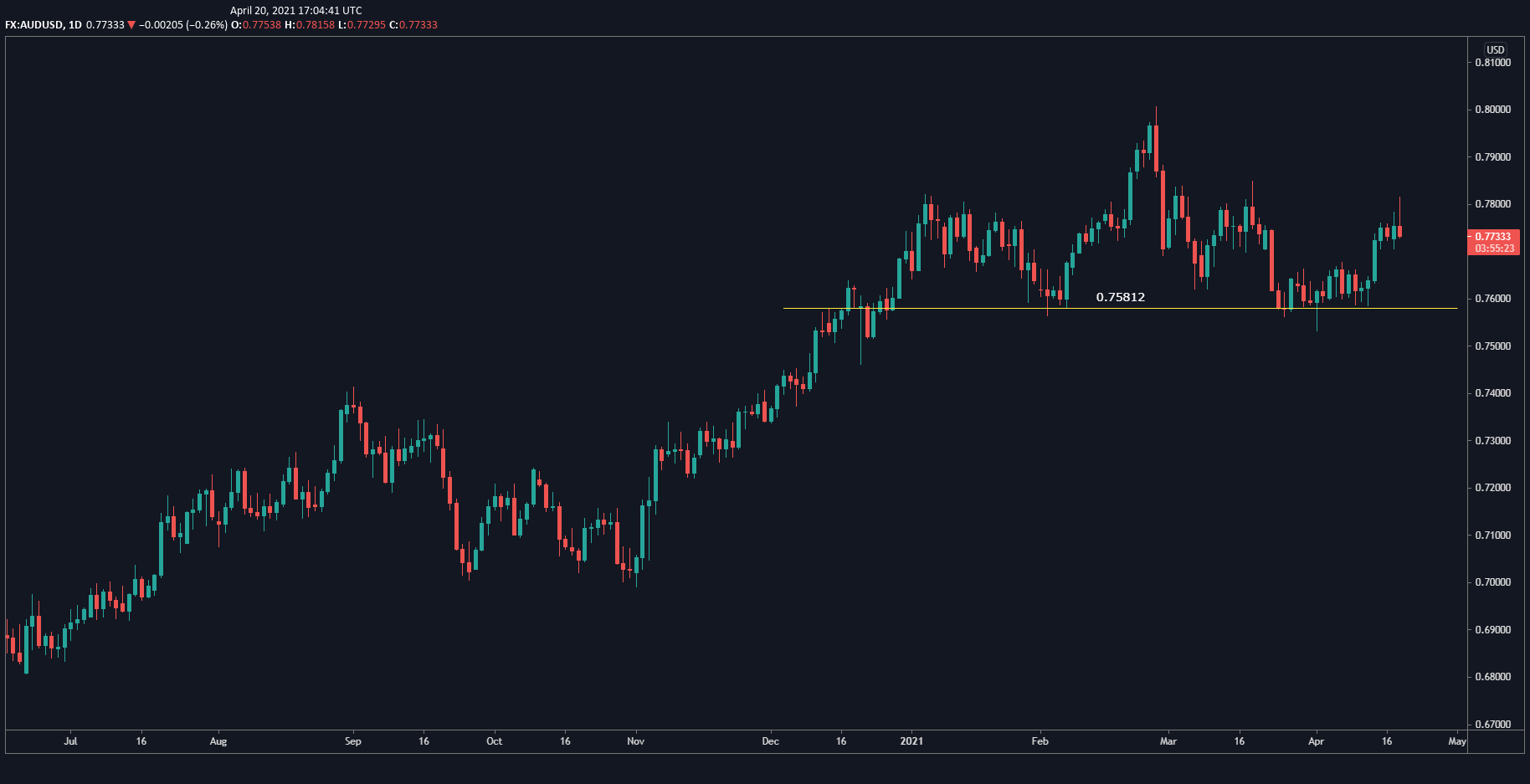

Set a sell-limit at 0.7763 and a take-profit at 0.7650.

Add a stop-loss at 0.7815.

Timeline: 1-2 days.

Bullish View

Set a buy stop at 0.7765 and a take-profit at 0.7850.

Add a stop-loss at 0.7700.

The AUD/USD declined in the overnight session as the rising number of COVID cases raise concerns about the commodity sector. The pair is trading at 0.7718, which is 1.25% below this week’s high of 0.7816.

Australian Retail Sales Rise

The AUD/USD pair declined even after Australia’s Bureau of Statistics published the latest retail sales numbers. The data revealed that a surge in consumer confidence has led to robust retail spending. The confidence has jumped to the highest level in 11 years as they eye the country’s reopening.

In total, retail sales rose by 1.4% to A$30.7 billion in March. This was a substantial increase compared to the 0.8% decline in February. The growth was mostly because of more spending in cafes, restaurants, and takeaway services.

The data came a day after the Reserve Bank of Australia (RBA) published the latest minutes. In the minutes, the members insisted that the country was still having an uneven recovery and that they would continue to support it through low-interest rates and asset purchases.

The AUD/USD is also falling as fears of a global slowdown intensify as the number of coronavirus cases rise. While cases in developed countries have slowed, emerging market countries like Brazil and India are seeing higher cases. This could have an impact on global demand, which could impact the commodity sector. This is important because the Australian dollar is often viewed as a proxy for commodities.

The AUD/USD pair has also declined as the US bond yields rise. The 10-year yield has risen to 1.56% while the 30-year has risen to 2.26%. Still, these yields are lower than where they were a week ago.

AUD/USD Forecast

The AUD/USD pair declined sharply in the overnight session. It is trading at 0.7715, which is substantially below where it was this week. On the four-hour chart, the pair has moved from the 38.2% Fibonacci retracement level and is now approaching the 61.8% retracement. It has also moved below the 25-day and 15-day exponential moving averages while the Relative Strength Index (RSI) has continued to decline.

The pair also seems to be forming a head and shoulders pattern, which is a well-known reversal pattern. Therefore, while the pair will likely keep falling, there is a possibility it will rise slightly to form the right shoulder.