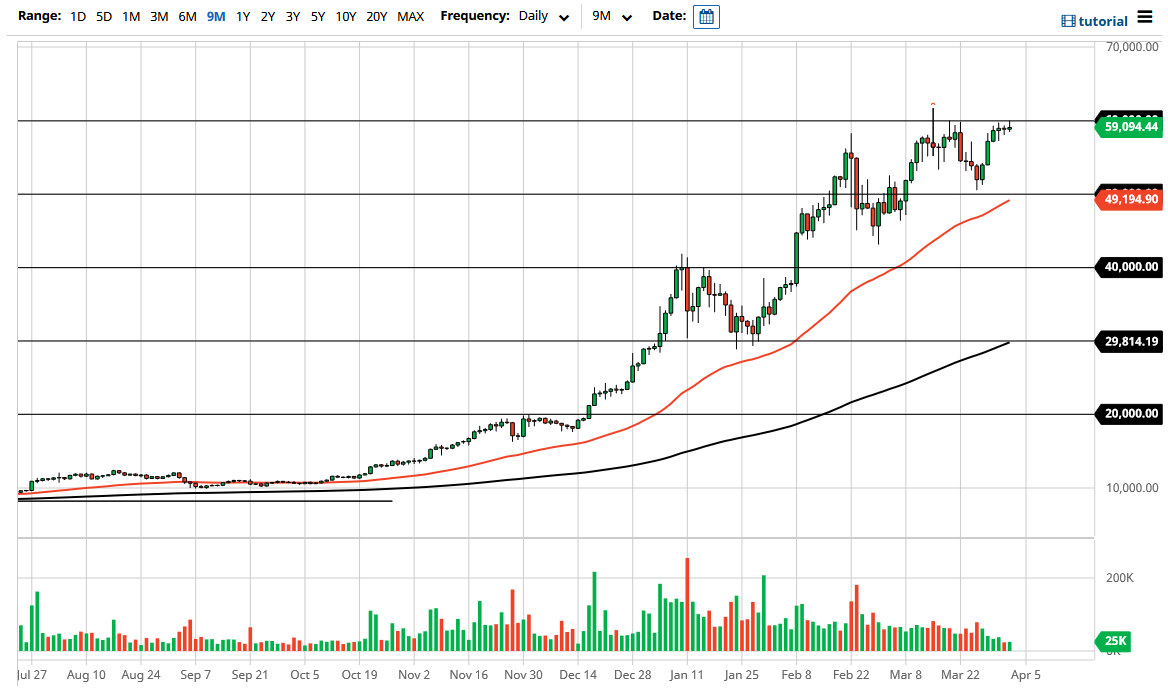

The bitcoin markets continue to fail at the $60,000 level which is a bit surprising considering that the market had been in such a major bullish run until recently. At this point, if we were to break above the $60,000 level it would be an obvious shot higher just waiting to happen. That being said, I think we are going to see a potential pullback at this point, with the $50,000 level underneath being the floor. I think at this point it is a matter of whether or not we pull back and build up enough momentum to break out to the upside, or if we need to pull back a little bit further to reach down towards the $50,000 level.

What I like about the $50,000 level is that the market has already seen that is an important area, and it is also an area of psychological importance. Furthermore, we also have the 50 day EMA sitting just below it, so that could offer a significant amount of support as well. With that being the case, I think it is only a matter of time before buyers return somewhere between here and there.

However, if we can take out the recent highs at the 61,800 level, then the market would be free to go looking towards the $65,000 level. The market does tend to move in $5000 increments, so that also sets up quite nicely. The 50 day EMA recently has been rather supportive, and therefore I think that we are looking at something that you could look at as a bit of a trendline. If we were to break down below that 50 day EMA, then I see the market could go down to the $40,000 level after that. All things being equal, I do not anticipate that happening, but we all know that crypto markets can melt down suddenly, so that is something that you need to be cognizant of.

Bitcoin continues to be bullish overall, but it certainly looks as if we are at the very least taking a bit of a breather, which is a bit interesting considering that so much institutional money is looking to get involved. With that, I suspect that if we do get some type of major selloff, a lot of that institutional money will come flooding in and pick it up “on the cheap.”