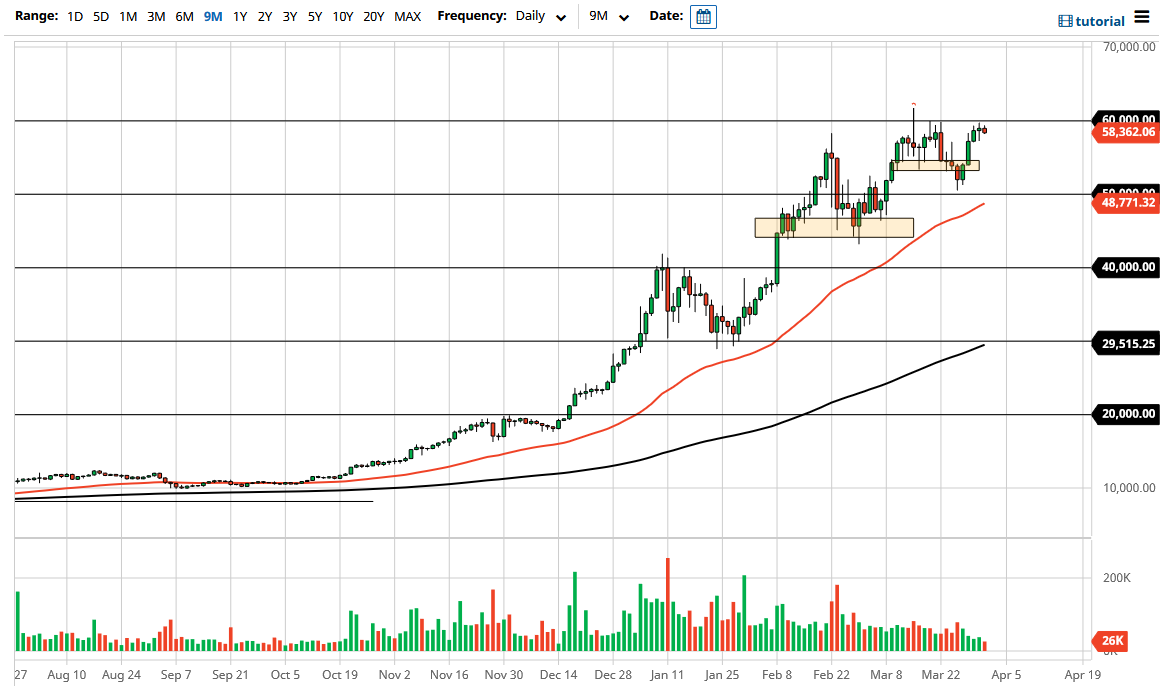

The bitcoin market has drifted a little bit lower during the trading session on Thursday in what would be best described as a very quiet session. What is interesting is that the $60,000 level continues to be extraordinarily stubborn, and therefore it is worth paying attention to the fact that we cannot seem to break out above there. Nonetheless, it still a very bullish market, so even if we do pull back at this point in time, I think it is only going to end up being a buying opportunity. One would have to think that eventually that $60,000 level gets broken and closed above it on a daily chart, we are ready to take off at that point.

To the downside, I believe that the $55,000 level continues to be supported, so if we do pull back to that area, I would anticipate some value hunting going on. Furthermore, underneath there we have the $50,000 level which is not only a large, round, psychologically significant figure, but it also has previous pedigree when it comes to support resistance and of course has the 50 day EMA in that same scenario.

If we were to break down below the 50 day EMA, then it is possible that we could see a bit more of a significant move, mainly because the 50 day EMA has been so supportive. I think that would be a major technical break out but right now I do not see the catalyst for that. All things been equal, any time this market pulls back people are thinking of it as potential value, and that is probably the most important thing to pay attention to.

On a move above the $60,000 level, then I think it is likely that this market will go looking towards the $62,500 level, and then eventually the $65,000 level. Ultimately, I do think that happens, but it might be rather sluggish until we get that daily extension above the $60,000 barrier. I think at this point it is simply a matter of accumulation so therefore we may continue to grind back and forth for a while, but the trend continues to look very healthy and of course crypto, and Bitcoin in particular, is starting to attract a lot of institutional interest as well which can only help.