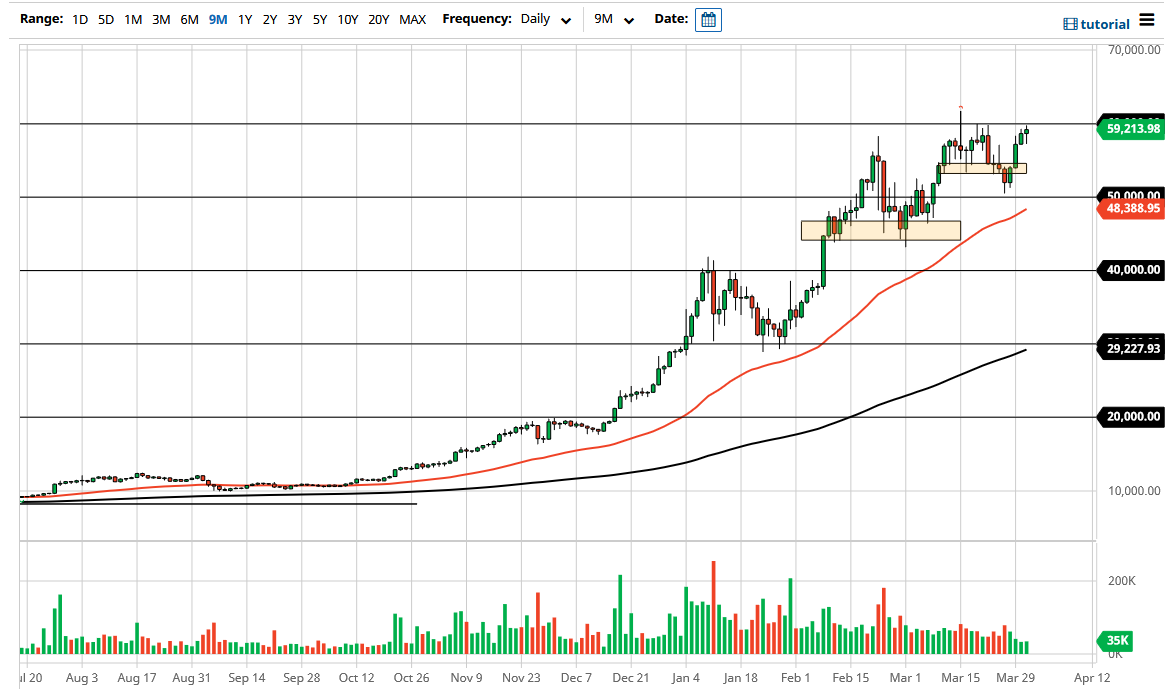

Bitcoin markets have fallen a bit during the opening hours on Wednesday, only to turn around and show signs of strength yet again. That being said, I think the market is probably going to continue to see a lot of interest as not only is Bitcoin making a lot of headlines, but now we are starting to see banks like Morgan Stanley and Goldman Sachs get into the game, allowing accredited investors to get exposure to bitcoin funds.

The $60,000 level of course is a psychologically significant figure that a lot of people will pay close attention to, but that has no real reason behind it to be one way or the other as far as where we go next. The market will continue to be very noisy in general, but I think if we can get a daily close above the $60,000 level, then it is possible that we could see a significant move to the upside. At that point, I would anticipate that we would look at the $62,500 level, followed by the $65,000 level.

To the downside, I see the $55,000 level is an area that a lot of people will be looking at, and the $50,000 level after that would more than likely be massive support as well. Not only is it a huge round figure, and it is where we see the 50 day EMA reaching towards right now. All things being equal, this is a market that I think will continue to be a “buy on the dips” type of market, as we have seen so much in the way of bullish pressure.

What is worth noting is the fact that the US dollar has been very strong, but at the same time we have seen bitcoin rise against that backdrop. In other words, it still continues to strengthen against the US dollar, despite the fact that the greenback has been so strong. That tells you just how resilient the bitcoin market is right now, and that something that must be kept in the back of your mind. Ultimately, this is a market that I think will eventually take off, and at this point I think every time we pull back there will be plenty of people willing to get involved in the “FOMO trade.” I have no interest whatsoever in trying to short this market.