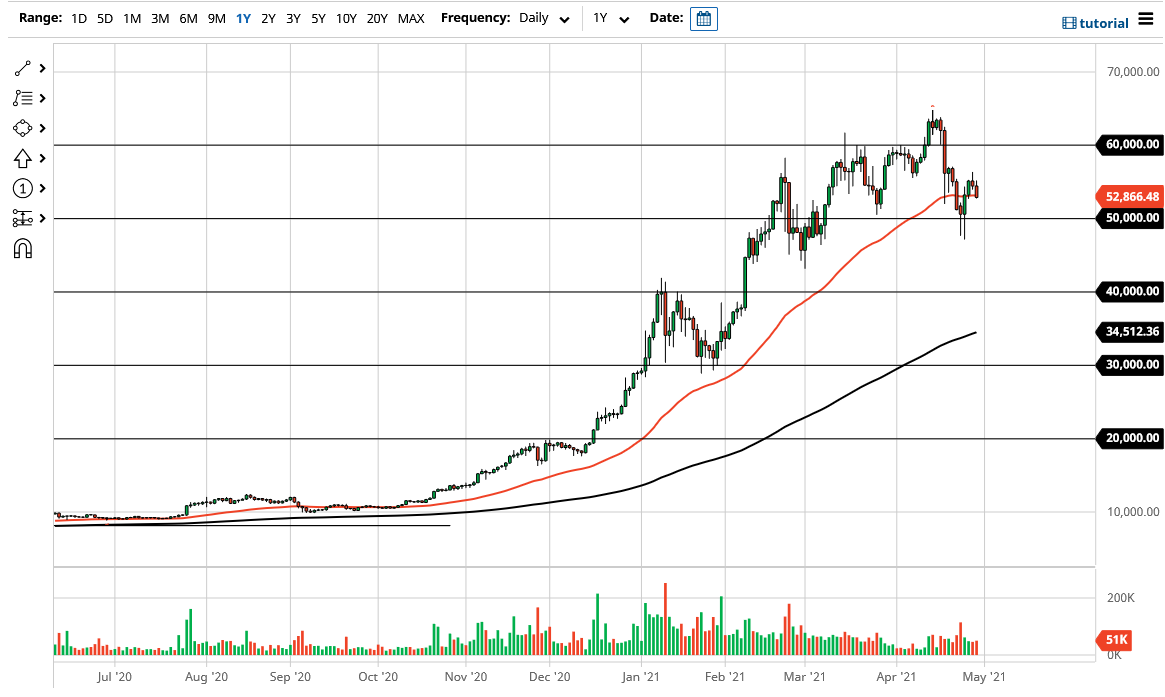

The bitcoin market initially tried to rally during the training session on Thursday but has fallen again after we ended up forming a bit of a shooting star for the previous session. At this point, the 50 day EMA is offering a little bit of support, but I do not necessarily think that you can bank on that being the case. The $50,000 level underneath should continue to be an area that will attract a lot of attention, not only from a structural but also from a psychological standpoint. If we were to break down below the long wicks that sit just underneath there, then I think we could see a little bit more of a pullback.

The market certainly looks as if it is ready to do a little bit of a pullback, the reality is that we are going to continue to see buyers underneath, but we may need to pullback in order to find an of value to attract more money. With institutional money flooding into the market, I do think that there are plenty of people out there that are looking to take advantage of value. The value play will continue to be what people look for, as the market is likely to continue to see more and more people jump into this market as it becomes much more mainstream.

Recently, we have seen credit cards, payment systems, and banks get involved and that should continue to be yet another driver for why crypto will continue to do well. This is not to say the people will pay any price forward, just that there should be plenty of demand. In fact, it is not until we break down below the 200 day EMA that I would be concerned about the overall trend, something that we are nowhere near approaching.

To the upside, the $65,000 level of course will be a target, which is a huge top in the market. Even though we have dropped roughly $15,000, and the big scheme of things it is not a huge selloff and therefore think a lot of people will look at this as a market that is still very strong. Even if we do break down, I will be looking to get involved at $40,000 as the 200 day EMA comes into play, as well as the structural noise that sits there as well.