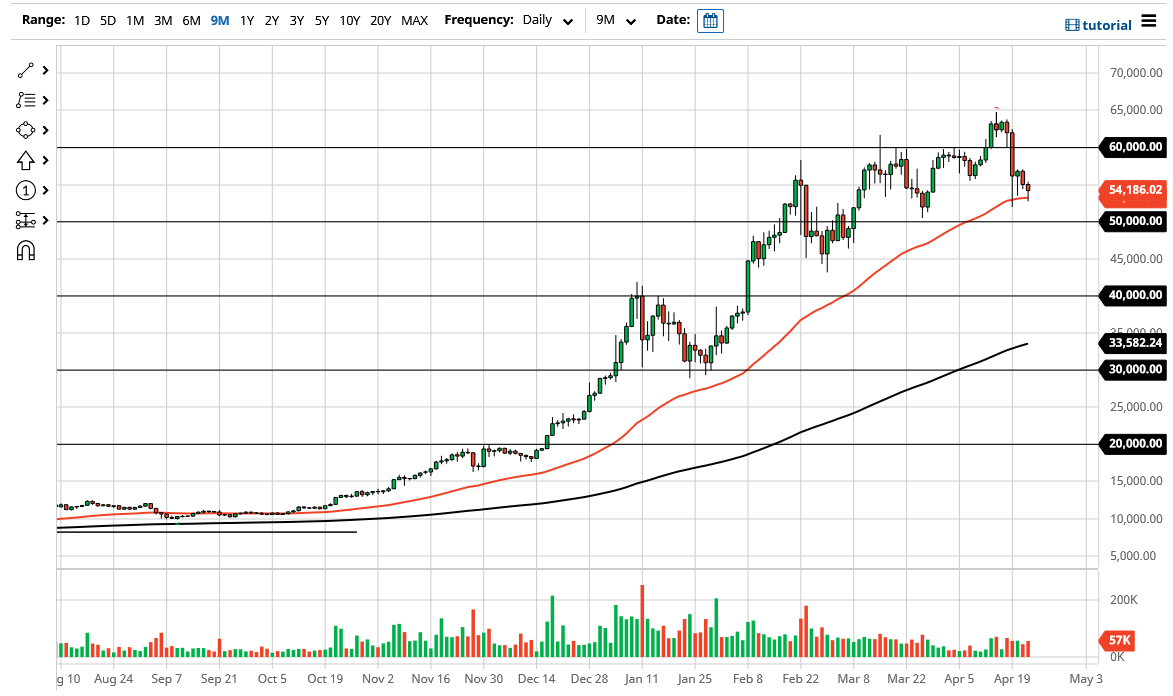

The bitcoin markets have fallen a bit to reach down towards the 50 day EMA again on Thursday, but also continues to see plenty of support underneath to turn things right back around. Ultimately, this is a market that I think is trying to form some type of base that is going to be reason enough to go long given enough time. That being said, the market is likely to see value hunters coming back in, and therefore I do not have any interest in trying to get short of the market.

When you look at the chart, you can see clearly that the $50,000 level underneath should be relatively supportive as well, so all of that being said I think it is only a matter of time before we turn around. Yes, we have recently had a very nasty pullback, but we are most certainly in an uptrend and with all of the institutional money coming back into the marketplace, it is very difficult to imagine a scenario where we simply melt down like we did a few years ago. This is not to say that we cannot pull back, and I think a lot of people would like to see that. After all, that will only offer more value the people will be looking to get involved in what is obviously a very strong market.

If we were to break down below the $50,000 level, then we probably go looking towards the $45,000 level, which was also supportive as well. That would be a bit more nerve-racking, but this is a market that has been so bullish that I am not even sure where you would get a signal to start selling at this point.

I suspect that the 200 day EMA is probably what a lot of traders would look at as the trend defining indicator, but we are a long way from reaching that area so obviously at this point it still becomes a “buy on the dips” type of scenario. The Bitcoin market has slowed down a bit as of late, but that is not necessarily a bad thing, because parabolic runs do end up having massive pullbacks, which can wipe out the retail trader again. This is something we certainly do not want to see again.