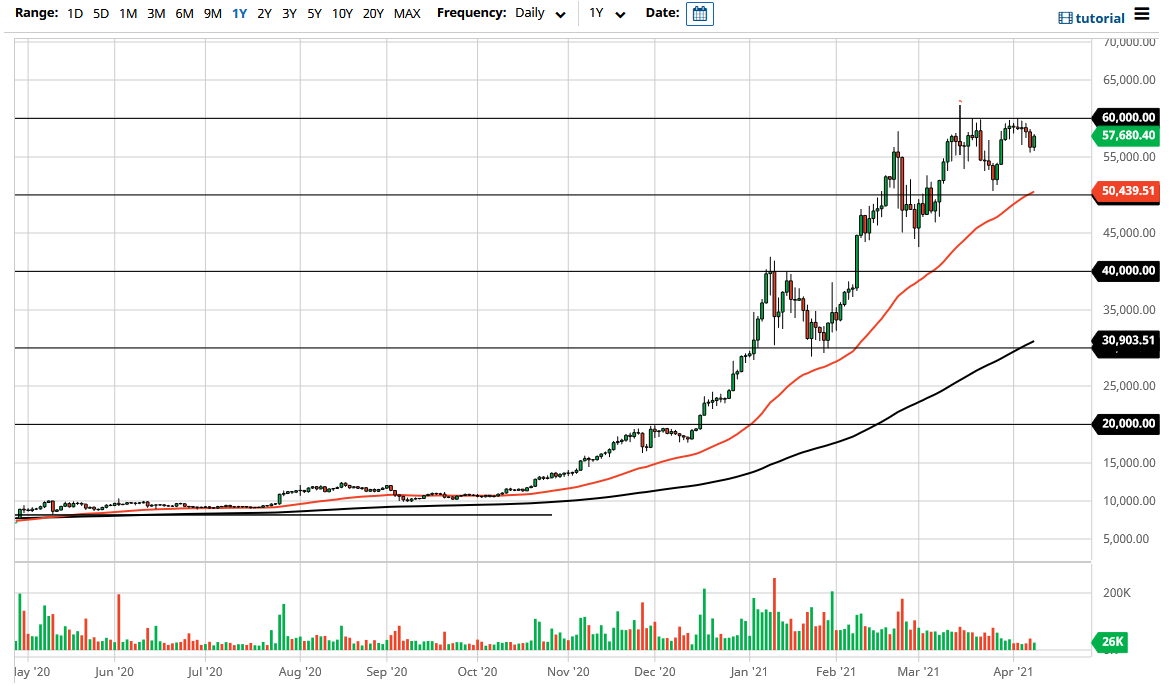

Bitcoin markets have rallied a bit during the trading session on Thursday to show signs of life again. The market looks as if it is going to go looking towards the $58,000 level, and keeps an eye on the $60,000 level above that has offered quite a bit of resistance multiple times. It looks like we are going to go looking towards that area again. Ultimately, this is a market that should continue to be resilient, as there has been a lot of momentum coming into the market as far as institutional money is concerned.

The $55,000 level has been supportive during the trading session and it now looks as if we are ready to go higher. If we can break above the $60 level, then the market is likely to go much higher. If we can break above that level, then it is likely that this market will go looking towards the $62,500 level, and then of course the $65,000 level after that.

Underneath, if we were to break down below the $55,000 level, then it is likely that the market will go looking towards the $50,000 level again, as it is supported not only due to the fact that the figure is a large, round, psychologically significant handle, but it is also supported by the 50 day EMA. The 50 day EMA has been supported more than once, and at this point it is likely that we would see quite a bit of buying pressure right in that general vicinity.

If we break down below there, then we could go to the $45,000 level underneath, which of course is rather well supported based upon previous action as well. With this being the case, I think it is only a matter of time before we will find value hunters getting back into this market, trying to take advantage of what has been a massive move to the upside and of course a market that is trying to continue to go higher. The momentum has been slowing down, but at the end of the day that is probably a good thing, due to the fact that the market had gotten far too ahead of itself. Nonetheless, I think buying pullbacks for value will probably continue to be the best way most traders play this.