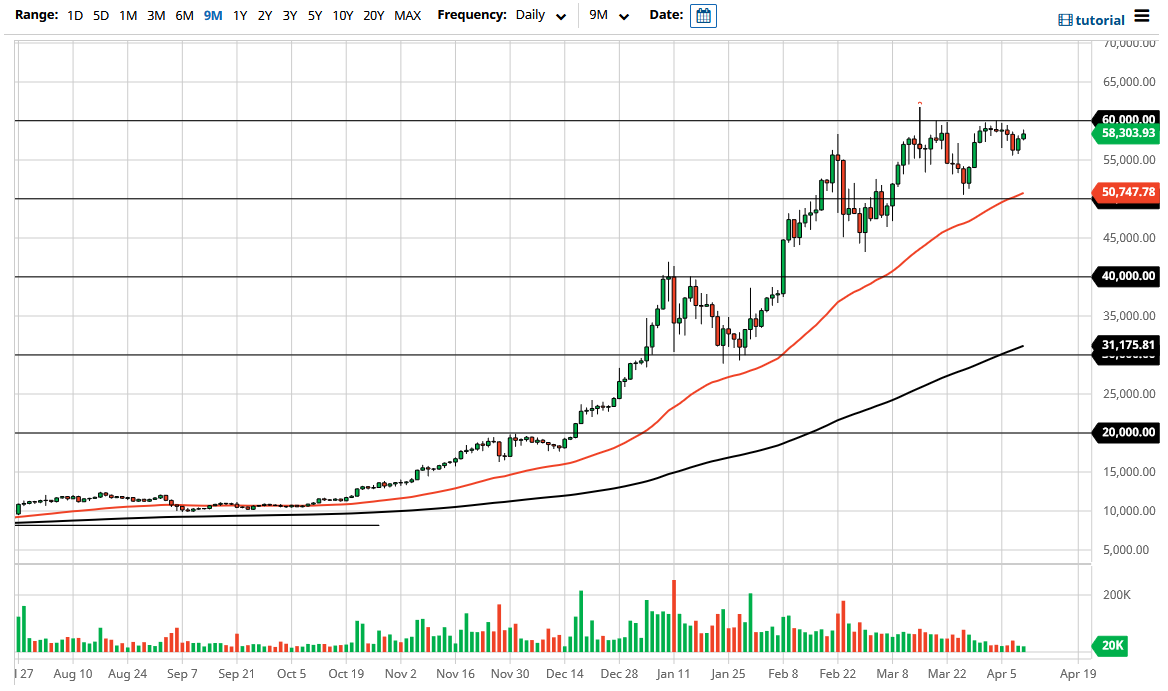

Bitcoin markets have rallied slightly during the trading session on Friday but still struggle with the idea of breaking above the $60,000 level. It has become increasingly obvious that this is a level that is going to take a lot of effort to get through. This is not to say that we are not going to be able to do so, just that I anticipate that we will continue to see a lot of trouble just below there.

Taking a look at the candlestick for the trading session, it did take off the top of the negative candlestick on Wednesday, so I suppose that is something to hang your hat on; then, you also have the massive amount of bullish pressure that we have seen over the last several months. However, there is something to worry about all of a sudden, and that is a major lack of momentum. I am not necessarily trying to be an alarmist, but this is a classic pattern that you will see occasionally when a market is due for some type of correction.

One thing is for sure, though: there does seem to be a lot of momentum underneath that will continue to be a mainstay of this market, and therefore I think there are plenty of areas where we would see a significant amount of support. The $55,000 level would be the first area, followed by the $50,000 level which is also supported by the 50-day EMA as well. To the upside, if we were to break above the $60,000 level on a daily close, that would kick off the next move to the upside. In general, the market will probably go looking towards the $62,500 area, and then the $65,000 level, which would be the next target.

To the downside, if we did break down below the $50,000 level, it is likely that the market would probably go looking towards the $45,000 level, which has been supported. If we break down below there, then the uptrend is certainly being threatened.

Regardless, the $60,000 level has certainly shown itself to be extraordinarily difficult to overcome, but I think that any sharp sell-off will probably be met with quite a bit of institutional buying, due to the fact that they are openly embracing the idea of owning Bitcoin.