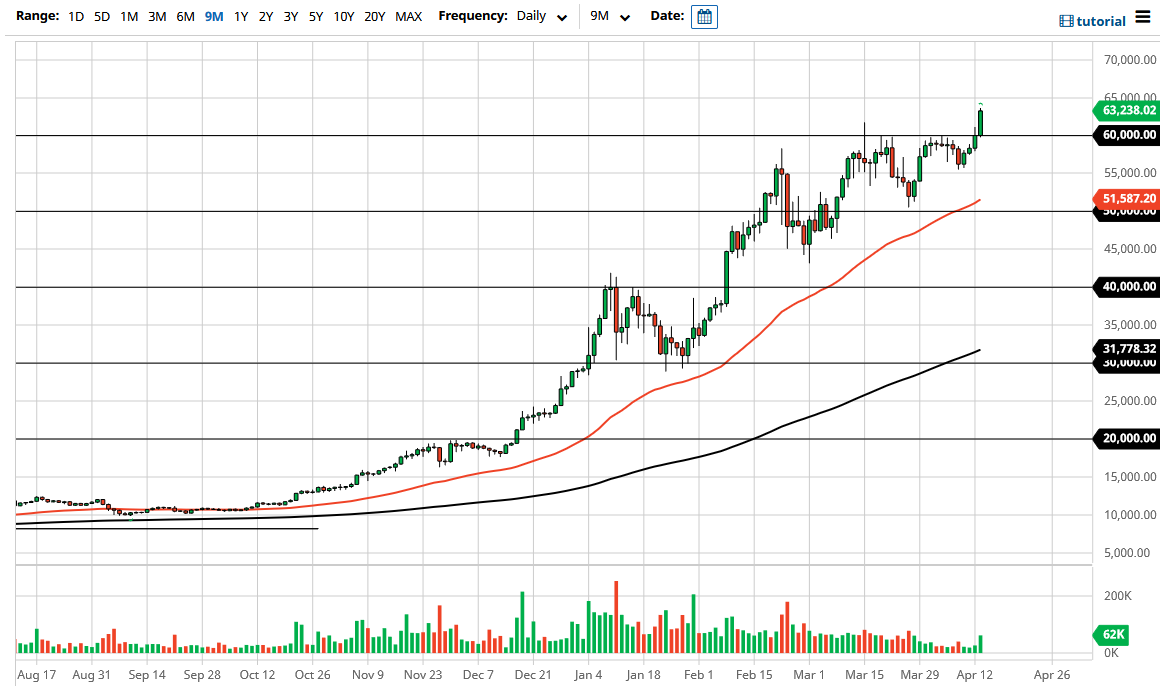

Bitcoin markets have broken above the $60,000 level finally and are meant to close well above there. That being said, the market is at the top of the overall range for the day, and that typically signifies that we are in fact going to go higher. After all, as a general rule, when buyers are willing to sit on an asset at the end of the session, the next day follows through.

A pullback from here more than likely will see the $60,000 level offer a bit of support, as it was such significant resistance previously. We have been knocking on the door of breaking out above this level, and now that it has finally happened, I am pretty sure that a lot of people will be jumping in to follow the momentum. This is a market that has plenty of support underneath at multiple levels, not just the $60,000 level. After the $60,000 level, the next major support level is going to be near the $55,000 level. After that, the 50-day EMA comes in at roughly $51,500. Furthermore, we would also have plenty of support at the $50,000 level as well.

It currently looks as if we are going to go test the $65,000 level, an area that will attract a certain amount of attention, but based upon the most recent market moves, I would fully anticipate that the market should continue to go higher, perhaps reaching towards the $70,000 level. As you can see, the market has been very bullish for some time - so I have noticed in trying to short the Bitcoin market. The crypto currency markets are taking off to the upside, and it should continue to find plenty of momentum going forward. Breaking above the $60,000 level is a psychological victory, so now I think that a lot of people would be more willing to jump into the market and push to the upside.

Looking at this chart, there is absolutely nothing on this chart that suggests that we should be selling this market, so I think you should be looking for plenty of buying opportunities going forward, as this is a “one-way trade” to say the least. While the markets have been rather overextended at times, it looks as if we have worked off quite a bit of froth lately, and we are probably ready to go higher.