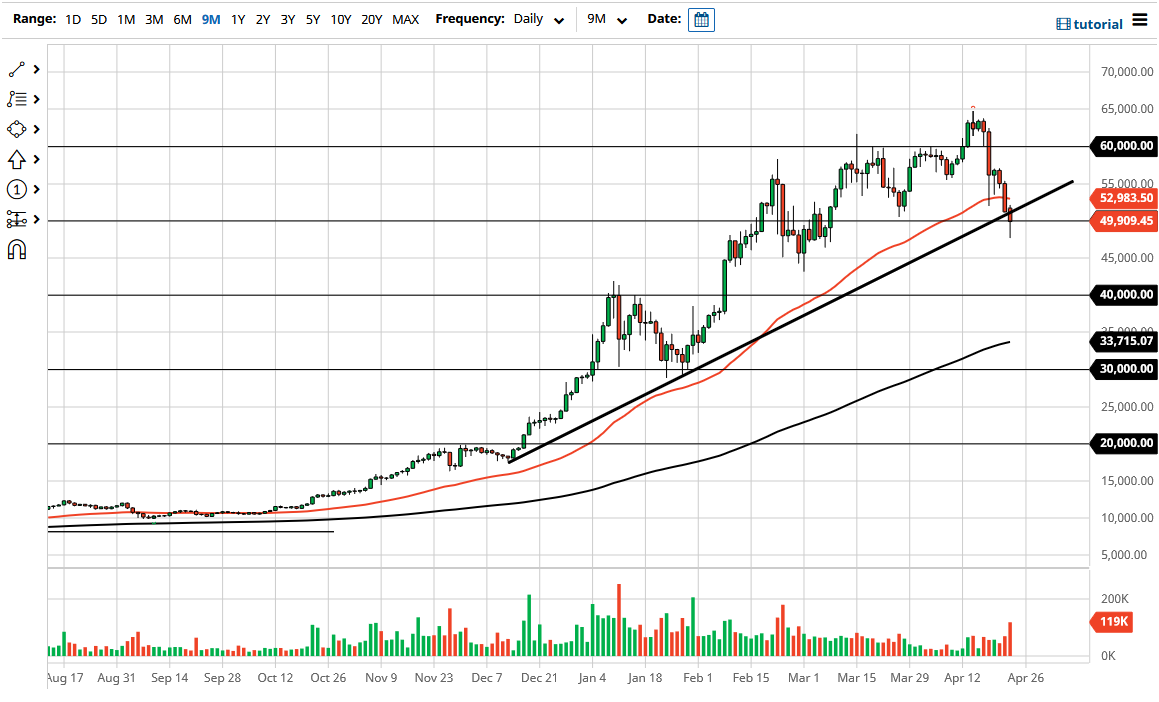

Bitcoin markets have taken a bit of a beating recently, dropping over 20%. However, by the end of the day on Friday, it looks as if we are trying to hang onto the uptrend, so it is interesting that we are forming a bit of a hammer, especially as it is sitting right at the $50,000 level. Furthermore, there is also the uptrend line that had previously been so important sitting right around the same area as well, so I do think there is going to be a certain amount of support for the market.

All that being said, I would not expect this to be an easy recovery, because a lot of people will have probably been shaken out. A lot of the selling that we have seen will be due to the higher taxes coming for capital gains in the United States, at least in theory, and therefore a lot of people would have been willing to take profits in their biggest gainers, perhaps avoiding taxes later this year. That is the narrative for the session, so that is the one we are going with.

That being said, the market was already falling, and I think we got to the point where it had been a bit overbought. With this, I think that there should be plenty of value hunters underneath, and I would not be a seller of this market. If you remember from the last several sessions, I suggested that the $45,000 level should be supportive and that I would not be overly concerned about the uptrend unless we broke down below the $40,000 level. I do not think wewill get there; I think what we are more than likely going to try to form some type of consolidation area in this general vicinity. We probably have a couple of days ahead that are going to continue to be volatile, but the Friday candlestick is the first of stability to continue the overall uptrend. Clearly, institutional money has a huge effect on this market, both good and bad, based upon what we have seen over the last couple of days. I do believe that we will revisit the highs eventually, but this pullback was long overdue, so I look at this as being healthy for the longer-term outlook for Bitcoin and crypto in general.