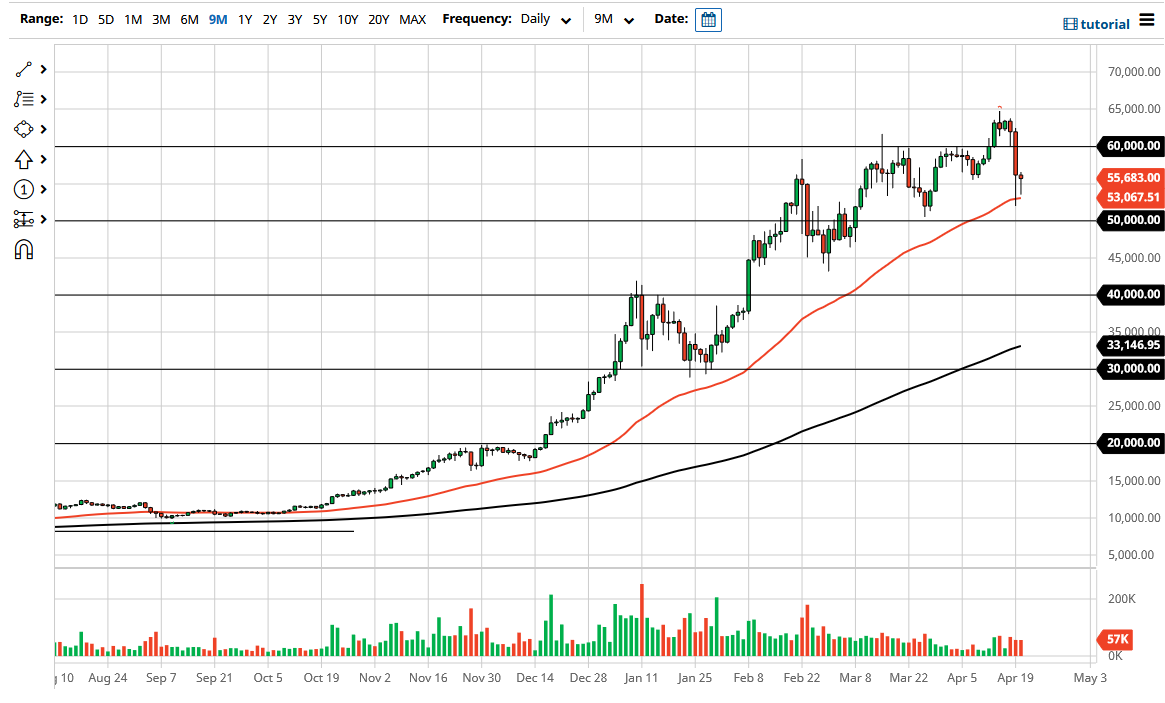

Bitcoin fell initially during the trading session on Tuesday but found the 50-day EMA to be supportive enough to turn around and cause a bit of a bounce. The candlestick forming a bit of a hammer is a bullish sign, as the candlestick is bullish in and of itself, but we also have the 50-day EMA offering support as well. That being the case, the market is likely to continue to see buyers on these dips, as the market has been relentless to the upside, and as a result, it is almost impossible to short this market. The $60,000 level above obviously would be a target, and the fact that the 50-day EMA is holding is a bullish sign.

Keep in mind that institutional money continues to flood into the cryptocurrency markets, with Bitcoin being the first stop. With that being the case, the market is likely to continue to see a lot of value hunting out there, and every time Bitcoin does drop, it seems as if that is only reinforced. Granted, the market has been very bullish, but we are starting to see more volatility now than previously. After all, for several months it was simply a market that was going straight up in the air, so the fact that we continue to see a lot of back and forth is probably going to be a good sign long term.

Underneath, the $50,000 level underneath will be massive support, as it is a large, round, psychologically significant figure and has offered support the last couple of times we have reached towards it. To the upside, if we can break above the $60,000 level, it is likely that we would see a move to the $65,000 level. Breaking above there, it is likely that we would go much higher. I have no interest in shorting this market anytime soon, and I do believe that we are trying to see some type of fight to push this market higher, but it is likely that we will see more of a value hunting situation. The uptrend is not over, and you could even say that we are closer to the bottom of a channel than anything else right now.