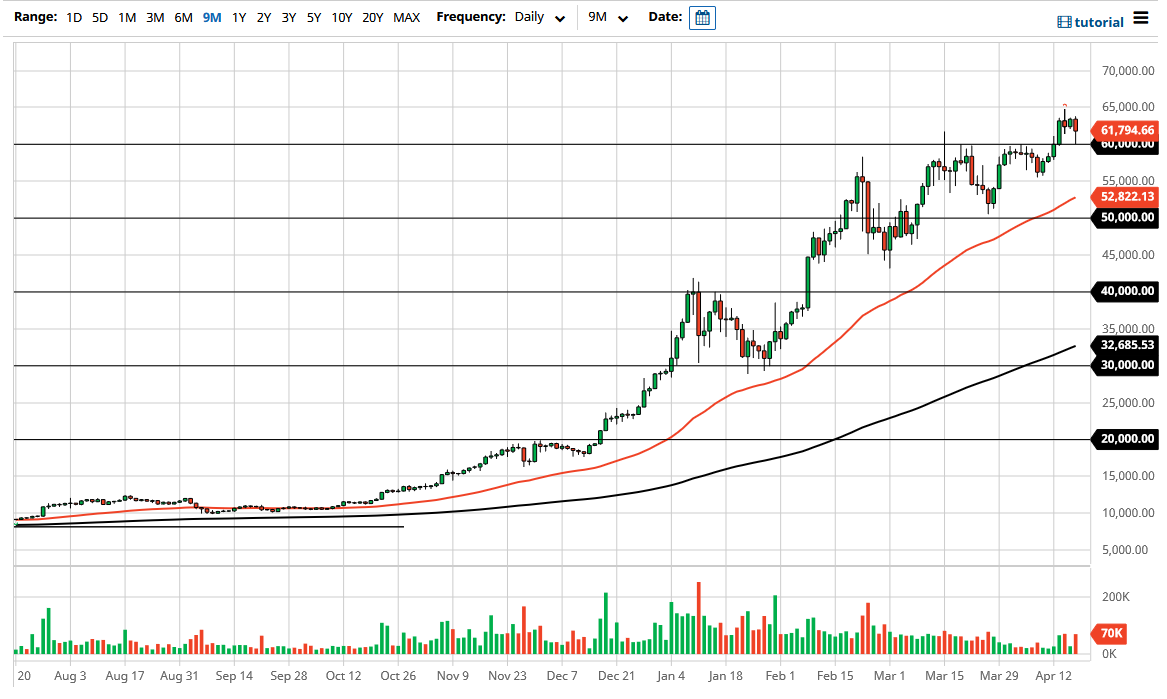

Bitcoin markets fell a bit during the trading session on Friday to reach down towards the $60,000 level. The $60,000 level was previous resistance, so the fact that we pulled back to that area only to turn around and bounce is a good sign, as it shows a continuation of the uptrend. The candlestick does form a bit of a hammer, and that is something that would be worth paying attention to. If we turn around and break above the $65,000 level, then it is likely that the market could go much higher.

On that move higher, we could see a rather significant flood of money back into this market, but it clearly looks as if the market is starting to run out of momentum to the upside, perhaps stabilizing, which is a good sign. After all, the market cannot go straight up in the air forever, so we need to be willing to take the occasional pullback due to the fact that we cannot have markets defy gravity forever. That being said, the market breaking down below the $60,000 level could open up a move down to the $55,000 level. At that point, we would probably see the 50-day EMA come into the picture as well, so I think that could give us an opportunity to pick up a bit of value.

This is a market that I think you cannot short, as it has been far too strong. With that, it is probably going to be a scenario where the overall long term continues to favor the upside, but I think at this point we would anticipate quite a bit of volatility. If you are a longer-term believer, then it is likely that we continue to see traders hold on, but you also have to be willing to put up with a lot of noise. As long as we can stay above the $45,000 level, then I think that this is a market that will continue to see plenty of buyers. If we were to break down below that level, then we probably would make a move down to the $30,000 level, possibly even lower than that. This is a market that I think will eventually give us a nice buying opportunity.