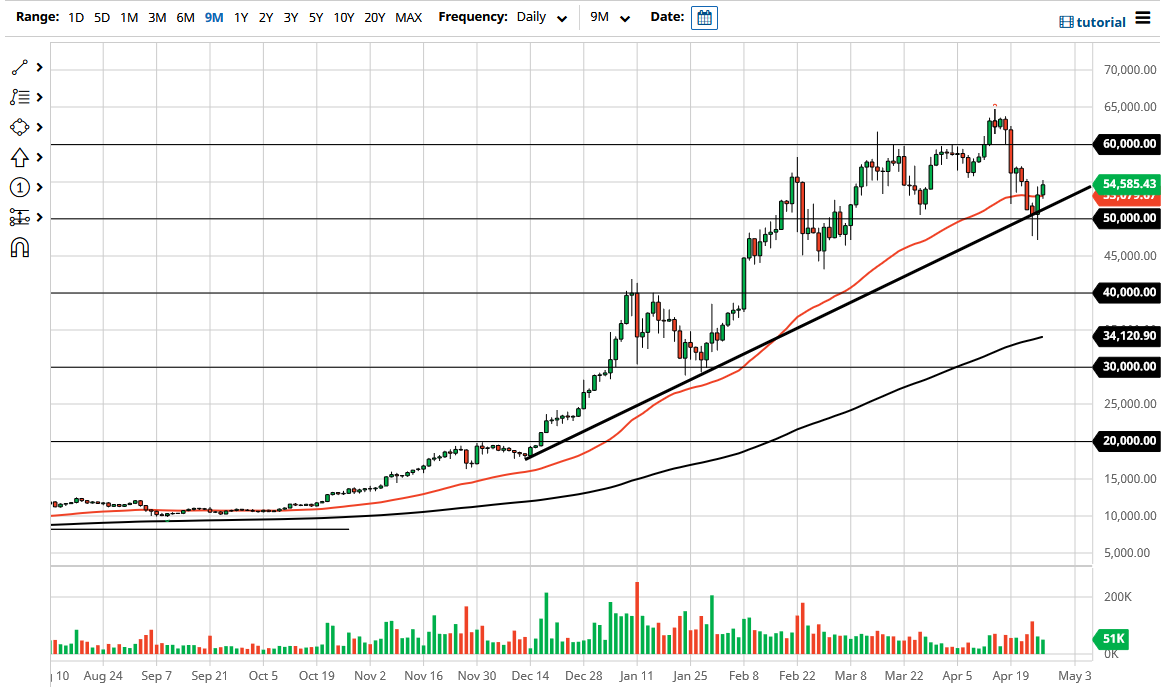

The Bitcoin market has broken significantly during the trading session on Tuesday again to clear the 50-day EMA. The market looks as if it is ready to take out the $55,000 level, an area that would attract quite a bit of attention, as it was previous support and resistance. If we can break above the $55,000 level, then it is likely that we could go looking towards the $60,000 level next. Ultimately, the market does look as if it is trying to reach the highs again, and the nice 20% pullback that we had gives plenty of value hunters a reason to get long.

The 50-day EMA is somewhat sideways, but still is coming from the lower left and going to the upper right. Because of this, I think it is only a matter of time before buyers continue to jump into this market. Furthermore, there is also a nice uptrend line that comes into play as well, as the market should continue to find plenty of buyers underneath. Furthermore, the $50,000 level has offered significant support based upon the last couple of candlesticks, so it is likely that we will see that offer a bit of a “floor in the market.”

If we were to break down below the last couple of candlesticks, it would open up a significant attempt to take out the $45,000 level, which is a large, round, psychologically significant figure, and an area where we have seen a lot of buying previously. If we break down below there, is very likely that we would see quite a significant amount of resistance to buying pressure, and we could go looking towards the 200-day EMA.

All that being said, it is much more likely that we will go looking towards the highs again, perhaps even trying to break out above there to go much higher. Bitcoin is a market that has been bullish for ages, so the fact that we have pulled back means that we could find a bit of value that people can take advantage of. Plenty of institutions are getting involved in Bitcoin, and it is going to be very difficult to get on the wrong side of that trade. Because of this, I do believe in buying on the dips and that this latest hit will end up being a nice opportunity.