The CAC Index gapped higher to kick off the trading session on Tuesday as we started to see more Europeans jump into the marketplace after the Easter holiday on Monday. That being said, the market is likely to see a short-term pullback, but that pullback more than likely will find plenty of buyers underneath. This flies into the face of the lockdowns that we are seeing in places like Paris, but that is par for the course when you look at global indices.

The CAC is moving higher based upon the potential reopening trade, and the fact that the European Central Bank has jumped into the marketplace to buy bonds hand over fist. As long as there is loosening monetary policy and a serious lack of yield coming out of the bond markets, it is likely that the Parisian index, as well as most of the other ones in the European Union, will probably continue to reach towards fresh highs.

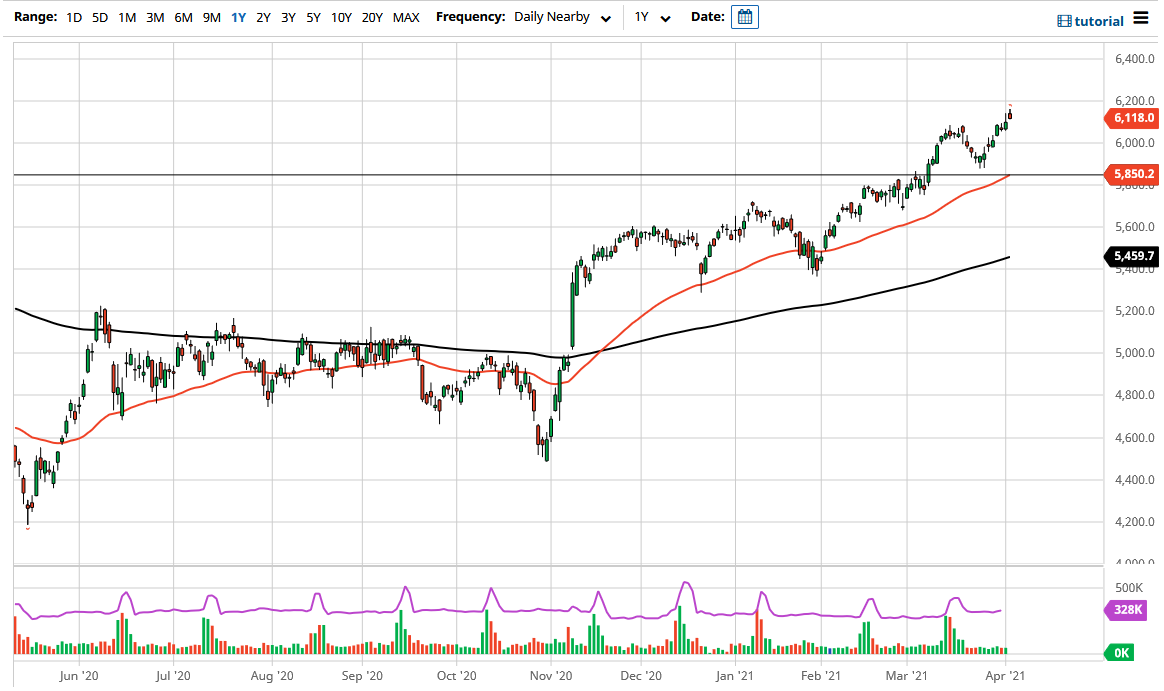

The 6200 level above is a target based upon the psychology of the large number, but you can see how the 6000 level underneath has been sliced through multiple times now, so the psychology is a temporary thing at best. As long as the euro continues to say somewhat soft, that should help not only the CAC but other indices on the continent as well. The idea is that it makes French exports cheaper as the euro is sitting around the 1.18 level. That being said, it does help the idea of exporting companies doing quite well.

The CAC is a little bit different than some other indices in the European Union though, because it is so highly influenced by luxury goods and Airbus. The play for Airbus is more than likely going to be a scenario where people are expecting more orders, due to the fact that there will be much more travel once the vaccination becomes complete. Underneath, we had recently bounced from the 5850 level, which also features the 50-day EMA, so I do think that is an area that should be rather supportive. That being said, I do not even think that we get down to that area, so it is likely that buyers will show up sooner, rather than later. For a longer-term target, I am looking at the 6400 level.