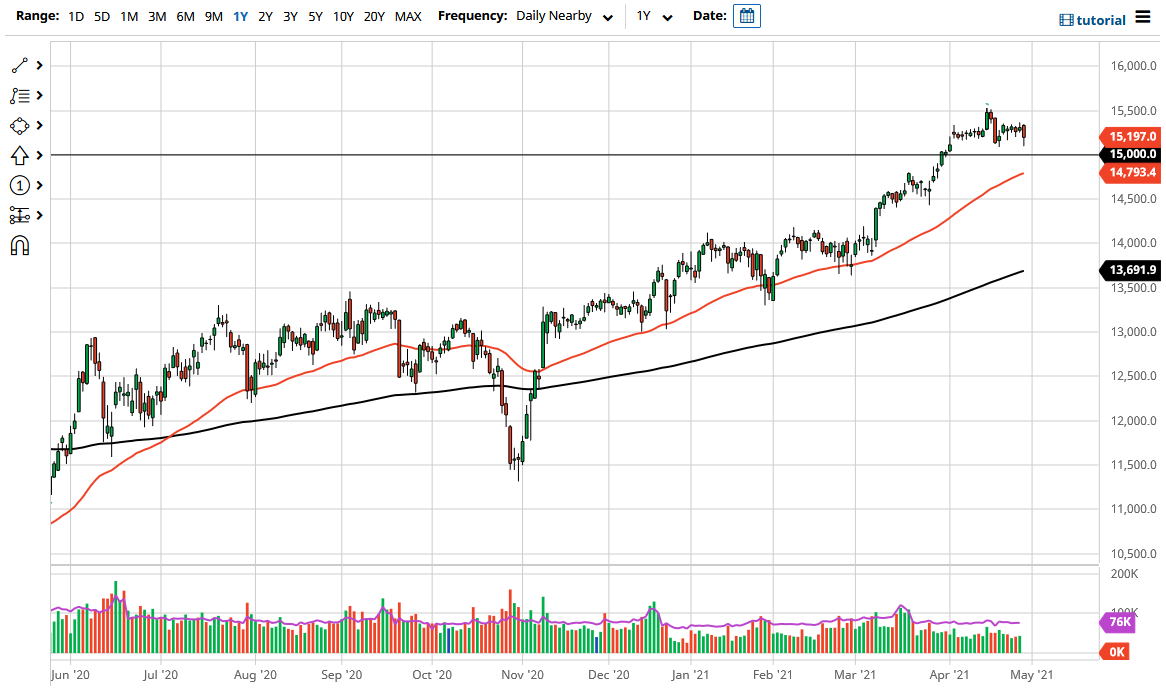

The German index broke down significantly during the course of the trading session on Thursday but then found support just above the 15,000 level, a large, round, psychologically significant figure that a lot of people would be paying attention to. The 15,000 level of course has attracted quite a bit of attention, and as a result we have turned around to show a bit of support. As long as we continue to see the market react to this big figure, I think that it is a “buy on the dips” type of situation.

[CAD:EN - 2 - Test technical skills

Furthermore, it does make a certain amount of sense that this should continue to be the case, because the 50 day EMA sits just below, and it certainly looks as if it is trying to reach towards that area. All things been equal, the market is likely to continue seeing plenty of value hunters jumping into the market, especially as the European economy is supposedly recovering, and of course that is the most important factor in what we are seeing in the DAX, as it is a major blue-chip index for the continent.

Furthermore, the market will also focus on the fact that there is the “reopening trade” going on right now, and of course Germany is a major player when it comes to that situation. They will continue to supply quite a bit of the world with industrial components, and of course the heavy machinery that a lot of the European Union will need to reopen the economy and get things moving. Furthermore, Germany is without a doubt the strongest economy in the European Union, so it is the first place where traders get involved when it comes to putting money into the stock market on the continent.

If we do break down below the 50 day EMA, I believe that there is a massive amount of support at the 14,000 level, and therefore I think even a break down to that area should end up being thought of as value that you can take advantage of. With that being the case, I think that this is a “buy on the dips” situation as stated previously, and there is no way to short this market. At this point, I do believe that we are much more likely to see 16,000 then we are 14,000.