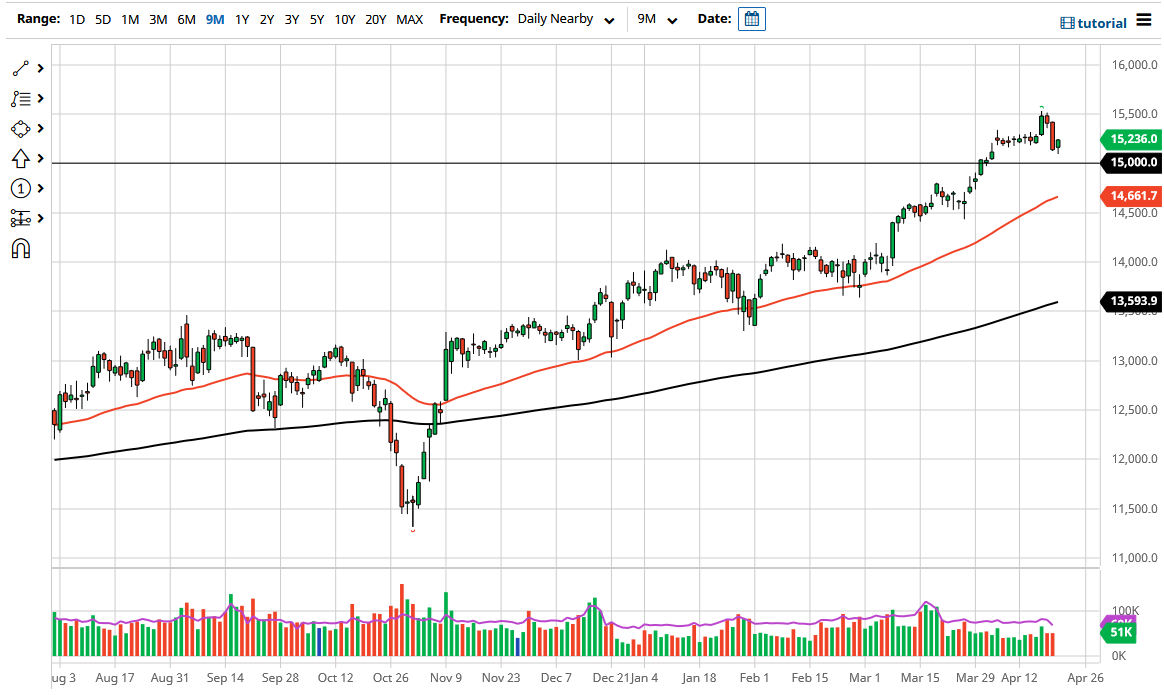

The DAX broke down a bit during the trading session on Wednesday but then turned around to show signs of strength again. By doing so, this is somewhat of a hammer, and it does suggest that we will continue to go higher. Yes, we had that very negative candlestick from Tuesday, and that means that it will probably be very noisy on the way back up, but at the end of the day I think we are likely to see a continuation higher anyway.

The DAX is getting a bit of a boost due to the fact that there is more of a “risk on” attitude globally, but perhaps even more so due to the fact that the currency markets have settled down a bit. We do not have to worry about the value of German exports suddenly spiking due to the exchange rate, so that helps everything as well.

If the global markets are in fact going to start pricing in the reopening trade, the German exporter should do quite well, which makse up a huge portion of the DAX 30. At this point, I think it is only a matter of time before the German index rallies based upon the idea of massive exports coming out of the country and restarting the rest of Europe, as well as China. Nonetheless, in the short term, it looks as if the 15,000 level can be thought of as a support level, as it is a large, round, psychologically significant figure and there is a gap just above it that has just been filled over the last couple of days. In other words, this is a pretty standard technical analysis-type of pullback signal that suggests that we are going to go higher.

Even if we did break down below the 15,000 level, then the market is likely to see a lot of support at the 50-day EMA, which currently sits at the 14,661 level, and is rising to reach towards the 15,000 level as well. I think that is going to continue to be respected by the market, unless there is some type of massive shock economically or politically that could have more of a “risk off” type of attitude entering the market.