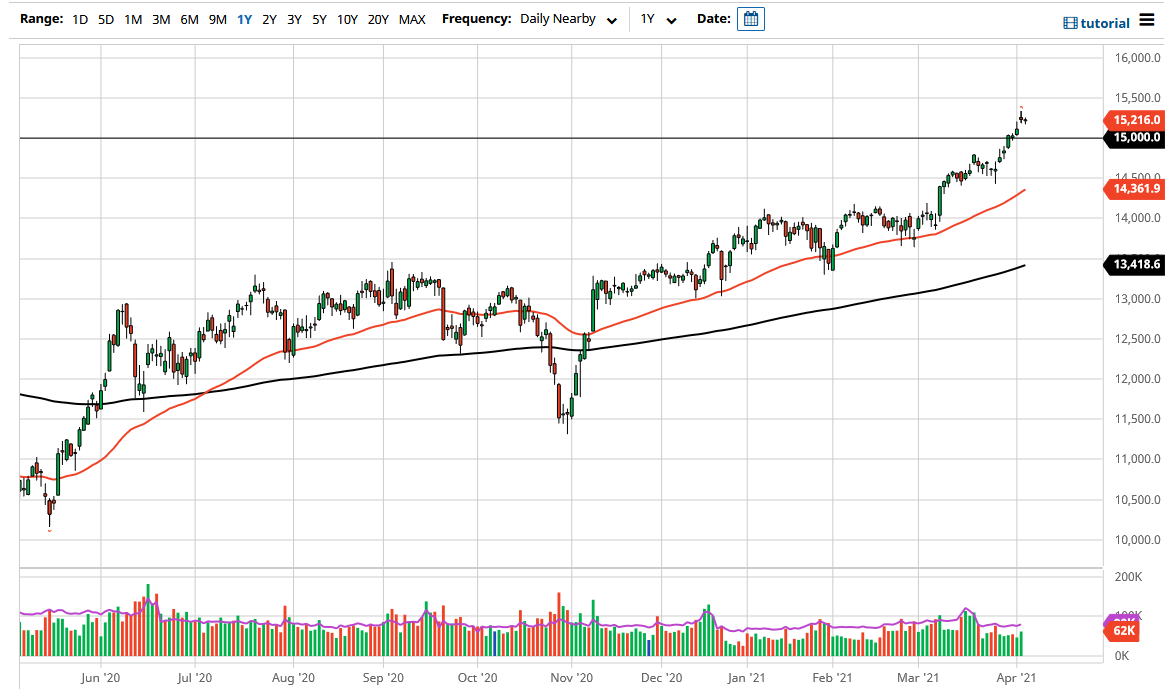

The DAX Index went back and forth during very quiet trading on Wednesday, as we continue to hang about the 15,250 level. The market was slightly negative for the trading session, but just so. At this point, there is a gap underneath that should continue to offer support and I think that a lot of traders out there will be looking at pullbacks as potential buying opportunities. The DAX is an index that is highly sensitive to the reopening trade, despite the fact that Germany cannot seem to get its act together when it comes to vaccinations.

The DAX is full of companies that will benefit from industrialization and the increased industrial demand for building economies back out. With that being the case, I think that the DAX is a natural leader, even in a world that has a significant amount of bullish behavior out there when it comes to indices. That being said, when you look at the chart you can see that the market has gotten a little extended, so a pullback does make a certain amount of sense in this area. I believe the 15,000 level is also supportive just based upon the psychological aspect of a big figure like that.

Underneath there, one would have to think that the 14,750 level would be followed by support at the 14,500 level that is quickly attracting the 50-day EMA. In other words, there should be plenty of areas of support underneath that traders can take advantage of, which is exactly what I plan on doing. I will be looking for a supportive daily close along the lines of a hammer in order to get long yet again.

I have no interest in shorting the DAX, at least not unless we break significantly below the 14,000 handle, something that does not look very likely to happen anytime soon. Ultimately, I do believe that this is a market that continues to see plenty of buyers looking to pick up little bits and pieces of value as they occur. If the euro could drop in value a bit, which at the end of the session it looks like it may be ready to do, that could also help the idea of German exports being cheaper enough to propel profits even higher for domestic companies.