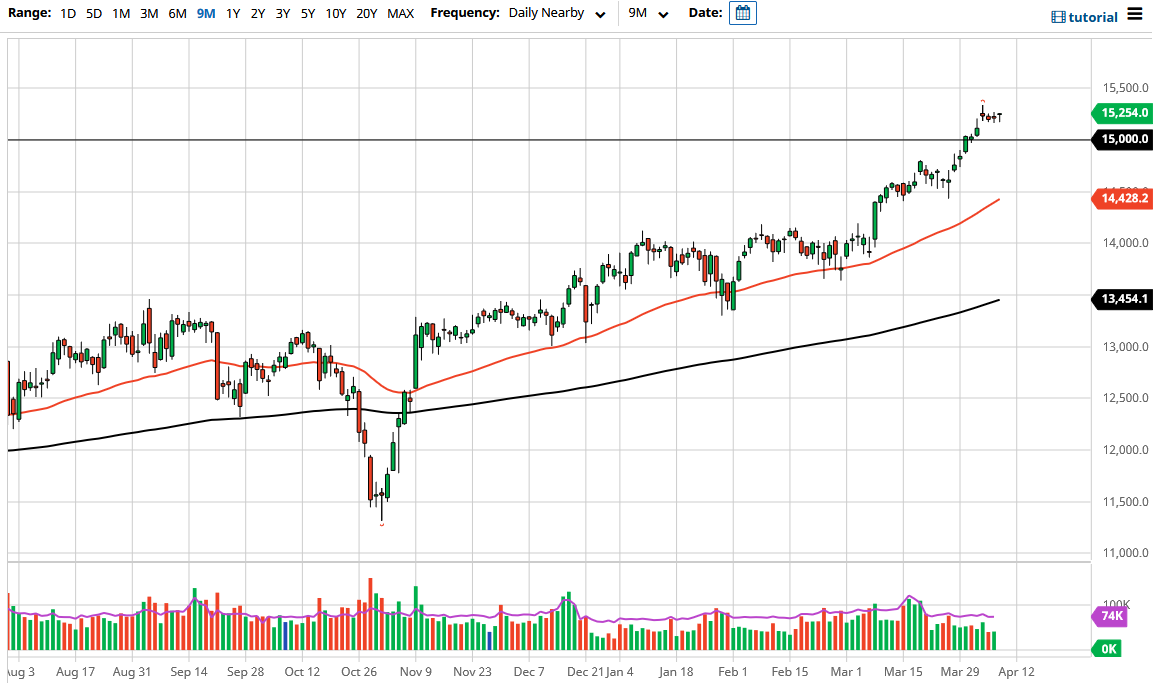

The DAX Index has gone back and forth during the last several days, as we are trying to keep the upward momentum going by working off some of the extreme bullish pressure over the last several weeks. That being said, the market looks as if it is simply trying to work off the froth, perhaps offering an opportunity for the market to continue going higher.

At this point, there is a gap underneath that should also offer support, as it has not been filled quite yet. It sits above the 15,000 level, an area that is a large, round, psychologically significant figure and would attract a lot of traders. The candlestick for the trading session on Friday suggests that there are buyers underneath, but a “dragonfly doji” is not necessarily the strongest of signals in and of itself. However, combining that with a gap in a large figure suggests that there is something to the idea of support in this general vicinity.

Furthermore, the market is likely to see a lot of traders looking towards the global reflation trade as a reason for the DAX to rise as it is so heavily influenced by major exporters in the industrial sector. Germany is a major engine for growth in the European Union, and the heavy industry sector will be in high demand. With that being the case, I think it is only a matter of time before traders go back into the DAX.

From a technical analysis standpoint, we are well above a large, round, psychologically significant figure, and you could start to take a look at what has happened recently as a bit of a pennant or a flag or something like that. Even if we were to break down below the 15,000 level, I think there are plenty of buyers underneath near the 14,750 level and then the 14,500 level. Although not directly related to German companies, Wall Street starts earnings season next week, and that could give traders an idea as to what the “recovery trade” may look like. It will be yet another piece in the puzzle of where we go next in major indices around the world, so you should not trade the DAX in a vacuum next week.