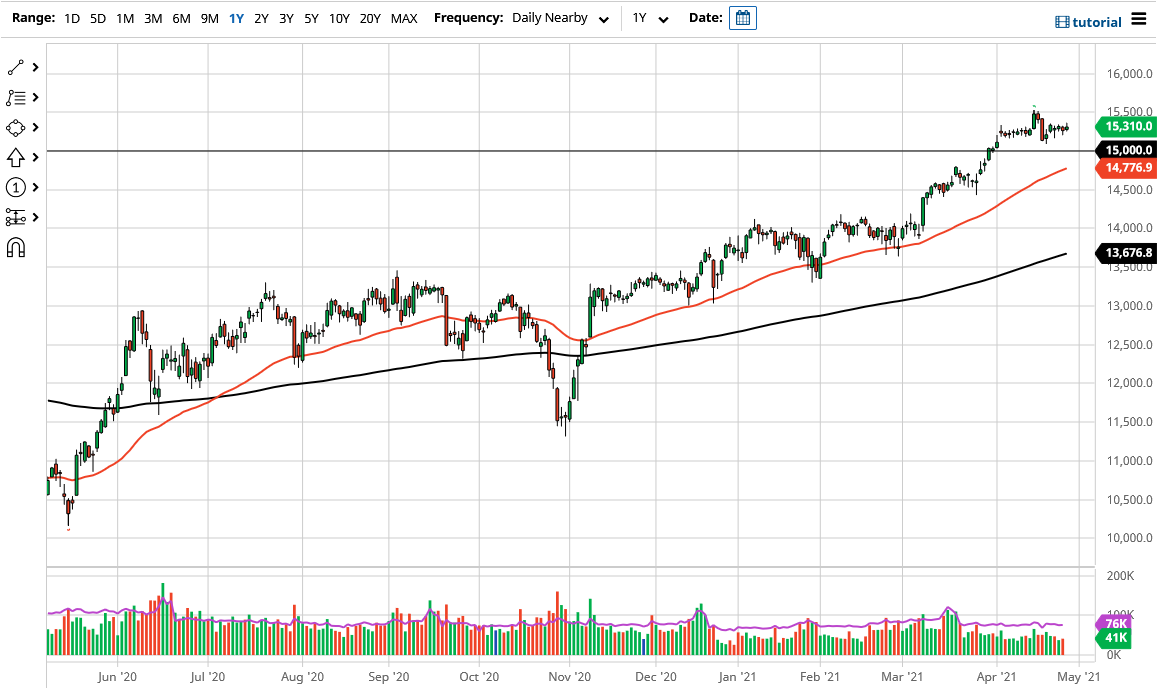

The DAX Index did very little during the trading session on Wednesday as we continue to hang around the 15,300 level. Ultimately, this is a market that I believe will eventually have to make a bigger decision, but right now it looks like we are simply treading water in order to try to get comfortable above the 15,000 handle. The 50-day EMA is also reaching towards that area, so that is another reason that I think the market may be paying close attention to that level as well. With that being said, I think that this remains a “buy on the dips” type of scenario.

The DAX gets a benefit from the overall reopening trade, as the DAX is full of major exporters and companies that will have a lot to do with the reopening trade from the industrial side. That being said, the market is likely to continue to at least attract a certain amount of money, as it is a “blue-chip index” that a lot of people pay close attention to in the European Union. The DAX is the first place that money goes to, as it is considered to be safer than many of the other indices.

Underneath, we have seen a couple of hammers form as well, so that is yet another reason to think that the buyers are going to continue to be looking to pick this market up. If we can break above the 15,500 level above, then it is likely going to open up another leg higher in what has been a huge uptrend for some time. Furthermore, the 50-day EMA is also an indicator that a lot of people pay attention to anyway, so I do not have a setup to start shorting anytime soon, so I simply will ride right along with the overall trend. If we do break out above the 15,500 level, the market is likely to go looking towards the 16,000 level next as it is a large, round, psychologically significant figure. Given enough time, I do believe that this market will continue to chip away at the major resistance that we have seen at the 15,500 level. That does not mean that it is going to be easy, but it certainly seems to be the overall attitude of the market as we may have gotten ahead of ourselves just a bit.