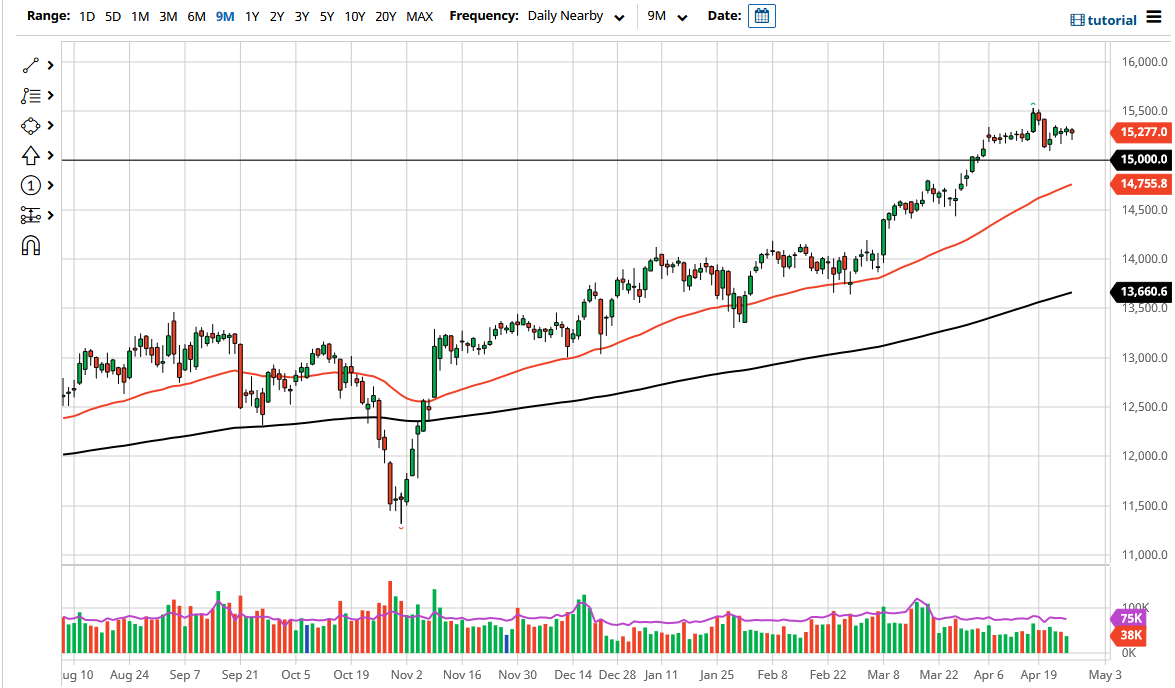

The DAX Index initially fell during the trading session on Tuesday, but has turned around to show signs of strength again. This is a hammer that we are forming, just like we had formed on Friday. The market looks as if it is trying to figure out whether or not the 15,250 level is going to continue to be supportive, extending down to the 15,000 level underneath. That is a large, round, psychologically significant figure, and I think a lot of people will be paying close attention to what happens in that general vicinity if we do pull back. Furthermore, the 50-day EMA is now reaching towards the 15,000 level, so again, I believe that the level is extraordinarily important to pay attention to.

The DAX has a little bit of a boost due to the fact that the European Union is starting to produce better economic figures as of late, and it is possible that a lot of traders out there are trying to get exposure to Europe via the easiest way possible, i.e., the DAX, as it is the “blue-chip index” for the entire continent.

You should also pay close attention to the reopening trade because Germany would be one of the first places people will be looking to invest based upon the industrial base of that country. The Germans will be exporters of huge industrial machinery and products throughout the European Union and beyond. If the euro is going to stay somewhat stable, then that also helps the idea of the German economy being one of the big beneficiaries of the reopening scenario. However, it is worth noting that we have recently seen an influx of new coronavirus cases in places like Brazil, India and Japan. If that does start to become a major issue, then it is possible that the DAX itself may suffer.

While the selloff is not my best-case scenario, it is something that we need to pay close attention to. If we were to break down below the 14,500 level, then I think the market will go looking towards the 200-day EMA. Otherwise, this is a market that is simply going to continue to be a “buy on the dips” type of situation where we will probably go looking to break above the 15,500 level.