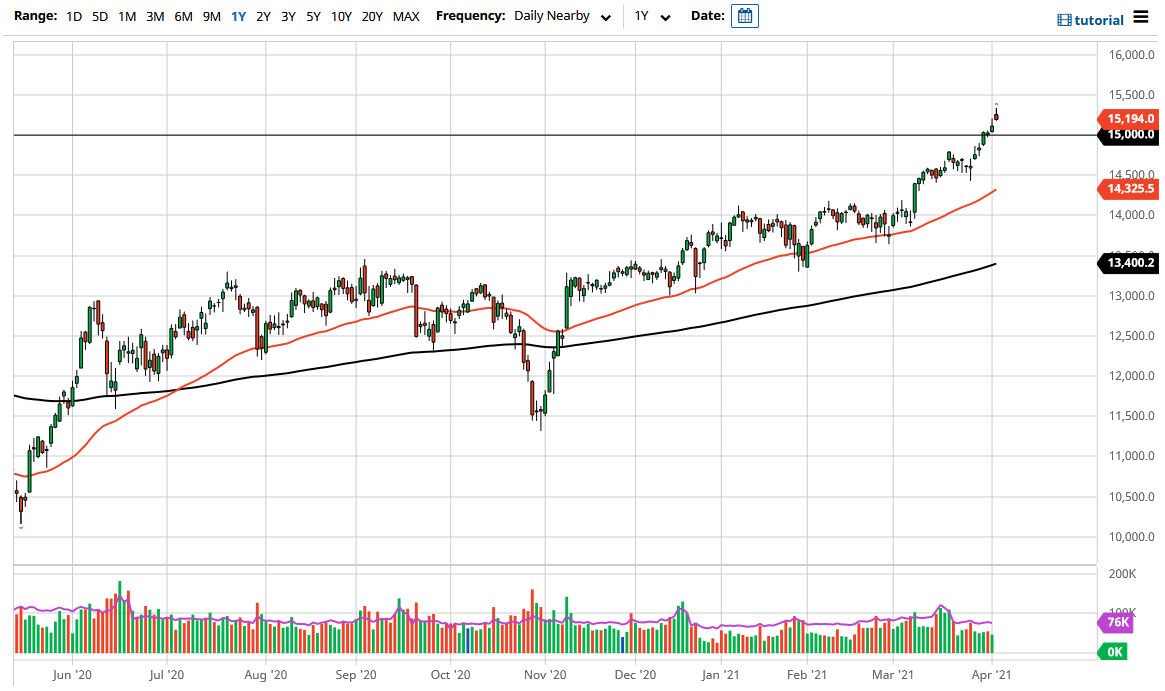

The DAX Index gapped higher to kick off the trading session on Tuesday, and then shot towards the 15,350 level. That being said, the market gave back the gains to turn around and form a shooting star, which is a negative sign. We blew through the 15,000 level like it was not even there, so it does makes sense that we would have to pull back in order to build up enough momentum to continue going higher.

However, if we were to turn around and break above the top of the shooting star, it would show extreme strength, not only due to the fact that we would continue to go higher and make another all-time high, but it also would be blowing through the shooting star, where there had been massive amounts of short-term selling. I do believe that the market is a little bit over-extended anyways, so I would not be surprised if we broke back down below the 15,000 level. The 14,500 level underneath has shown itself to be important more than anything else recently, and then we have the 50-day EMA reaching towards that level. The 50-day EMA has been a bit of an uptrend line as of late, so I think that a lot of traders will look at that as a potential buying opportunity.

I think that we will probably continue to see a lot of volatility and currency play when you look at the euro and its influence. The European Central Bank continues to buy bonds, so that should put a little bit of softness in the euro, as we continue to see a bit of a “push/pull” situation between the ECB and the Federal Reserve. At this point, the market is likely to continue going higher, but that does not necessarily mean that we need to go straight up in the air like we had over the last two weeks or so. Pulling back to acknowledge gravity is probably what we will see in the short term, followed by a longer-term move to the upside. At this point, I do not have a specific target, but I do believe that the 15,500 level will be a short-term one worth paying close attention to as there is a certain amount of psychology in that area.