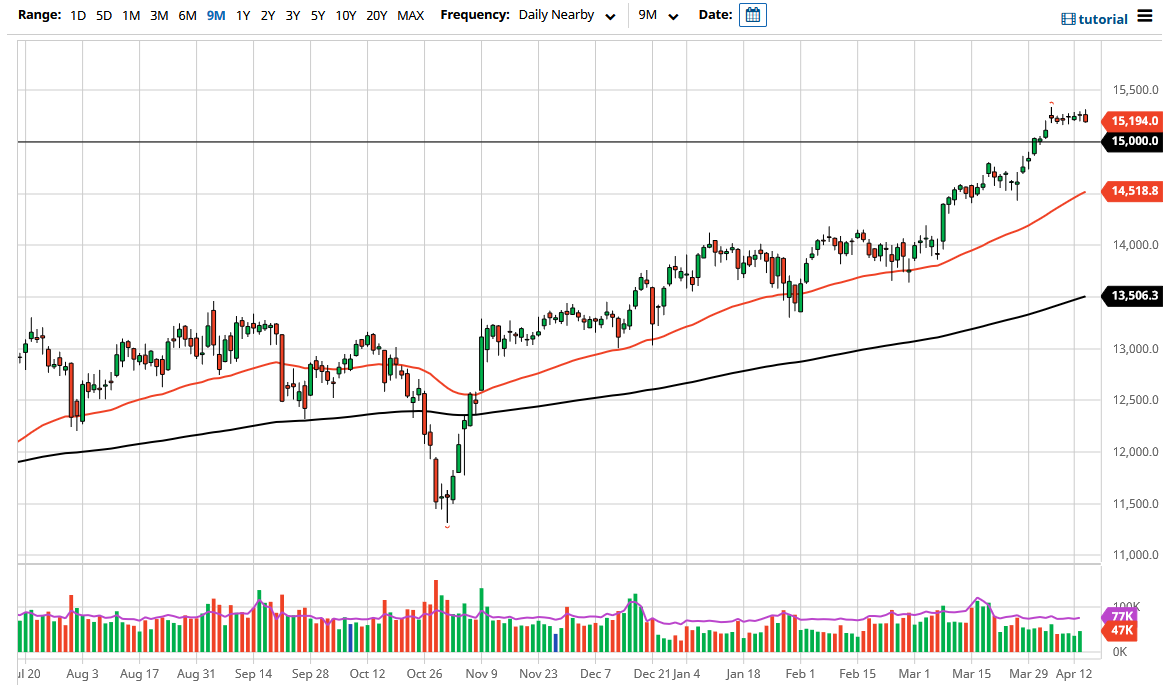

The DAX Index initially tried to rally during the trading session on Wednesday but gave back the gains to fall significantly. That being said, we are still well within the previous consolidation area, and it looks as if we are trying to pull back to fill the gap. The gap sits just above the 15,100 level, and I think there is a significant amount of support that will extend all the way down to at least the 15,000 level.

The German index is a major leader when it comes to the European Union and the “risk-on trade” that you see with the global supply chain. With that being the case, I think it is only a matter of time before we would see the DAX try to break out to the upside even further, but we may need to pull back in order to work off some of the excess “froth” that we have seen in the market. The 50-day EMA is at the 14,500 level and turning higher, so it does make sense that it could offer a bit of a “floor in the market”, not only due to that indicator, but also the fact that we have a gap just above it.

At this point, I think what we are looking at is a market that needs to pull back in order to find buyers, and some type of supportive candlestick like a hammer on the daily chart would be the indication for traders to come back and pick this up. On the other hand, if we were to break above the top of the candlestick for the trading session on Wednesday, that would also be a very bullish sign and send this market towards the 15,500 level, which is my short-term target.

I have no interest in shorting this market, because just like the US indices, the DAX is highly manipulated by ECB bond buying programs and the like. All of this cheap money flowing into the system will continue to lift equities, as there is no such thing as a return on investment when you are looking for yield in the bond markets. That is going to be the way going forward, so simple liquidity measures will continue to push this market higher.